Bark's Bites: Regulators, Mount Up!

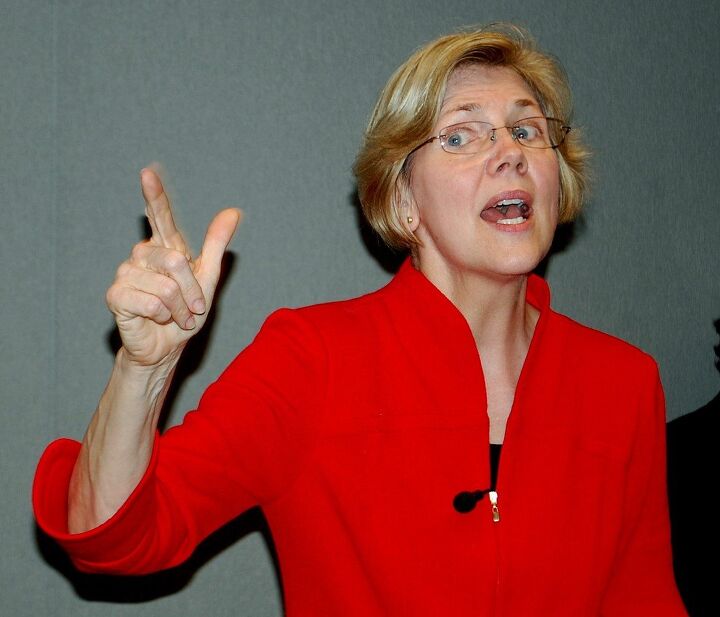

It pains me greatly, dear readers, to say what I’m about to say. Those of you who regularly follow my writing know how I lean when it comes to politics. However, given the current state of the auto dealership world, I have no choice. I gotta admit it — I agree with Elizabeth Warren on something.

Good ol’ P…er, Senator Warren and I both agree that there needs to be more oversight of the automotive lending business. Part of my day job is to educate new automotive advertising sales representatives about the car sales industry, and when I get to the part of the day where I tell them about how the Finance and Insurance office works, I always give them the following warning:

“Guys, if you don’t know about how car loans work, you’re about to get very, very angry.”

So I’ll give you the same warning, friends. I’m going to share about the predatory lending practices that go on behind the scenes, and I’ll tell you what I think should be done to stop it.

Let’s say you’re Suzy SubPrime, and you want to buy yourself the latest and greatest CUV from Maibatsu. You don’t have the worst credit in the world, but you know that you’ve missed a payment or two along the way, so you’re a little bit nervous about whether or not you might get approved on a loan. After you pick out your dream car from the lot, you find yourself in a very confusing office, where the man sitting behind the desk looks less like a salesman and more like a banker, which intimidates you more than a little bit.

You fidget as you sit in your chair and watch as he murmurs quite a bit, shaking his head as he scratches out some numbers from his computer screen (which you can’t see). After several more uncomfortable moments, he sighs and says, “The best we could get you approved for is 6.9 percent, but luckily that still fits your payment that you told your salesman that you could afford.”

Breathing a sigh of relief, you sign whatever papers are put in front of you, and drive home happily with your new ride.

Here’s what really happened.

The finance office is designed to confuse and intimidate you. There’s nobody offering you popcorns or drinks, no colorful balloons and cheery music. There’s just you and a ton of paperwork that they genuinely hope that you don’t read. You’ll be given a Truth in Lending disclosure, which is required by law. It tells you what your Annual Percentage Rate is, the total cost of your financing, the amount financed, and the total of the payments.

However, what it doesn’t tell you is what your Buy Rate from the lender was, and what the bump in your rate was. In 2016, the average bump for consumers financing through a dealership was 2.5 percent.

This should be the part where you get very, very angry.

Yes, that’s right — the dealer doesn’t have to (and most likely won’t) give you the actual rate that the lender has approved you for, and in many states in the union, there’s no limit to how much the dealer can add in interest. It’s in his best interest to get you bumped as much as he can, because the dealership gets to keep the majority, if not all, of that money.

Your average car buyer has no idea about this. Maybe you do, Mr. Educated TTAC Reader, but when I get to this point in my training workshops, there is genuine shock and outrage from my employees — and these aren’t low income individuals. These are career sales professionals, many of whom are earning in the six-figure range. Nearly unanimously, the sentiment expressed is along the lines of, “I really wish that I had known this before I bought my last car!”

Senator Warren wants auto lending to fall under the jurisdiction of the Consumer Financial Protection Bureau, a federal agency created in the aftermath of the 2009 financial crisis. While the CFPB can and does regulate loans that take place outside the four walls of the car dealership, they have no power over what happens inside. The Bureau did, however, issue a warning memo to dealerships back in 2013, advising them that hiking the rates of minorities more than their white counterparts would be seen as a discriminatory practice. As a result of this memo, Ally Financial was forced to pay $98 million to settle claims that the average black car buyer was charged $300 more over the course of his loan than the average white buyer with the same credit score.

So what should be done? I say we should introduce federal legislation capping the amount that a loan can be bumped to 2 percent. I also say that the Truth in Lending statement should disclose the buy rate that was offered by the bank, any additional markup by the dealer, and the amount of money that the consumer will pay as a result of this markup.

B-b-b-b-but, says the dealer, that will cost me thousands in back end profit! I don’t know if that’s necessarily true. Once customers are educated on the nature of auto lending, they might be encouraged to go loan shopping, yes, but most customers understand there is profit on the front end of a car sale, and yet you’re still making money on your used car sales.

In fact, there’s no ethical reason that a customer shouldn’t be made aware that he’s not getting the best possible rate that he can get. Customers assume — and F&I managers often straight up say — that the reason their F&I guy is sweating is so hard is that he’s working his hardest to get the customer the best deal. Negative. He’s working hard to find the bank that will give him the best deal, so he can bump you as much as possible and keep you in a comfortable payment.

The best thing about this legislation, however, is that it would force the National Automobile Dealers Association to have to lobby against it, exposing them for the snakes that they are.

So go on with your bad self, Liz. I got your back.

[Image: Edward Kimmel/ Flickr ( CC BY-SA 2.0)]

More by Mark "Bark M." Baruth

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Formula m How many Hyundai and Kia’s do not have the original engine block it left the factory with 10yrs prior?

- 1995 SC I will say that year 29 has been a little spendy on my car (Motor Mounts, Injectors and a Supercharger Service since it had to come off for the injectors, ABS Pump and the tool to cycle the valves to bleed the system, Front Calipers, rear pinion seal, transmission service with a new pan that has a drain, a gaggle of capacitors to fix the ride control module and a replacement amplifier for the stereo. Still needs an exhaust manifold gasket. The front end got serviced in year 28. On the plus side blank cassettes are increasingly easy to find so I have a solid collection of 90 minute playlists.

- MaintenanceCosts My own experiences with, well, maintenance costs:Chevy Bolt, ownership from new to 4.5 years, ~$400*Toyota Highlander Hybrid, ownership from 3.5 to 8 years, ~$2400BMW 335i Convertible, ownership from 11.5 to 13 years, ~$1200Acura Legend, ownership from 20 to 29 years, ~$11,500***Includes a new 12V battery and a set of wiper blades. In fairness, bigger bills for coolant and tire replacement are coming in year 5.**Includes replacement of all rubber parts, rebuild of entire suspension and steering system, and conversion of car to OEM 16" wheel set, among other things

- Jeff Tesla should not be allowed to call its system Full Self-Driving. Very dangerous and misleading.

- Slavuta America, the evil totalitarian police state

Comments

Join the conversation

Congratulations, Mark! The reality based community urges you to continue this journey towards us and welcomes these tentative steps away from the realms of absurd right wing trollery!

Mark, Well written and concise article, and frankly this sentence sums it all up so nicely.. "The best thing about this legislation, however, is that it would force the National Automobile Dealers Association to have to lobby against it, exposing them for the snakes that they are." Lobbying firms in general, as well as the senators that ally with them ARE snakes, and so are the companies that employ them. Rarely is a time when a company has anything but their own profits in mind, they hire a lobbyist, the lobbyist and the company WRITE THE LAW - and they find a senator to push it on some BS platform that makes no sense. I work in state government, and I always say if people REALLY knew how the sausage was made ... look out. I'm going to actually say this, as absurd as it sounds; The government, at ALL levels (Local, state, federal) is in fact.. run by the corporations, man. JimBot