GM's Bad Driver Appreciation Program

We didn’t want to mention it when we wrote about GM’s buy a car, get free insurance deal. If we would have said it, it would have been the nasty B-word all over again. The rest of the media showed less compunction. “The worse you drive, the bigger the deal” headlined MSN Money. The deal can be staggering under the right or wrong circumstances, says MSN Money:

June Sales Forecast: Swing Low, Sweet SAAR-iot

The US market’s Seasonally Adjusted Annual Selling Rate (SAAR) hurdled the 12m mark towards the end of last year, and was cruising above the 13m mark for much of the first half of 2011, but after a rough May, June seems set to become the market’s second month back under the 12m mark.

April Sales: Incentives And Transaction Prices

So, sales are up… but what are the automakers spending in order to get those sales? And what are they getting for their cars? Step inside our incentives and transaction price tracking center for a look at the factors that play affect how sales turn into profits (or don’t). But first, take a look at the graph above showing US-market incentive spending broken out by the regions where automakers are based. As usual, the US-based OEMs put more cash on the hood than their competitors, but more importantly notice how much money is spent on sales each month: nearly $2.5b was spent last month. And despite being a serious chunk of change, Edmunds AutoObserver says that’s the lowest overall level of incentive spending since 2005. So if you’re inclined to ignore incentives when it comes to your monthly sales education, you might want to start paying some attention…

Industry: Bailout? What Bailout?

TTAC has always taken pride in its outsider status, and we’ve taken pains to cover the industry from a safe distance in order to continually bring a fresh perspective to developments. As a result, we’re not always on the same page as trends in the industry at large, which tends to be far more given to wild optimism than the average TTAC analysis. But, based on a new study by Booz & Company [ PDF], it seems that the “carpocalypse” of recent years has driven the industry to a more TTAC-esque pessimism. According to responses by executives at both OEMs and suppliers, the industry generally feels that the bailout was either a missed opportunity or it didn’t do enough to address fundamental weaknesses… and as a result, executives see challenges ahead.

Do GM's On-Off Incentives Help Or Hurt?

Speaking at the New York Auto Show today, GM CEO Dan Akerson defended his inconsistent approach to sales incentives, telling the AP [via The Washington Examiner]

I feel pretty good about that. I think we’re in pretty good shape. I don’t want to be a predictable competitor. I don’t want the other guy to know exactly what I’m doing.

For some context,

GM surprised the industry — and Wall Street — when it raised discounts by $400 per vehicle in January and February. Most automakers didn’t raise them because demand for new vehicles has been rising in line with supply…

GM pulled back on its incentives in March, spending $600 to $800 per vehicle less on the deals. But it was too late for some investors, who shied away from the company’s stock because higher rebates lower car companies’ profits.

But does Akerson’s upside, the element of surprise, outweigh the downsides of his hot-cold incentive strategy?

Is Ford… Underperforming?

Ask an industry-watcher to name an automaker that seems to be doing things right, and chances are one of the top choices would be Ford Motor Company. And though Ford is enjoying favorable perceptions in the media, according to the company’s own internal goals, it’s actually underperforming. And in a key metric, no less: retail market share. Bloomerg reports:

So Much For The Price War? Ford Raises Prices By $117

Just two short months after Hyundai CEO John Krafcik warned that a brewing incentive and price war was “a step backward for the industry” and “short-term thinking in a long-term process that hurts manufacturers and consumers,” it seems that any signs of a price war are over. But before you rush to give a certain earthquake/tsunami combo credit for the entire situation, consider for a moment that Ford has now joined Toyota in raising prices while insisting it has nothing to do with supply interruptions. A Ford spokesman tells the Detroit News that

This is the second price increase this year [Ed: Ford bumped prices by $130 in January] but has been in the works for months as the industry faces higher commodity costs

Meanwhile, Ford is also the only Detroit-based manufacturer to bring incentives below nine percent of its average transaction price, as its March incentives were down nearly 10 percent compared to March of 2010. Between Ford and Toyota bringing up prices and Hyundai keeping sales growth strong despite low-low incentives, the pressure is mounting on GM, Chrysler, Nissan and Honda. Will they continue to trade margins for volume, or will they take the opportunity to bump prices as Japanese parts shortages continue to play out?

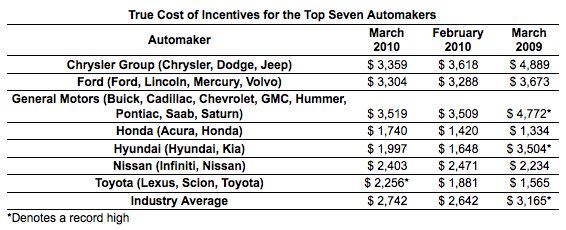

March Incentives And Transaction Prices

For March, TrueCar has included a chart diagramming the ratio of incentive spending to average transaction price, giving us a look at two key metrics on a single chart. Short of a complete fleet sales or a retail market share breakout falling into our laps (crazier things have happened), this is one of the more important metrics you’ll want to look at to qualify the raw volume numbers coming out of March. But it’s not the only one…

Rattner Reacts To GM's Sub-IPO Stock Price

As the former “car czar,” who led the government’s restructuring of GM and Chrysler, Steve Rattner has a considerable interest in portraying his pet projects as having turned the corner. But in a recent CNBC appearance, Rattner acknowledges that the market is “spooked” by GM’s increased reliance on incentives and the “unexpected” departure of its Chief Financial Officer. Ford, meanwhile, simply gets rapped for not communicating a slightly lower Q4 profit than Wall Street expected. And though Rattner’s not the guy to press the point home, there’s a clear distinction to be made between a much-hyped stock aligning itself with expectations (while making a tidy $6b+ profit) and a company that’s losing key personnel while leaning on incentives to recover the volume lost on brand and dealer cuts. But Rattner’s got bigger worries than short-term financial performances, or incentives or personell changes… he sees another, equally familiar problem that’s fixing to give GM (and, to a lesser extent, Ford) the fits: rising gas prices.

Will Japan's Tsunami End The Emerging Price War?

With automakers keeping the incentive pedal pinned to the floor as they entered the new year, a price war has been brewing in the US market for a while now. Hyundai USA CEO John Krafcik has called the trend “a step backward for the industry,” pointing out that nearly every automaker had struggled to regain pricing power coming out of nearly three years of industry-wide weakness. But with GM and Detroit leading the way with high (if “targeted”) incentives, matched by uncharacteristically high incentives from import-brand rivals like Honda and Toyota, it seemed that nothing could prevent a volume-pumping, but profit-sapping price war in the US. At least until Japan was hammered by earthquakes, tsunamis and nuclear accidents. Now, with manufacturers and suppliers still struggling to understand the full impact of production shutdowns and reduced inventories, TrueCar has projected current price trends forward, and finds that supply interruptions could reduce supply to the point where prices actually start coming up again. Check out TrueCar’s spreadsheet on supply and pricing projections in XLS format here, or hit the jump for a few highlights.

February Sales: Leasing, Incentives and Price Wars, Oh My!

Remember the phrase “jobless recovery”? Well, the auto industry is having something of a “price dropping recovery.” The headline for February auto sales may have been “the buyers are back,” but beneath the big volume boosts there’s trouble a-brewing. According to TrueCar’s transaction price forecast (above), Hyundai CEO John Krafcik was right to warn of an industry price war, as the industry has lost .3% of its average transaction price during the last year of recovery. Over the last year, Honda, Kia, Toyota and GM have all seen declines in average transaction prices, led by GM’s staggering two percent drop. And falling transaction prices are just the beginning: as we explore after the jump, incentives are also remaining high, and yet another volume-boosting technique is enjoying a boom as the industry once again starts to redline its sales.

Sergio Works Pro Bono

Sergio Marchionne is a multitasker: He has been knighted in Italy in 2006, and is CEO of two carmakers, Fiat and Chrysler. Money-wise, he’s just getting by. A 300-page filing with the SEC revealed that his pay as CEO of Chrysler equals what he draws from his knighthood: Niente. Marchionne received no cash salary from the company. He didn’t work entirely for nothing though.

Do GM's Lease Offers Signal Return To Bad Habits?

Bloomberg seems to think GM is heading back towards bad habits, reporting

General Motors Co. is offering to waive the last three payments on existing leases if holders buy a new car, adding an incentive onto deals that last month exceeded offers made by rivals.

The promotion began this month and is valid on most models with leases that expire between now and Aug. 31, according to the company. GM raised incentive spending in January by 16 percent to an average of $3,663 per vehicle, the highest among major carmakers, according to researcher Autodata Corp. GM sales outpaced the industry that month.

GM said in a video presentation for its initial public offering in November that it intended to offer fewer incentives that crimped margins and created an impression that price was the main selling point for GM vehicles. Early-return leasing deals may conflict with the that pledge, said Jessica Caldwell, an analyst at Edmunds.com.

“I hope they’re not walking down that road,” said Caldwell….

Given GM’s decision to release less incentives data, the signs do seem to be piling up. But, says Chevy marketing VP Rick Scheidt

I am not seeing any internal behavior that suggests we have gone back to old ways. It’s still way too close to the bankruptcy for us to be sliding back into bad habits. We know everybody’s watching.

Quote Of The Day: Price Wars Edition

Is the auto industry headed for a price war? Hyundai Motor USA CEO John Krafcik seems to think so, telling Reuters

I think we can officially say that a price war broke out in the industry. There is apparently a lot of pressure to deliver sales results. I would call this a step backward for the industry. This is short-term thinking in a long-term process that hurts manufacturers and consumers.

Krafcik says GM kicked off the rush for increased volume by cutting prices in January, and that Toyota (which has increased its incentives by 37.5% since last January, according to TrueCar) “quickly” responded by matching The General’s price cuts. Honda, Nissan and Chrysler have also kept their incentives high, and Chrysler has told Automotive News [sub] that it plans on increasing sales by 45% this year. Says Krafcik

We’ll see if others decide to follow. It’s certainly not in our plan right now.

Krafcik has a point: though sales have recovered over the last year as the economy has come back from the depths of recession, industry-wide incentive spending is up 1.3% in the last 12 months. Rather than taking advantage of the economic recovery to bring incentives down and transaction prices up, automakers appear to be focused entirely on volume. That’s certainly the message GM has sent by announcing that it would no longer release its incentive data. And, as Krafcik points out, the industry has already suffered mightily from such short-term, unsustainable thinking… but not everyone shares his concern.

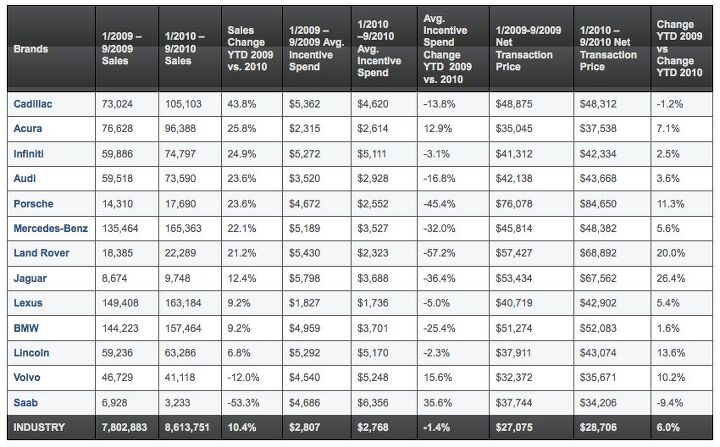

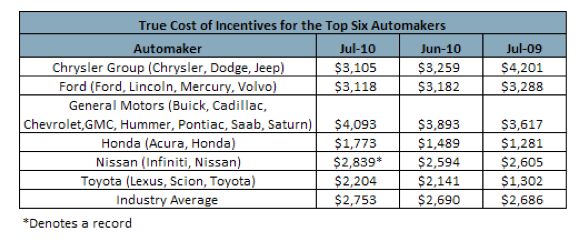

December Incentives Report: Detroit Dominates, But Imports Are Catching Up

As we wade through our year-end sales number reports, one of the important metrics that we’ll be looking at are incentive spending rates. Detroit continues to dominate both Edmunds’ True Cost of Incentives index (above) and TrueCar’s incentive forecast (after the jump), with little serious competition for their supremacy in this profit-sapping and brand equity-squandering category. Still, the foreign firms are increasing their incentives while Detroit has generally scaled back over the last year, so the incentive race is slowly getting tighter…

The Curious Case Of Honda's Missing Mojo

Though the US auto market is up 11 percent this year, Honda’s sales are up only 3.6 percent compared to last year’s weak performance. That means the Motor Company isn’t even keeping up with the growth rates of such maligned brands as Lincoln (+7.4%), Chrysler (+16%) and Mazda (+9.8%). But Team Honda isn’t sweating the details. After all, the Civic and CR-V are nearing the end of their model cycles, while the Accord is a year and a half from its replacement. And, as Honda USA’s Executive VP John Mendel tells Automotive News [sub], at Honda

no one talks about share. Chasing share gets you into bad habits. We set a business plan to sell a certain number of cars. We don’t set the plan based on an assumed share. We plan to grow 2 or 3 percent in volume in good times, and bad times. And there are times we’ll give share back.Which is the kind of thing you’d expect to hear from an exec in Mendel’s situation… unfortunately, there are troubling indicators on the horizon that could cause Honda’s “bad times” to go on longer than anyone expected.Subprime Auto Sales Heat Up

The debate over Detroit’s bailout was dominated by a narrative that portrayed the automakers as victims of Wall Street excess, and placed blame for their collapse on the frozen credit market. And though the credit crunch certainly hurt GM and Chrysler as well as their customers, Detroit was a victim of the credit crunch in the same way an addict is a victim of his dealer. By l everaging easy credit to fuel the SUV boom which covered for unprofitability in passenger cars (or didn’t, as the case may be), Detroit binged on zero-percent financing as the market road confidently to 16m annual sales. And then, finally, the music stopped and the Domestics crumpled, victims of their own greed, but with a convenient scapegoat in the hated Wall Street bankers. But if the bailout was intended to not only get GM and Chrysler back on their feet but also to prevent future collapses, there’s some troubling news in the offing: subprime auto lending is starting to roar back, and if it goes unchecked, it could reach pre-recession levels in short order…

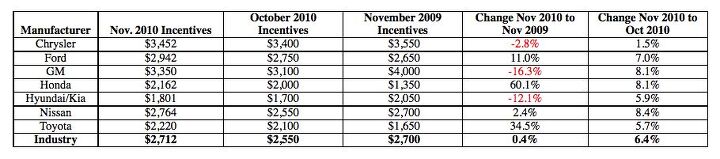

November Sales: Unraveling The Incentives

This, according to TrueCar.com, is what automakers spent on incentives last month. Though Chrysler and GM have cut compared to November of last year, their incentive spending is on the march compared to last month, and they still vie for industry “leadership” in these profit-sapping spiffs. But that’s just TrueCar’s perspective…

Could GE's EV Mega-Buy Be Bad For Consumers?

The Auto Prophet brings up a point that completely escaped our discussion of General Electric’s EV mega-buy:

By gobbling up EVs, GE certainly helps to jump-start the industry, but they also gobble up future tax credits that consumers would have gotten, unless GE opts to forego the EV tax credit. Which would be bad business.

Yup, GE’s huge EV buy will be good for GE… but it won’t be so great for the 25,000 Americans whose tax credit will slurped up in the process. After all, the credit expires after a manufacturer sells 200k qualifying vehicles, so every credit GE uses brings GM and Nissan that much closer to the day they have to ask consumers to pay full price for their pricey EVs. No wonder GM is already pushing for an extension of the credit past 200k units.

The Top 20 Fleet Queens Of 2009

Fleet sales data can be some of the toughest numbers to find, but thanks to a post from commenter GarbageMotorsCo, we’ve got some pretty comprehensive numbers for last year’s fleet performance [courtesy: automotive-fleet.com, PDF list here]. Overall fleet levels have been higher this year, but by identifying the most popular vehicles with fleet buyers (in terms of fleet sales as a percentage of overall sales), we’ll at least have some hints about this year’s performance. To help give a more accurate picture, we’ve left out obvious commercial vehicles (mainly large vans, and the queen of all fleet queens, the Ford Crown Vic (95% fleet)), as well as discontinued models like Chevy Uplander (57%) and Pontiac G6 (44.7%). We also left out hybrid or CNG versions of nameplates. Two vehicles with limited sales last year (GMC Terrain and Kia Forte) are on the list, even though they may not be on a similar list for 2010 (the Honda Insight is not on the list, despite selling all 193 of its 2009 sales to fleets). Hit the jump for our full list.

Detroit Leads Incentives, But Toyota Forecasts Volume-Buying Binge

Who spent the most money on volume-building but profit-sapping incentives over the last month? Well, it depends on who you ask. Edmunds.com’s True Cost Of Incentives index puts GM at the top of the heap, with an October estimate of $3,437 spent per sale. Truecar.com has a similar number for GM, at $3,472, but says that Chrysler was the king of incentivized sales last month, spending $3,629 per car sold. Interestingly, both firms put Ford at just over $3,000 spent per vehicle, but Edmunds says Chrysler is actually under that mark, spending $2,927 per vehicle. In another discrepancy between the two reports, TrueCar puts Nissan at $3,050 while Edmunds puts the Nissan number at $2,321. In any case, Toyota may just be the Japanese automaker that breaks Detroit’s dominance of average incentive numbers. Toyota’s Bob Carter has revealed that big incentives are coming as Toyota struggles to get its volume up by year’s end, telling Automotive News [sub]

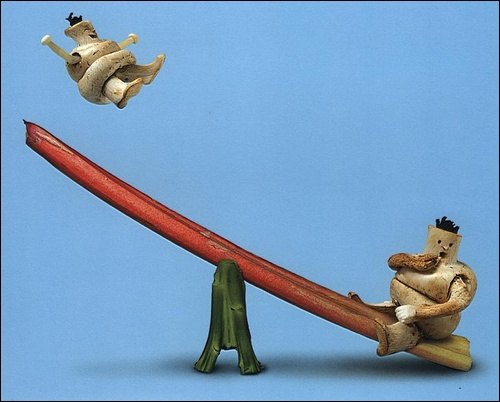

You will see an enhancement to marketing and incentives but [they] will remain consistent in the APR and lease arenas,” he said. “They will be the best deals of the year — leasing and APR deals are moving the market.Hit the jump for average incentive spending reports from Truecar.com and Edmunds.comThe Other Side Of The See-Saw: Toyota Transaction Prices Lowest As Percentage Of Sticker Prices

In almost perfect contrast to Ford’s rapidly rising average transaction prices ( previous post), Toyota is having to keep incentives and dealer discounts high in order to keep moving the metal. Automotive News reports that Toyota dealers, once money printing machines, are having to accept lower gross profits. Transaction prices on new 2011 models are the lowest, as a percentage of sticker prices, of all mainstream brands, according to TrueCar and Edmunds.com. And Toyota dealers aren’t denying it:

What's Wrong With This Picture: Jobless Recovery Edition

Anticipating 200k Volt Sales, GM Pushes Against EV Tax Credit Cap

The Federal tax credit for purchasing an electric vehicle is good for up to $7,500 off your next tax bill, under current provisions. But it won’t last forever: each manufacturer can sell 200,000 EVs and plug-ins with the federal rebate, but after that, consumers must pay full price (less any state incentives). And though GM will produce only 10k Volts in 2011, and only 45k units in 2012, its Vice Chairman Tom Stephens is already agitating for the 200k unit limit to be lifted. Optimistic much?

Ford's Hatchback Tax: 2012 Ford Focus Five-Door Costs $795 More Than Similar Sedan

Tickets for Ford’s 2012 Focus (coming next spring) start at a Cruze-pipping $16,270 (destination charge not included), but that’s for a “S” Trim four-door sedan with “100A” equipment (rear drum brakes, manual air conditioning steelies). In other words, as with the Fiesta, Ford has made its “come-on-in special” version of the Focus sedan-only. Move up to the “SE” trim for an apples-to-apples comparison, and you find that the Focus hatch carries the same $795 “hatchback tax” as the Fiesta. SE Sedans start at $17,270, while the SE hatchback starts at $18,065 (Sedan pricing in PDF here, Five-Door here). Meanwhile, “Titanium”-spec Focii are knocking on $23k, at which point you’re getting the same 2.0 GDI as the base model, while Cruze customers venturing into similar price territory will have upgraded to the well-received 1.4 Turbo. So why is it that the hatchback tax bothers me the most?

Incentives for September 2010. They're Lower, But Only Just

You’ve probably digested September’s sales figures. Now comes the paying the bill part. Quite literally. Edmunds (via Newswire) has broken out the incentive figures.Industry average for September 2010 stands at $2,576 (lower than August 2010, which stood at $2,701 for the month).

Japan In September 2010: Sayonara, Growth

TTAC (and just about everybody who comments on the Japanese market) saw it coming: After 14 months of government subsidies-induced growth, the Japanese car market took a corner. And now its nowhere but down. Japanese sales dropped 4.1 percent on the year to 308,663 units in September, the Japan Automobile Dealers Association told The Nikkei [sub]. This number does not include Kei cars, which will be published separately.

Chrysler: Once Again, Regrets Come Standard

Gimmicky sales techniques are tough. On the one hand, Hyundai’s 10 year warranty and Assurance buy-back program have helped it become one of the fastest-growing auto brands in the country. On the other, Chrysler’s free gas giveaway, “lifetime guarantee” and its latest, the “regret-free purchase” offer, have all come and gone without materially moving the needle for the beleaguered automaker. In fact, cars.com reports that just 21 buyers opted for the option of returning their Chrysler within 60 days instead of a financing deal. Which makes sense: people buy Chryslers because they’re cheap and they offer lots of incentives. If we’re honest, the option of returning a car because it is of lower quality than the competition shouldn’t really appeal to deal-minded consumers. Which is why only Ram now offers the “regret-free” deal, while the rest of Chrysler, Jeep and Dodge’s nameplates have loaded back up on incentives. It’s clearly what brings the customers in.

Marchionne Blames Bailout For Profit-Free 2010

We’re hardly shocked by the idea that Chrysler won’t turn profit this year. After all, Auburn Hills has barely made its minimum monthly sales volumes (at best, and with rampant incentives and fleet mix) this year, and lost $50m+ in “industrial inefficiencies” on the Jeep Grand Cherokee launch alone [ Q2 results analysis here]. With plans to close out the year with a non-stop barrage of product launches and attendant media spending, it would take a minor miracle for Chrysler to break even. But we’ve essentially known this all for some time… what’s truly shocking is that Chrysler’s CEO Sergio Marchionne actually admitted to the media that Chrysler won’t turn a profit.

Detroit Dominates Year-To-Date Fleet Sales

Automotive News [sub] takes a stab at calculating the numbers that Detroit doesn’t want you to see. Best of all, AN says the numbers are based on “internal documents.” During this morning’s financial results conference call, Chrysler CEO Sergio Marchionne railed against AN’s “crusade,” implying that the industry paper of record is nursing a vendetta against Chrysler… which is usually a good sign that a media outlet is doing its job well. It’s also a sign that Marchionne knows his firm’s fleet dependence is a problem.

GM Kills The Competition… In July Incentive Spending

Postcards From "The New Normal"

Sales numbers for the US market in July should drop today, and based on an early analyst survey, the market’s only recovered to a 12m SAAR at best. Estimates aside though, it’s beginning to look more and more like the US market for new cars is approaching a “new normal.” How so? Automotive News [sub]’s Jesse Snyder figures it’s

Because discipline is breaking out all over– at manufacturers, suppliers and dealerships.

Even Snyder’s headline captures the mood of cautious realism that’s suddenly taken hold of the auto industry: though the market appears to have moved towards 12m annual units in July, Snyder’s analysis is headlined Life at 11 million U.S. sales.

California Denies Volt AT-PZEV Status, Tax Rebate, HOV Access

With Chevy’s Volt priced at an eye-popping $41k before tax breaks, those tax breaks are now more important than ever. The first 200k Volts will qualify for up to $7,500 in federal credits, but Chevrolet had to be hoping for state incentives on top of the federal credit, especially in the key launch state of California. For a number of reasons though, the Volt doesn’t meet California’s requirements for Advanced Technology-Partial Zero Emissions Vehicles, and will lose out on a $5,000 tax credit that’s available to its cheaper competitor, the Nissan Leaf. As a result, the Leaf will cost Californians who qualify for both full credits about $20k, while the Volt will cost about $33,500. Moreover, the Leaf will have full access to California’s High Occupancy Vehicle lanes while the Volt will not, unless a pending bill before California’s state Senate passes. Together, these developments represent a serious advantage for the Leaf over the Volt in what is almost certain to be the world’s largest market for electric cars in the short-to-medium term. So how did GM let this happen?

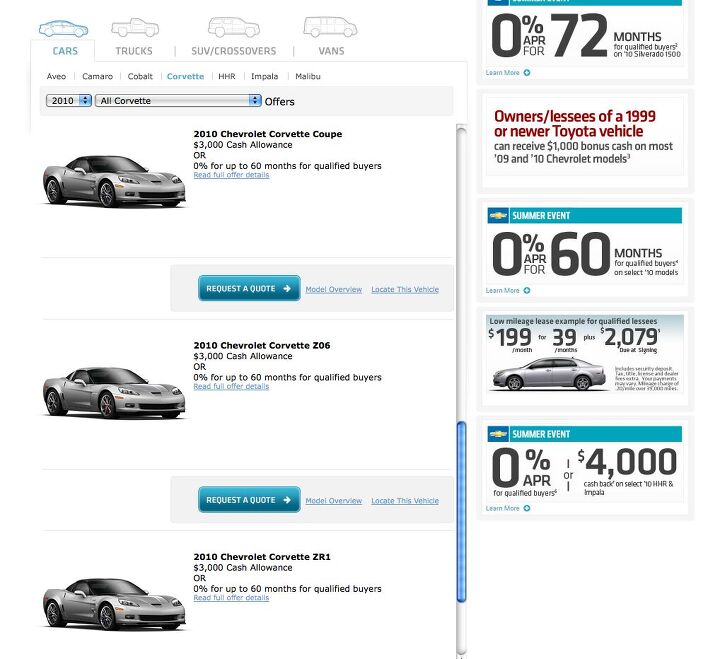

TTAC Moves Fast On A 0% ZR1

We don’t know for sure, but Dr. Sanjay Mehta (TTAC commentator doctorv8, awesome brother) did the deal on a 2010 Corvette ZR1 for 0% while the autoblogosphere still had it in editing. Not that the Internet is slow, he’s just that damn fast.The dude’s been keeping tabs on the inventory nightmare, calling out for GMAC’s corrective action on the Corvette Forum…almost a month ago. It’s so nice to see the two brothers speak The Truth About Cars, via different media.

Auto Dealer Tricks That The Financial Reform Bill Didn't Fix

With President Obama set to sign a new financial oversight bill into law on Wednesday, the New York Times has dug into the bill looking for key oversights. Because auto dealers were exempted from the bill (thanks at least in part to their mobilization by the GM/Chrysler dealer cull), auto dealer finance tactics ended up square in the NYT’s crosshairs, and paper’s Your Money blog has a rundown of three of the most heinous of these tactics: the Yo-Yo, the Markup and the Add-On.

What's Wrong With This Picture: Incentivize This Edition

The good news? GM is so desperate to move Corvettes, it’s decided to give you $3k back or 0% financing on every single new ‘vette, including the world-beating ZR1. The bad news? You have to build the engine yourself. Also, this won’t exactly help GM climb off its throne as the reigning king of incentive spending. But hey, if $106k for a Corvette was sounding a little ridiculous, at least the price point has effectively fallen to $103k. If you’ve been on the fence over that three thousand dollars, it’s time to adjust your spreadsheet accordingly. [ZR1 incentives explained after the jump]

All Things Must Pass: Honda Gets Ready For the Big Meltdown

Japanese car makers castworried glances at the thinning calendar: On September 30, Japan will discontinue their subsidies for environmentally friendly cars. That program had provided Japan with China-sized double-digit growth rates. All things must pass, and Japanese automakers are getting ready for a German sized Abwrackprämien-aftershock: Everybody is expecting a run on dealer lots through September and then: Bang. Other than in Germany, where people who never bought new traded in the jalopies for a cheap new car, in Japan there is a huge pull-forward effect. Automakers are preparing for the worst.

GM Tops June Incentive Spending

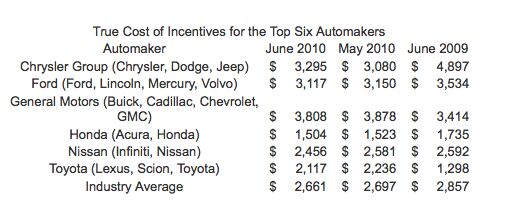

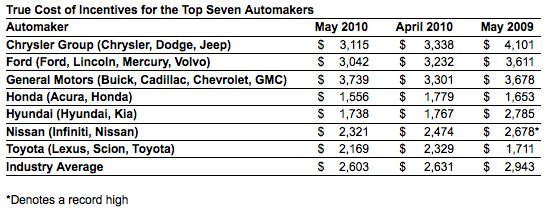

Detroit Tops May Incentives, Residuals Rise Regardless

Once again Detroit finds itself atop Edmunds’ True Cost of Incentive ranking of the top seven automakers [via earthtimes], as the domestic OEMs spent about $1.7b (or, about 60 percent) of the $2.8b paid out by the entire industry on incentives last month. Trucks were the most heavily discounted segment, with average incentives running around $4,650, or nearly 13 percent of the average segment sticker price. Saab spent the most by brand, slapping an average of $6,813 on its vehicles, with Lincoln coming in second at $4,987 per vehicle sold. Saab’s incentives equaled 17.1 percent of its average vehicle price, while Chrysler gave away about 12.2 percent of its average vehicle price last month.

What's Wrong With This Picture: A Giant Clunking Sound Edition

Reuters And WSJ Get Unglued Over Chinese Plug-In Subsidy

China has finally revealed its worst kept secret and announced a pilot program for five Chinese cities. It’s raining cash for buyers of electric vehicles and plug-in hybrids. And it “reflects Beijing’s resolve to foster domestic brands,” says Reuters.

Really? At first glance, there is no discrimination against laowei cars.

Forbes: The "Most Overpriced Cars of 2010" Are Trucks And Utes

The only “real car” on Forbes’ most overpriced list is the Chrysler 300. Really. Despite being based on the compact Cobalt, Chevy breaks sales of its HHR out as a “truck,” in search of improved CAFE performance. And despite an MSRP of under $20k, the PT Cruiser-inspired wagon was still one of Forbes’ most overpriced vehicles of 2010. The rest of the list’s 11 models are unquestionably trucks, or truck-based utes, and save for Nissan’s Titan and Armada, they’re also all from Detroit automakers as well. If you’re looking for more reasons to build a cheap, utilitarian compact pickup truck ( ahem, General Motors) this list has got ’em. Hit the jump for Forbes’ list of most overpriced vehicles, and the magazine’s formula for deciding who makes the cut for this dubious distinction.

The Day After: Ford Rolls Out The Discounts

Ford Europe will swallow a tried and trued antidote against flagging car sales: Heavy discounting. Yesterday, Ford had announced – in a rather roundabout way – that their European sales had dropped a breathtaking 17 percent in April. Putting cash on the hood is no surprising move. Wouldn’t there be another detail.

Inside Chrysler's Sales Increase: 40 Percent Fleet Mix And Industry-High Incentives (And Climbing)

To say that Chrysler’s 25 percent year-over-year sales increase last month came as a surprise would be pushing the boundaries of overstatement. Chrysler’s sales and market share have been in decline for a long time, but over the past several years, the tailspin seemed to have become terminal. So, how did the Pentastar (barely) make its 95k minimum volume level and increase sales by 25 percent over April 2009? Fleet sales, for one thing: according to The Freep, TrueCar.com estimates that a full 40 percent of Chrysler’s April sales went to fleet customers.No wonder made a big deal about publicly finding Jesus on the fleet sales issue… at the end of the month (to say nothing of the conspicuous absence of retail sales numbers in its April report and massive increase in Sebring sales). And the bad news doesn’t end there. Not only did Chrysler top all automakers in per-vehicle incentives last month according to Edmunds’ monthly True Cost Of Incentives index with $3,374 on the average Mopar’s hood, they’re actually increasing incentives even further.

GM Market Share In Reverse For Q1

Back in October, GM’s then-CEO Fritz Henderson announced that GM would make a stand on market share, refusing to allow its share of the US market to slip below 29 percent. Oh wait, that was Gary Cowger’s campaign of 2003, which saw GM execs wearing symbolic “29” lapel pins. Where Henderson actually drew GM’s market share line in the sand six months ago was

At this point about 19 percent… We’ll finalize that, but I’m not interested in going down from that

And according to the Detroit Free Press, GM actually achieved that goal in December, logging a 21 percent share based on Autodata findings. Unfortunately, things have been slip-sliding ever since. In February, GM’s share fell to 18.1 percent, and last month it fell even further, to 17.6 percent.

Edmunds: Record Percentage Of March Sales Were Financed At Zero Percent

Ever since a debt crisis toppled the already-precarious auto sector into undeniable crisis there’s been a running debate about when US car sales would “return to normal.” By now though, even the most ardent bulls seem to have accepted that 2007’s 16m number will be out of reach for at least several more years. So, how will we know when we’ve hit the new normal? According to Edmunds, at least one statistic roared back to 2006 levels last month: the percentage of sales financed at zero percent.

In March, more than 22 percent of financed new cars were purchased with zero-percent finance deals. Last March the total was just 13 percent. The prior high was 21 percent in July 2006.

Japanese Auto Industry In The Grips Of Angst And Anxiety

Japan’s domestic car trade can look back at the first up year in seven years. Japan goes by the fiscal year, which spans from April 1 in the current year to March 31 in the next. In the 2009 fiscal, domestic sales of new vehicles rose 10 percent on the year. You think that’s an occasion to head down to your favorite Ginza hostess bar, break out the sake, or stronger stuff, and party like it’s 2003? Chigaimasu. Quite the opposite is true. The land of the rising sun is worried about falling sales. “A strong sense of anxiety continues to grip the industry,” reports The Nikkei [sub].

China To Seriously Subsidize EVs

China’s carmakers better get their pure plug-ins ready. The central government is set to spend serious money to electrify development and sales. China Daily reports that “a much-awaited government stimulus plan” is ready for government approval and should be in effect in the next couple of months.

Private buyers in five chosen cities (so far unveiled, but the usual suspects apply) will be able to collect close to $9000 if they buy a pure plug-in. Imports need not apply.

Last Chance To Get A Hummer

Have you been secretly lusting for a Hummer? Here is your last chance. GM is definitely shutting Hummer down. The remaining inventory of 2,200 Hummers will go on a big fire sale.

Quote Of The Day: Alternate Reality Edition

We no longer have the dubious honor of leading this category. We’ve been down that road before, and we know it’s a dead end.

We didn’t listen to GM’s monthly sales call today, but it we had, we would have been even more likely to screw up the headline for Edmund’s incentive report [ed: for which we deeply apologize]. The cognitive dissonance between Susan Docherty’s triumphalist quote and Edmunds’ harsh version of reality left even Automotive News [sub] scratching its head. “GM says it avoided spiff frenzy — but Edmunds numbers beg to differ,” runs the shit-starting headline. Docherty claims that GM pays a mere $2,800 in incentives per vehicle, far short of Edmunds’ chart-topping $3,519 “true cost.” So what gives? Well, GM’s numbers do come from JD Power…GM Tops March Incentives

Daimler In The Grips Of U.S. Graft Police: "Pay $185m And We'll Let You Walk."

Money-wise, the United States is in a bit of a tough spot. Must create revenue wherever it can. From red light cameras to shaking down foreign companies. On Tuesday, Germany’s Daimler AG was charged with violating U.S. bribery laws “by showering foreign officials with millions of dollars and gifts of luxury cars to win business deals,” as Reuters has it. After asking “how much will it take for this to go away?” Daimler plans to pay $185m to settle charges by the U.S. Justice Department and Securities and Exchange Commission.

March Sales: Party Like It's 2005?

Peter Schiff (the man who saw the financial meltdown coming from a mile away) continually asserts that financial stimulus isn’t cure, it prolongs or postpones the problem. Any hardcore free capitalist will find it hard to disagree with Mr Schiff. There is no governmental stimulus such as in Europe. There is plenty of stimulus from the car makers.

March sales for the United States are forecast to explode according to ecreditdaily. They report that JD Power & Associates forecast that new vehicle retail sales going to increase 25 percent. New vehicle sales for the month of March 2010 are expected to be around 883,300 units. The majority of the growth is expected to come from a certain manufacturer who’s been in the media for other reasons. Our own Darth Niedermeyer, saw this coming.

Japanese Auto Makers: Let's Make A Deal!

Lavish cash on the hood of Japanese cars may help their U.S. sales (or soften the fall in Toyota’s case). The largess also “will put pressure on earnings,” says The Nikkei [sub].

Toyota, Nissan, Honda raised sales incentives in February to an average of 2,221 dollars per vehicle, up 11 percent from January.

February Sales Snapshot: Truck Month Headed For A Letdown?

If there are two words that can’t be left out of any discussion of 2010 auto sales numbers, they are “incentives” and “fleet.” With a fleet sales binge well underway, and Toyota recall-triggered incentive wars raging with no end in sight, the spring Truck month rituals have been bounteous. And with sales of full-sized trucks through February trending flat and fragmented, they had to be. But will they make a difference?

Saab Puts $4k-$8k Incentives On 2009 Models

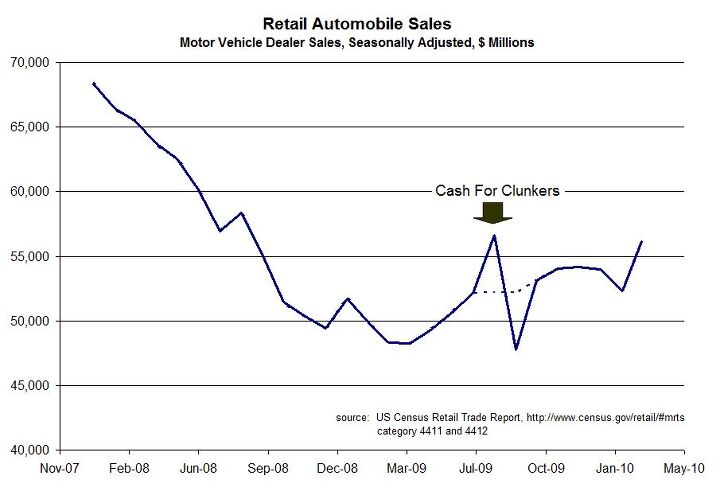

Toyota Woes Drag Detroit Back Into Incentive Wars

The biggest storyline right now for America’s bailed-out automakers is how little they’ve been able to capitalize on Toyota’s stumbles. While Ford and Hyundai made hefty sales gains last month, both GM and Chrysler’s performances were distinctly unimproved by Toyota’s woes. And now that Toyota is launching major incentive packages to recover lost sales momentum, Detroit has no remaining incentive to not revert to the bad old practices of incentive dependence. With GM and Ford diving into the zero-percent war, Global Insight’s George Magliano tells Automotive News [sub]:

Incentives are going to be here into the third quarter. We’re not going to wean consumers off incentives any time soon. We’re stuck with it. They’re all jockeying for position… After clunkers everybody backed off incentives. Now they’re going to the whip again

Scuffle Brews Over GM Request For Dealer Incentive Payback

GM earned some goodwill with dealers in recent weeks by reinstating over 600 dealers, most of them rural Cadillac stores. But as always, as soon as one grating issue in GM’s relations with its dealers is resolved, another one appears. Automotive News [sub] reports that GM is seeking five- and six-figure sums from what it terms “a very small” number of dealers who allegedly violated the terms of its Standards for Excellence Incentive program. This might be a relatively normal occurrence, if it weren’t made more complicated by GM’s recent bankruptcy. Because GM audited its dealers before bankruptcy, but didn’t act on the information until now, GM says that its penalties aren’t debatable, and that the normal audit process will not be available to dealers receiving the bills.

Toyota Buyers: They're Baaack!

Further in the Toyota caper, there are new reports of sudden acceleration – in Toyota sales.

Toyota buyers seem to have a big case of the bashing fatigue. And they are coming back in droves. Toyota said (via The Nikkei [sub]) that “its new cars sales in North America jumped around 50 percent from a year earlier in the first week of March due to recently introduced sales incentives.”

Russia To Spend $20b On Auto Industry Stimulus

Vladimir Putin has announced that his government will spend $19.6b (584 billion rubles) on auto-sector stimulus, with spending planned on technology development, employee re-training, direct subsidies, and cash-for-clunker-style consumer stimulus. Another $20b of investment is expected from foreign automakers. These measures are aimed at a host of of ills besetting the Russian auto industry and market, ranging from what the government describes as a 4-7 year technological deficit, and a 50 percent drop in sales last year.

Recent Comments