Like the Saviors They Are, Two Compact Crossovers Lifted Their Struggling Brands in October

It might not be the reality we want, but it’s the only reality we have. As car sales continue to dwindle (they’re down to roughly 30 percent of new vehicles sold), light trucks have picked up the torch at most brands, though some aren’t arriving fast enough to satisfy jittery executives in today’s stagnating market.

At two premium Japanese brands, the arrival of two crossovers in the scorching compact segment had exactly the effect their creators hoped for. Acura and Infiniti, faced with declining sales in recent years, had reason to smile in October. The recipe is working.

Toyota Prepared to Drop the Blade, but Which Models Will Get the Chop?

Toyota isn’t immune from the light truck epidemic sweeping the globe; certainly not in North America. In October, the automaker saw light truck sales across both of its divisions rise 6.8 percent, year over year, in the United States, offsetting an 7.2 percent drop in passenger car sales. Tally that volume up over the first 10 months of 2018 and the picture’s even more stark. Year to date, trucks are up 7.7 percent, cars are down 11.1 percent.

The automaker’s North American CEO admits it’s looking at passenger car candidates for execution.

As Troubles At Home Hit Subaru's Bottom Line, Americans Do Their Duty and Hand the Brand Another Record

Subaru reported an operating loss in its most recent fiscal quarter, with recalls and regulatory scandals in its home market dragging the company into the red. The company said it lost $22 million in the quarter ending September 30th, a departure from last year’s $816.3 million operating profit. Meanwhile, global volume fell 6 percent.

In the company’s largest market — the United States — it was an entirely different scenario, with American buyers conspiring to give the brand its 83rd consecutive year-over-year sales increase. A record for October, too, but that’s sort of a given. Very nice of those buyers, but the credit really belongs to the Ascent crossover.

October 2018 U.S. Auto Sales: Last Month Brought More Treats Than Tricks for Most Automakers

More mainstream brands saw year-over-year rises in sales volume last month than those who endured a sojourn into the red. It will surprise exactly no one to learn those who did earn sales growth largely did so on the backs of trucks, SUVs, and crossovers.

Nowhere was this more apparent than at Genesis, a brand peddling some excellent cars but – for the moment – completely bereft of an offering in America’s hottest segment. Fiat Chrysler, on the other hand, had a particularly strong October thanks to its top-heaviness in each of those markets.

As Sales Slump, Jaguar Land Rover Moves to Plug Leaks

It’s not oil dripping onto a snooty cobblestone driveway this time around — it’s cash. Following the release of its latest quarterly fiscal report, Jaguar Land Rover announced a plan to plug the leaks threatening its existence.

The automaker cites declining sales as the reason for a 10.9 percent drop in revenue for the three month period ending September 30th, with buyers in China, the U.S. and Europe taking much of the blame. Globally, sales fell 13.2 percent in the last fiscal quarter, with the total volume of vehicles sold by both brands falling below the number of Chevy Silverados sold in the U.S. last quarter. Jag needs to fatten up those seals.

Sorry, Shoppers: October Auto Sales Expected to Slip, Along With Incentives

Analysts are projecting U.S. light vehicle sales will decline in October as incentives do the same. Could they possibly be related?

While we don’t have have official figures on how much of the domestic population has a limitless supply of cash, our collective intuition suggests most do not. This leads us to believe the elevated cost of owning an automobile has likely impacted deliveries for this month. Fortunately, the experts seem to agree, predicting the lowest October volume since 2014.

New vehicle incentives have been on the decline for a while now. This looks to be the fourth consecutive month without a rebound — which would make it the longest time frame since the recession, according to J.D. Power. That’s not necessarily a bad thing for automakers, since they’re losing less money on every model sold.

Volkswagen Wants the World to Buy Like Americans

The world needs to adopt North America’s penchant for high-riding SUVs if Volkswagen has any hope of building a clean, green, safe future for your kids. That’s basically the message coming from the automaker, which wants 50 percent of its global product mix to be made up of crossovers and SUVs by 2025.

High-margin SUVs will bolster the brand’s business, the company says, helping bring in the cash needed to eventually take your internal combustion engine and steering wheel away.

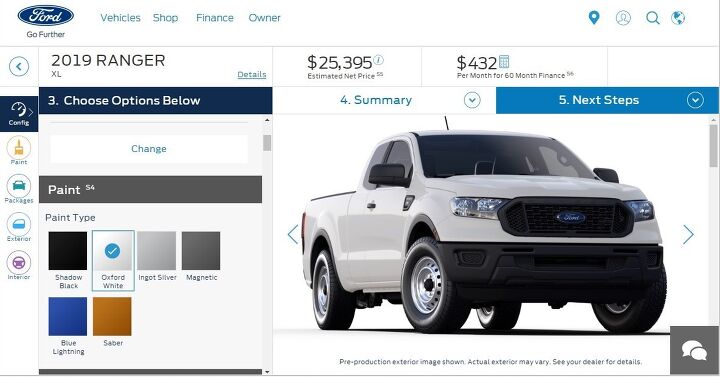

U.S. Midsize Pickup Truck Market Share Is at a Nine-Year High, Just In Time for a New Ford Ranger

Just ahead of the launch of a new Ford Ranger, production of which began earlier this month, midsize trucks’ share of the overall U.S. pickup truck market is up to a respectable nine-year high.

Thanks to significant year-over-year improvements from the two top sellers in the segment plus meaningful increases from the third and fourth-ranked midsize pickups, category-wide volume has grown by more than 60,000 units during the first nine months of 2018. Compared with the same period in 2017, volume in the much larger full-size pickup truck segment hasn’t even grown by half that much.

If you’re a pickup truck buyer, you remain far more likely to acquire a full-size F-150, Silverado, Ram, Sierra, Tundra, or Titan than a Tacoma, Colorado, Frontier, Canyon, or Ridgeline. But the slice of the pie afforded to the five-strong midsize sector is above 18 percent for the first time since 2009.

Could the new Ford Ranger push midsize trucks over the one-fifth mark for the first time since 2006?

The Ranger's No Cannibal, Ford Says

Good news: the Ford F-150 will not be discontinued as a result of the runaway popularity of the 2019 Ford Ranger. Phew.

As the Blue Oval readies its midsize pickup for a winter launch, Joe Hinrichs, head of global operations, claimed Monday that the automaker doesn’t expect much cross shopping among would-be Ford pickup buyers. Frankly, this would have only been a concern if buyers focused on a truck’s tow rating and nothing else. Still, Hinrichs felt it needed to be said.

Ranger folks are not F-150 folks.

More Bad News for Passenger Car Buyers

Flat new vehicle sales and an industry that’s far more interested in making crossover lovers’ dreams come true add up to a poor environment for a traditional new car buyer.

We’ve already told you how high demand for a shrinking supply of off-lease sedans and hatchbacks has sent used car prices through the roof compared to just a few years ago. That erased a go-to option for many thrifty buyers. In the new car market, however, automakers’ need to boost profits in a stagnant market means incentive spending is dropping as fast as used car prices are rising.

It’s not just sedans that saw a decline in discounts last month.

An All-electric Jaguar Range? Might As Well…

Jaguar Land Rover has a problem, and it’s not Land Rover. The Indian-owned (but still quintessentially British) automaker has seen sales of is fairly vast Land Rover family flourish, at the expense of its Jag models. Sedan sales are grim, and the two SUVs launched to prop up the brand haven’t kept its head above water, volume-wise.

Reportedly, JLR has proposed a radical solution: turn the brand into an all-electric family, thus boosting the corporate MPG of the automaker as a whole while keeping Jaguar viable in a rapidly changing regulatory landscape. Putting aside heritage and associated romance, it’s hard to come up with an argument against it.

Low-priced New Vehicle Buyers Are Missing in Action

Once a bracket where most desirable vehicles lived, the sub-$20,000 price range is not the hot neighborhood it once was. The ever-upward creep of new vehicle MSRPs increasingly places most vehicles above that marker, and shifting consumer trends haven’t helped expand its ranks.

According to data from J.D. Power, 2018 has seen a rapid exodus from the cheap seats, with retail volume from the $20k-and-under crowd sinking 20 percent since the start of the year. Big spenders, on the other hand, are gobbling up $80,000-plus vehicles at a rapid clip.

A Buick Is in Danger

The Buick Cascada, known to Europeans as the Opel Cascada, appeared on North American shores for the 2016 model year, offering buyers (and renters) a pleasant, four-seat replacement for the discontinued Chrysler 200 drop-top.

Now wholly owned by France’s PSA Group, not General Motors, Opel plans to ditch the model once 2019 is up, meaning America stands to lose its last non-sports car convertible. It would also knock the Buick brand down to five models.

Subaru Manages to Buck An Industry-wide Trend in September

U.S. auto sales took a roughly 7 percent year-over-year dive in September, pulling the market’s year-to-date sales total further in the red. The industry-wide sales gain seen in the first half of the year is gone.

At Subaru, however, good timing and the continued popularity of a certain model kept the automaker from joining the ranks of its rivals (a group that does not include a beaming Fiat Chrysler). The automaker somehow managed to pull off a win in a dismal month, and it’s still up on a year-to-date basis, despite having so many minuses on its sales ledger.

Mercedes-Benz's Massive Family Could Lose Some Members

Mercedes-Benz isn’t exempt from the normal ebb and flow of product lines, but no one would claim that the German automaker doesn’t have a crowded house. Coupe-ified versions of its utility vehicles proliferated in recent years, as have AMG variants of existing models.

This is an automaker with three roadsters. Coupes and convertibles spring from everywhere at once.

As Mercedes-Benz prepares to transition oversight of the company away from longtime CEO Dr. Dieter Zetsche, his chosen successor, Ola Källenius, admits the product family might require some paring.

Over the First Three Quarters of 2018, Only Four GM Cars Have Anything to Brag About

General Motors joined the vast majority of its automotive colleagues in having a crappy sales month in September, posting an 11.1 percent year-over-year volume loss. The issues facing OEMs last month were many. As interest rates rise and the market cools, automakers looking to capture more for their coffers are trending towards reduced fleet sales and lowered incentive spending. Hurricanes also played something of a role.

At GM, which graces us with sales figures just four times a year, what was likely a poor showing in September dragged down the third quarter as well as year-to-date sales, with volume since the start of the year now down 1.2 percent. That doesn’t mean several GM models didn’t have good quarters, or haven’t had good 2018s. Some 18 models can boast of YTD sales gains.

Of those 18, however, just four are passenger cars, and one member of the group already has one and a half feet in the grave.

Tesla's Third-quarter Model 3 Deliveries Fall Short of Target

If that headline was a tweet, it would certainly qualify as “evergreen.”

With Model 3 production having ramped up towards the very end of the previous quarter, Tesla production in the third quarter of 2018 totalled 80,142 units, some 53,239 of them Model 3s. Compared to the 53,339 vehicles built in Q2 2018, it’s a hefty increase in output.

However, lost in the megaton-yield controversies that follow Tesla CEO Elon Musk like a stray dog in search of a home is the fact that Q3 production didn’t quite make it to an oft-promised target.

Dueling Hurricanes Met Dueling Pickups in September

Much has been made of the impact of two hurricanes, Harvey and Florence, and the two storms’ impact on September vehicles sales in the United States. Harvey swamped the Houston-Galveston area in August 2017, leading to an uptick in vehicles sales the following month, while Florence menaced a broad area of the U.S. Southeast for days in September 2018.

For Ford especially, these storms are the stated reason for the vaunted F-Series line of pickups suffering its first year-over-year sales drop in 16 months. If you can forgive April 2017, when the F-Series failed to clear the previous year’s bar by 117 units, that winning stretch can be lengthened to 23 months. Was Mother Nature truly to blame?

U.S. Auto Sales, September 2018: An Athletic Fiat Chrysler Leapfrogs Ford

Dealerships across America were awash in red last month, both from the ink spilling across financial ledgers and the anger emitting from corner offices. Just about every marque was off in September and not by insignificant amounts. This can be blamed on a number of factors, not the least of which was last year’s pent up demand after a devastating Hurricane Harvey and this year’s Hurricane Florence having the opposite effect.

One ray of sunshine? Fiat Chrysler, which finally got its Ram production in gear and started delivering snazzy new pickup to eager customers in a big way. Of course, having the perpetually strong-selling Jeep brand on the books didn’t hurt, either.

Times Get Tougher for GM's Chinese Venture As Automaker Orders 3.3 Million Vehicle Recall

Tariffs and other pressures are weighing on the once blistering hot Chinese new car market, and a suspension issue has now added new storm clouds to General Motors’ formerly sunny skies. The automaker’s Chinese arm, GM Shanghai, has announced the recall of 3.3 million Chevrolet, Buick, and Cadillac models.

Bad news for a foreign company in a suddenly dodgy market.

Tesla Flings Incentives, Builds Volunteer Army in End-of-Quarter Push

Tesla Motors is currently offering up a bevy of incentives, even a few it once discontinued, in order to maximize deliveries before the end of the quarter. The brand has also reached out to enthusiastic owners who may want to help during its time of need, creating a weird sort of volunteer army for itself.

The company is desperate to prove to investors that Model 3 volume is making meaningful headway before its next shareholders meeting. As you’ll recall, the Department of Justice opened a criminal investigation after the Securities and Exchange Commission began a civil probe into Elon Musk’s August tweet about possibly taking Tesla private. The automaker also fired more than 3,000 employes over the summer and lost several important executives. It’s been a rough year for the brand, which makes having a good quarter all the more important.

While a significant portion of that battle is being waged at the factory, helped by simplified paint options and new car carriers, Tesla thinks it can move enough extra metal at its delivery centers to make up some of the difference.

What Needs to Happen for Ford to Set a U.S. F-Series Sales Record In 2018?

Ford Motor Company is currently on track to sell 939,809 F-Series pickup truck sales in the United States in calendar year 2018.

That number is hugely significant. Not only does it represent far greater volume than any other vehicle line can manage (the F-Series was outselling the combined efforts of the Chevrolet Silverado and GMC Sierra by 15 percent at the halfway mark), it would also mark the first occasion since 2005 in which any vehicle line topped the 900K mark.

The F-Series accounts for 36 percent of U.S. Ford Motor Company sales, outsells Ford/Lincoln cars by nearly two to one, and outsells all Ford/Lincoln SUVs/crossovers by roughly 2,000 units per month. Use Volkswagen, a global powerhouse, for further comparison: the German brand isn’t likely to sell 400,000 vehicles in America this year. With one-third of the year remaining, Ford has already sold 603,926 F-Series trucks.

But the track towards 939,809 is important for another reason. It’s also 298 sales greater than Ford’s all-time best number. What does Ford need to do during the final four months of the year to break its record?

A U.S.-launched Trade Dispute Is Helping Toyota in One Key Market, but for How Long?

While the trade situation is still very much in flux, Toyota sees itself as standing to gain from the turmoil, just not in the United States. The automaker, along with other Japanese brands, finds itself in an advantageous position in China — a massive market facing its own troubles.

China’s anger at the U.S., and vice versa, could mean big bucks in the short term for Toyota.

Two Countries Prepare to Launch Two Very Different Nissan Altimas

It’s the third high-profile midsize sedan launch in a year, and Nissan’s pretty confident that this — THIS — is the one that’s really going to turn the declining segment around. Or so U.S. chairman Denis Le Vot claim s. In our first drive review of the all-new 2019 Altima, scheduled for Friday morning, we’ll ponder if this revamped sedan and its revolutionary new engine makes for a worthy challenger to Toyota’s segment-leading Camry and the somewhat lagging Honda Accord.

Meanwhile, north of the border, Nissan Canada is busy preparing its own launch. We’ve discussed some of the similarities and glaring discrepancies between the two vehicle markets before, but for the 2019 Altima, the gap between the U.S. vehicle and Canadian one is vast. Maybe it has something to do with optimism vs. realism.

QOTD: Can One Define the Specifics of Supercar?

In yesterday’s Buy/Drive/Burn post, we presented three coupes that are sporty, agile, and have over 500 horsepower. Yet each of them fell short of qualifying for supercar status. But why? In today’s QOTD, we’ll spend some time determining the characteristics which separate regular sports cars from supercars.

In What Kind of Market Will the Baby Ram Find Itself?

We’ve known since June that Fiat-Chrysler plans to re-enter a segment it abandoned at the dawn of the decade — in the U.S., anyway. A midsize pickup bearing the Ram logo will appear in 2020, a report claimed earlier today, joining what will by then be a stable made up of six brands. Ford makes a triumphant return to the segment this fall.

Luckily for Ram fans, it appears the forthcoming Ram truck won’t be some wimpy, unibody thing built on a Fiat platform, as Americans would like see such a creature as being worthy of contempt, and perhaps even ritualistic sacrifice. Still, a lot can happen in two years’ time. Analysts expect the auto market to cool off in the coming years, more so than the plateau we’ve been at for the past two.

Another Sedan 'Savior'? The Optimism Pouring From Nissan's U.S. Chairman Is Bittersweet

In the lead-up to the current-generation Toyota Camry’s launch in late summer, 2017, company brass predicted this model would change things. This Camry, in addition to the new-for-2018 Honda Accord and redesigned 2019 Nissan Altima, would arrest the segment’s downward plunge, said Jack Hollis, Toyota’s U.S. VP of marketing. He predicted a sales increase in 2018.

Well, while the Camry is more than likely drawing more buyers from a shrinking pool, the segment has not grown in 2018. The sales surge that followed the 2018 Camry’s release didn’t last, with the model posting declining year-to-date sales starting in July.

It seems there’s a severe lack of optimism in the segment, and with good reason. But Nissan North America chairman Denis Le Vot isn’t having any of it. The decline stops riiiiight now, he predicts.

It's a Car Bloodbath Out There, but a Few Large Sedans Can Claim They're Having a Good Year

As we told you yesterday, passenger car market share dropped to 30.6 percent in the month of August as a tide of crossovers, trucks, and SUVs continued swamping the automotive landscape. Few automakers can say their traditional passenger cars are making headway against the current.

Out of the struggling mass of drowning cars, compacts seem to have the most strength left, if only because of their affordability. It’s easier to flip a midsize buyer into a crossover than an entry-level buyer who wants to keep their monthly payments as low as possible, versatility be damned. Most small cars still see significant volume. At the upper end of the scale, however, large cars have become ghosts. I’ve taken to peering at drivers in any new Buick LaCrosse or Cadillac CT6 (etc) I encounter on the roads, checking out their age and gender, as it’s not a regular occurrence.

Still, despite ceding nearly all of its market share, the large car category isn’t entirely a room full of sob stories.

Shocked? One in Six Vehicles Bought Last Month Was a Compact, Mainstream Crossover

America knows what it wants, and the rest of the world — even those hard-to-reach places — is beginning to follow. Each week brings us news from far-flung locales pointing to increased demand for affordable crossover vehicles, if not the wholesale abandonment of certain car segments by certain automakers. Basically, the global auto industry in 2018 boils down to this: build a crossover, or become (or remain) a struggling niche company.

It’s hardly a new situation, but it’s hammered home with each passing month — as cars continue trickling out of every parking lot you pass and trunks begin appear on “Missing” posters at the post office.

Given that the compact crossover is arguably the most ubiquitous vehicle on the roads today, your author decided to look at just how prevalent their sales really are. Tossing aside premium or luxury offerings (a category we’ve tossed Buick into), this data dive focuses solely on the mainstream. The results? It’s grim stuff if you’re not the family type, so brace yourself.

American Automakers Losing Footing in China's Wonky Market

Last week, we looked at how the world’s largest automotive markets are coping. If you’re interested in an abridged version, they could all be doing better. We also noted that China was getting around to summarizing its summer sales data. Well, that ship has since come in, and it was full of corpses. The country has endured three straight months of falling car sales after years of consistent growth.

As the world’s largest automotive market, China impacts just about every other industrialized nation on the planet. Unfortunately, the China Association of Automobile Manufacturers (CAAM) reported that influence helped the market share of U.S. brands fall to 10.7 percent in the first eight months of 2018 versus 12.2 percent just one year earlier. The association’s assistant secretary general, Xu Haidong, said this decline could be attributed to American firms inability to refresh their lineups in a timely manner and definitely had nothing to do with the trade war, anti-American sentiments, or the boycotting of U.S. brands by Chinese consumers.

Are We Witnessing the Beginning of Hyundai's Recovery?

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Former British PM Winston Churchill used this somewhat confusing quote to describe the status of the war following the defeat of Axis forces in North Africa, and it popped into my head while scanning Hyundai’s U.S. sales data for the month of August.

The sales slump experienced by a once-skyrocketing Hyundai is well covered. Last year was a grim one for the brand, as a combination of falling passenger car sales and not enough crossovers saw the automaker’s U.S. fortunes tumble. Since then, Hyundai’s been on a new or refreshed model tear, and it’s not over yet. Has the automaker’s recovery seen the end of the beginning?

As Inventory Dwindles, Genesis Prepares to Turn It On Again

If you noticed your neighbor adding a glistening new Genesis model (the midsized one or the bigger one) to their driveway in the past month, you’re a member of a very small group.

Genesis, the luxury marque born of Hyundai, didn’t sell many vehicles in August, but that’s all part of the plan. The brand’s executive director claims there’s less than a month’s worth of vehicles currently in the U.S., but once those ships arrive, look out. Actually, a better way of phrasing that is: “prepare yourself for things to occur in a gradual and measured fashion.”

The Nissan Kicks Is - Unsurprisingly - Performing Much Better North of the Border

Not concerned with offering all-wheel drive, Nissan’s recently launched Kicks subcompact knows its ground clearance, styling, and low, low entry price is what customers will take notice of, not its perceived off-road prowess. It doesn’t have any (though on dry and flat boulder-free trails, it would probably do fine).

After Nissan unveiled its pricing in the U.S. and Canada, we noticed that the normal north-of-the-border markup was missing in action. As a result, buying a base Kicks S in Canada is just eight bucks pricier than an American purchase ($17,998 vs. $17,990). Both Canada and the U.S. love their big trucks, I said at the time, but this little ute will do better north of the border.

It’s always nice to be proven right.

North America Isn't the Only Major Auto Market With Huge Headwinds

For the past two years, we’ve reported that the post-recession upswing in new car buying in North America seems to have plateaued. Environmental factors have led to Millennials buying fewer cars than their parents’ generation, and wealthy folk have proven unable to pick up the slack — as no amount of money allows you to drive several cars at the same time.

Most major carmakers posted declining U.S. deliveries in July, and August’s data proved a mixed bag. However, America isn’t the only big market that’s taking a beating. The First World seems to have collectively surpassed peak growth and now has to ride out an extended period where volume dwindles until some other nation can afford to import container ships full of sparkly new automobiles.

With Rising Sales and Two Crossovers on the Way, Volkswagen of America Can Probably Breathe Easy

The diesel emissions scandal that continues swirling around Volkswagen’s German workforce is merely a far-off cloud for the folks at Volkswagen of America. Sunny skies reign, thanks to a decision to go heavy into “Americanized” crossovers.

Sure, the Jetta and Golf families continued their downward trajectory, joined in the descent by VW’s Passat sedan, but those lost sales are more than made up for by two nameplates: Tiguan and Atlas. Break out the iced tea.

Die Rivalitt: BMW Ekes Out Another Sales Win Over Mercedes-Benz

Without rivalry, there wouldn’t be sports, and the Atlantic Ocean probably would have been crossed for the first time by a multinational team assembled sometime in the late 1930s, backed by a top-heavy bureaucracy.

Rivalry, at least outside the workplace, is usually fun, and the fierce competition among Germany’s luxury marques remains an interesting one, simply due to the length of time this has been going on. U.S. sales figures from August show that Mercedes-Benz, which muscled out long-running best-seller BMW from its lofty perch in 2016, has at least some reason to be worried about its rival reclaiming lost ground.

Fiat Chrysler Heads in Different Sales Directions North and South of the Border, But We Can All Agree on Jeep (or Can We?)

Without its juggernaut Jeep division, Fiat Chrysler would find itself in deep trouble. We’re talking Mitsubishi, circa 2013, sorts of trouble. On a year-to-date basis, all of FCA’s brands save for Jeep and the low-volume, niche Alfa Romeo took a sales tumble in the United States. It’s the same story north of the border.

In both countries, Jeep is FCA’s knight in shining armor (coming to its financial rescue), only in Canada it’s not enough to boost flagging year-over-year sales. FCA’s volume sank 10 percent in August, while in the U.S. it rose 10 percent. Year to date, FCA’s up 5 percent in the U.S. and down 14 percent in the Great White North.

Why such a disparity between sales directions? It seems to come down, at least partly, to Jeep posting far greater gains in the U.S. than in Canada. Even within the division, there’s quite a difference between what buyers in both countries want.

U.S. Auto Sales: SUVs and Trucks Ruled the Roost in August

For marques flush with crossovers, SUVs, and trucks, August held some pleasant news. Any company whose portfolio is devoid of product (or filled with aging machinery) in those segments found their balance sheet wanting.

Evidence of this? SUV-anemic brands such as Genesis are falling off the proverbial cliff while Subaru is outselling the likes of Hyundai and the entirety of VW Group. It’s also worth noting that without Jeep, Fiat Chrysler’s fortunes would be markedly different this year.

Tipping the Sales Scales: Honda's Light Trucks Continue Filling the Hole Left by Cars

It’s nothing new in the industry, nor is it at all uncommon, but Honda’s distinctly balanced product mix continues to tip ever further towards the trucks and SUV side, despite the assertion of American Honda’s assistant VP of sales, Ray Mikiciuk, that cars will continue as the brand’s mainstay.

With the same number of selling days as August 2017, last month showed the automaker’s volume on the upswing, propelled by the strength of light truck sales. In keeping with the theme of balance, only one mainstream car saw its sales increase, year over year, while only one light truck model saw its sales decrease.

A Tenuous Balance: Honda's Still Bullish on Cars, but Even Segment Leaders Have Weaknesses

While the Ford F-150 will likely still be America’s top-selling vehicle when each of us dies a natural death, the entries below it will surely be subject to change. In the near future, at least, expect to see passenger cars sink further down the best-seller list.

Last year, Honda — a manufacturer with a fairly even car/light truck split — showed up three times on the U.S. Top Ten list: in seventh, eighth, and ninth place, with the compact CR-V leading the way, followed by Civic and Accord. This year’s sales haven’t been as kind to the Accord as it has its segment rival, the Toyota Camry, but at least the Civic’s almost holding its own.

Publicly, Honda remains optimistic about the continuation of cars, claiming they’ll remain its primary focus. Unfortunately, even for models that seemingly can do no wrong, there’s danger signs aplenty.

Desperately Seeking Sales: Jaguar's SUVs Are Not Keeping Volume Steady

For a builder of sexy vehicles with an enviable heritage, Jaguar always seems to be in a state of semi-crisis. From past reliability issues to a combination of aging and lackluster products under Ford’s oversight, the storied British brand was then cast off like a pair of trousers at Lover’s Lane, only to see its fortunes rise after its purchase by India’s Tata Motors. Cash poured in and product development ramped up.

When the sport/luxury F-Pace SUV arrived in 2016, Jaguar’s volume saw a corresponding boost, helping squash another threat: the rapidly growing hatred of sedans by a voraciously pro-utility American public. But you know what they say about things that go up…

Twenty Years of Cadillac Escalade, America's Bling Thing

Where were you when you first saw an Escalade? Do you recall the lesser but identical Yukon Denali? Twenty years have elapsed since the Escalade’s introduction, and the luxury brand of wreath and crest has never looked back.

But today, we’re going to.

Old Man's Game: Car Dealerships Can't Hold Onto Younger Employees

There’s a popular notion that young people are ruining the automotive industry. It probably has something to do with the steady climb of average transaction prices and a median income for millennials that’s comparatively worse than that of their parents at a similar age. Plenty of evidence exists that younger individuals aren’t particularly fond of the car-buying experience.

They don’t seem particularly fond of the car selling experience, either. Millennials account for nearly 60 percent of dealer hires but shops lose over half of them every year, according to a study by the management firm Hireology. That’s an impressively high turnover rate that probably isn’t helping turn around stagnating car sales, as it takes a while to master any profession.

America's Brief Infatuation With The Volkswagen Golf Is Fizzling Fast

Midst the turmoil of a diesel emissions scandal and the crisis that followed in late 2015, there was a quiet but striking development inside Volkswagen’s U.S. showrooms.

Americans were buying Golfs. A lot of Golfs. More Golfs than at any point since Ronald Reagan was president. Volkswagen Golf volume nearly doubled, year-over-year, in 2015, and Volkswagen nearly sustained that level in 2016 before rising to a 31-year high of 68,978 sales in 2017.

A trend it was not. Seven months into 2018, Golf sales are nosediving.

2019 Toyota Sienna: Bringing All-wheel Drive to More of the Masses

As the Ford Aerostar and Toyota Previa fade from our collective memory, one could be forgiven for thinking minivans were always a front-drive proposition. As for winter-beating all-wheel drive, a laundry list of crossovers and SUV fill that buying space, poaching sales from the once-hot minivan segment.

Still, one model continues offering four-wheel traction for buyers who aren’t scared of being seen in a traditionally uncool minivan. That model, the Toyota Sienna, enters 2019 with more AWD availability. As an underdog in the segment, it seems Toyota wants to sell its offering as the more family-friendly SUV alternative.

No Ford Buyers Allowed: To Seize the Future, Lincoln Needs Fancy Stores and Personal Space

The product pipeline is already in place, but what about the dealerships? That’s where Lincoln Motor Company’s focus now lies, as it begins rolling out a plan that will see standalone Lincoln dealerships pop up in 30 high-volume markets.

As the premium brand attempts to shuffle off sliding sales with a utility vehicle onslaught, the brand wants those high-rising vehicles shown off on well-lit runways encased in glass cubes. Lincoln calls this design “Vitrine.” It’s not just important to the brand — it’s “critical.”

Toyota and Honda Have Good Reason Not to Abandon Sedans

Ford’s already brought the axe down on all but one of its car models, and General Motors looks ready to do the same. Other automakers, however, know that ditching sedans would mean abandoning key groups of customers.

For Toyota and Honda, models like the Camry and Civic resonate far more among some demographics, and leaving that segment risks losing those buyers to other brands. Not everyone wants a crossover. Among Asians, Hispanics, and African-Americans, four Japanese nameplates keep popping up at the top of the most-bought list, but one domestic model poses a growing threat.

Fiat's U.S. Decline Continues Apace, but Somebody Please Put the Brand on Canadian Milk Cartons

If the Fiat brand was a human being, it was last spotted in the parking lot of a local bank. Police are now scouring the woods.

Launched with adequate, if not great, fanfare as a newly Italianized Chrysler powered out of the recession, the Fiat brand failed to put down roots in the American marketplace, with the automaker’s next five-year plan showing it as an afterthought with an uncertain future. Sure, Italy gets a wagon version of the little 500 and greener power options, but in North America, the brand went over with buyers like Catwoman or Heaven’s Gate did with movie audiences. Dealers aren’t exactly thrilled with having the Fiat name anywhere their Jeep or Ram banner.

As bad as the brand’s continued non-performance in America is, buyers north of the border have already moved on.

Ford's F-Series - A Cross-border Comparo

In a market that shrunk 3.7 percent in July, Ford managed to escape the steep volume loss seen by some of its rivals. Still, the Ford brand saw a year-over-year U.S. sales drop of 2.7 percent last month, with its Lincoln division falling 11 percent. Over the first seven months of 2018, both brands posted a loss — 1.6 percent for Ford, 10.8 percent for Lincoln.

For the Blue Oval, at least, that’s in line with forecasters’ estimates of a slow industry decline in 2018. Lincoln’s another matter.

A peek at Ford’s sales figures shows why Dearborn hasn’t much love for cars. Minus the Fiesta, which you won’t have to worry about much longer, every other Ford passenger car model declined in both July and 2018 (with the niche exception of the GT). Try as they might, Ford’s truck sales couldn’t replace the lost passenger car volume, but they certainly dumped more cash in Ford coffers — on average — for each model sold.

It’s become a safe bet that no matter how Ford Motor Company fares at sales time, the F-Series will do just fine.

July 2018 Midsize Sedan Sales: Toyota Camry Finally Slips Into the Red

Last year’s release of the radically revamped 2018 Toyota Camry lent buoyancy to a model seen as the troubled midsize sedan segment’s most resilient nameplate. It has history, name recognition, and a stigma for no-nonsense comfort and reliability. Could you ask for anything more?

And so, as other sedans, including the equally fresh Honda Accord, started falling away, the Camry retained its sales volume, finishing the first half of 2018 with a slight year-to-date increase. July brought bad news, however. While the Toyota brand performed worse than the industry average last month — sales fell 6 percent, year over year — it was passenger cars that earned the brand its volume loss.

And even the Camry’s partly to blame.

So Much Winning: Even With Cars Tanking, Subaru Hits Another Record

We’ve seen this kind of meteoric rise before, so it’s our duty to tell Subaru to “just say no” to drugs. Let’s not have this end in heartbreak for all the fans.

With that important announcement out of the way, it’s time to toss around some numbers — which, at Subaru of America, are quite positive. Despite an industry that sank over 3 percent overall, and with one less selling day than July 2017, last month was the brand’s best July in history, which followed its best June, and May, and… you get the picture. The first half of 2018 was Subaru’s best sales half to date.

Helping the brand achieve a 6.7 percent year-over-year sales increase was the arrival of Subaru’s largest vehicle to date. Go figure, Americans seem to like it.

Fiat Chrysler's U.S. Sales Success Sure Didn't Make It Across the Border

In a month Mike Jackson, chief executive of AutoNation Inc, described as a “ clunker,” numerous automakers took a hit. New vehicle sales in the U.S. fell by 3.7 percent compared to the same month last year, and lucky was the automaker that escaped the buying public’s cold shoulder.

Among the Detroit Three, Fiat Chrysler had the distinction of heading in the right direction as rivals GM and Ford fell. It wasn’t even a close race. FCA posted a year-over-year sales gain of 6 percent, with year-to-date volume up 5 percent. Naturally, Jeep led the way.

But not everything’s rosy on the North American continent. North of the 49th parallel, fate detained FCA’s good fortune at the border, leaving the automaker with a very steep sales loss. Only two brands posted a sales gain in July, and one of them seems to only have one model in the running.

U.S. Auto Sales, July 2018: Plenty of Red … Unless You're Fiat Chrysler

Major manufacturers saw their fortunes take a dip in July, with red ink spilling across the page like an airport departures board during a snowstorm.

More than ever, sales performance seems tied to the number of crossovers and SUVs available at a given OEM. Sedan heavy marques are taking a beating. Even Ford’s strong selling truck line could not drag the company’s results into the black, thanks to a tanking of sedan sales.

Foreign Influence? Europe Tilts Even Further Into SUV Mania; Diesel Popularity Plummets

The continent that spawned microscopic postwar bubble cars and made the “city car” segment a thing is moving ever further away from its automotive past. European buyers, perhaps influenced by their American counterparts, are beginning to realize they truly can have it all, adjusting their buying habits accordingly.

Of course, by “all,” we mean all the cargo space.

2019 Lexus ES: Luxo-Avalon Reveals Its Pricing

Long regarded as the pinnacle of worry-free premium transport, the Lexus ES throws off its dowdy clothes for 2019 in favor of a new, sportier look. It’s a makeover shared with its platform-mate, the Toyota Avalon, and the two large sedans both call dibs on the same V6 engine, four-cylinder hybrid powertrain, and eight-speed and continuously variable automatics.

The mission of this ES is not just to compel existing owners to return to the dealer for another go-around. It wants fresh blood — hence the new sheetmetal and addition of an F Sport model. To help keep both sets of buyers in its good books, Lexus hasn’t gone wild with the pricing. One version actually sees a price decrease for 2019.

Mike Manley Hits the Ground Running As Storm Clouds Gather Over FCA

Former Jeep and Ram boss Mike Manley was a top choice among the candidates competing to succeed Sergio Marchionne, but no one could have expected his ascension to the CEO’s chair would occur in such a sudden, tragic manner.

During his first earning call, Manley was forced to address not just his predecessor’s death — which occurred mere hours before investors, analysts, and journalists picked up the phone — but also the automaker’s slipping grasp on the Chinese market. FCA’s revenue and net income took a haircut in the second quarter of 2018. The company’s share price plunged in the wake of news of Marchionne’s death. And, last but not least, there’s tariffs flying left and right, cutting into the automaker’s earnings — indeed, the company has already readjusted its earnings forecast downward.

Some first week on the job.

Pony Car Check-up: If Only Our Lives Were As Stable As the Dodge Challenger's Sales

What’s something that’s really, really old, yet continues to attract a steady flow of buyers year after year? You could say the Colt 1911 and its knock-offs, and you’d be right — in fact, an old American pistol that packs a punch and never really saw the need to improve in a major way seems like an apt comparison to what we’re actually talking about.

When it first appeared on sales charts in May of 2008, the Dodge Challenger was pure throwback. A cherry to place on top of the brash, retro sundae Chrysler had constructed out of its 300 and Charger sedans. In case you missed it, last month was the 10-year anniversary of the reborn Challenger’s first full month of American sales; the TTAC crew deferred its celebrations until July 4th.

Taking a look at the sales performance of its domestic, um, challengers, it seems like the two-door Dodge might outlive us all. Will the last American passenger car on the market ride into the sunset with a supercharged roar and two smoking rear tires?

Acura's Redesigned RDX Did Exactly What the Brand Wanted It to Do

Acura would love it if we talked about the brand in the same manner that we did, oh, say a decade ago. Maybe the turn of the century. But we don’t, as vehicles like the second-generation NSX simply didn’t capture our imagination like the original. There’s no cheap, fun little car like the Integra anymore, and cars as a whole are vanishing from conversations as quickly as they fade from sales sheets.

Sales of Acura cars in the U.S. fell over 25 percent in June, year over year, and volume over the first half of 2018 was down 6.5 percent. That leaves Acura’s utility vehicles with the job of counteracting the loss — a difficult task for just two models.

For the freshest model in Acura’s stable — the totally revamped 2019 RDX compact crossover — June returned the news Acura execs were hoping for.

More Power Awaits Buyers of the Long-range Nissan Leaf

Many years ago, back when full-on electric cars were rare oddities, I drove an early first-generation Nissan Leaf in power-sapping Eco mode. It was, to this day, the slowest vehicle I have ever driven. The driver of a 1980s Tercel with a three-speed automatic could have handed me my ass in a stoplight drag race.

That was then, and this is now. The second-gen Leaf, which bowed for 2018, offers buyers 142 horsepower and a generous helping of low-end electric grunt to go with their 151 miles of range. But there’s another beast arriving for 2019 that should satisfy those looking for more miles and more horses.

Shocked? Ford's F-Series on Track for a Record Year

Future archeologists will recognize this period in man’s history by the thick layer of Ford F-150s covering the entire planet, pointing to an era where one vehicle could seemingly do no wrong.

As the world’s best-selling vehicle line for what seems like forever, the F-Series’ sales performance over the first half of 2018 points to an impending record for the hard-working and increasingly plush lineup. Ford can be expected to push for it.

Recent Comments