New Paradox: Sales Down in a Red-Hot Market

Delivery numbers for the first quarter of 2022 may be down compared to this same time last year, but don’t construe that as a lack of customer interest. Supply and demand are out of sync for many manufacturers right now, leading to a situation in which there seems to be no shortage of buyers but a dearth of inventory to satiate their requests.

Alert readers will recognize there are a number of holes in this chart, a situation one can blame on OEMs refusing to release sales numbers in a timely manner at the end of a quarter. This is in addition to scuttling the practice of monthly reporting, it should be noted. Companies like Ford, a trio of Germans, and Volvo will post their numbers sometime later this month. At that time, we will update this chart. Or not. Tesla did release their numbers for global production and deliveries, but it’ll be another three weeks until market specifics are given.

Still, there’s plenty to talk about. Toyota has once again bested General Motors for the top spot in America by these measures, outselling the Detroit behemoth by about 5,500 cars despite a near 15-percent drop in sales year-over-year. Given the tumbleweeds at your author’s local Toyota dealer, one can only speculate how many they would have sold if not for global supply chain issues. GM was off by about 20 percent with a notable blip at Buick.

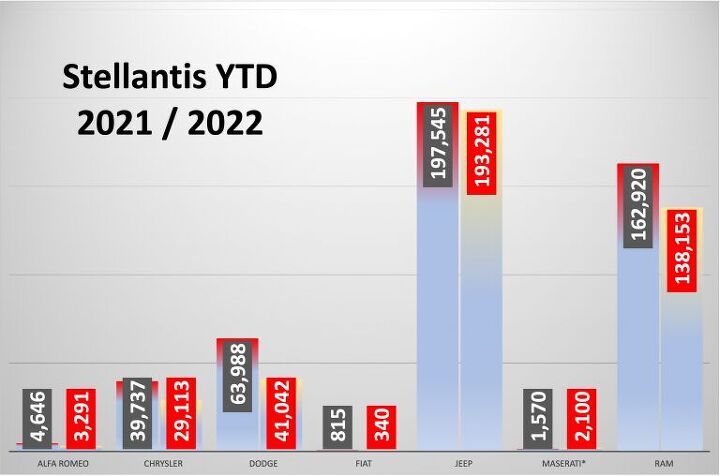

It’s endless fun to poke through the weird minutiae of sales numbers, including revelations such as the fact that Stellantis apparently managed to move a pair of Chrysler 200 sedans in the first quarter of 2022 despite it being a model which ceased production in December 2016. Someone unearthed a Dodge Dart as well.

The addition of automakers to our chart is a trip since the creation of new marques in this market hasn’t happened en masse for decades. Rivian, Polestar, and Lucid all shipped vehicles in the first quarter of this calendar year, with sales estimates aggregated from the eggheads at Automotive News.

No one should construe these difficult numbers with a lack of American desire to buy new vehicles. Most dealerships are selling rigs the minute they land, with many hot models pre-sold long before they ever turn a wheel on the dealer’s lot. This has given rise to endless ‘market adjustments’ and the associated clapbacks from manufacturers to some dealers who may be seen as taking advantage of the situation.

This may be one of the few times in recent memory that the pace of production is roughly equal to the pace of sales. Even if supply chains get back to normal and build rates improve, pent-up demand will hoover any extra vehicles being pumped out of car factories.

[Image: Toyota / Charts: TTAC]

Matthew buys, sells, fixes, & races cars. As a human index of auto & auction knowledge, he is fond of making money and offering loud opinions.

More by Matthew Guy

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff JMII--If I did not get my Maverick my next choice was a Santa Cruz. They are different but then they are both compact pickups the only real compact pickups on the market. I am glad to hear that the Santa Cruz will have knobs and buttons on it for 2025 it would be good if they offered a hybrid as well. When I looked at both trucks it was less about brand loyalty and more about price, size, and features. I have owned 2 gm made trucks in the past and liked both but gm does not make a true compact truck and neither does Ram, Toyota, or Nissan. The Maverick was the only Ford product that I wanted. If I wanted a larger truck I would have kept either my 99 S-10 extended cab with a 2.2 I-4 5 speed or my 08 Isuzu I-370 4 x 4 with the 3.7 I-5, tow package, heated leather seats, and other niceties and it road like a luxury vehicle. I believe the demand is there for other manufacturers to make compact pickups. The proposed hybrid Toyota Stout would be a great truck. Subaru has experience making small trucks and they could make a very competitive compact truck and Subaru has a great all wheel drive system. Chevy has a great compact pickup offered in South America called the Montana which gm could be made in North America and offered in the US and Canada. Ram has a great little compact truck offered in South America as well.

- Groza George I don’t care about GM’s anything. They have not had anything of interest or of reasonable quality in a generation and now solely stay on business to provide UAW retirement while they slowly move production to Mexico.

- Arthur Dailey We have a lease coming due in October and no intention of buying the vehicle when the lease is up.Trying to decide on a replacement vehicle our preferences are the Maverick, Subaru Forester and Mazda CX-5 or CX-30.Unfortunately both the Maverick and Subaru are thin on the ground. Would prefer a Maverick with the hybrid, but the wife has 2 'must haves' those being heated seats and blind spot monitoring. That requires a factory order on the Maverick bringing Canadian price in the mid $40k range, and a delivery time of TBD. For the Subaru it looks like we would have to go up 2 trim levels to get those and that also puts it into the mid $40k range.Therefore are contemplating take another 2 or 3 year lease. Hoping that vehicle supply and prices stabilize and purchasing a hybrid or electric when that lease expires. By then we will both be retired, so that vehicle could be a 'forever car'. And an increased 'carbon tax' just kicked in this week in most of Canada. Prices are currently $1.72 per litre. Which according to my rough calculations is approximately $5.00 per gallon in US currency.Any recommendations would be welcomed.

- Eric Wait! They're moving? Mexico??!!

- GrumpyOldMan All modern road vehicles have tachometers in RPM X 1000. I've often wondered if that is a nanny-state regulation to prevent drivers from confusing it with the speedometer. If so, the Ford retro gauges would appear to be illegal.

Comments

Join the conversation

The reason for the push on the Maverick is that it takes a month or more to ship from the factory in Mexico. Ford is expecting the last dealer deliveries for Maverick MY 2022 to be in October. Sometime in September for the start of 2023 Maverick production. Ford is trying to catch up from plant shutdowns mostly due to part shortages.

You guys do grasp that the S in MSRP stands for SUGGESTED, right? If you don't like it I suggest you buy somewhere else.