GM Muses Spinning Off EV Operations to Better Court Investors

One of the strangest anomalies in the automotive industry is the way electric vehicle startups (like technology companies in general) seem to draw limitless support from investors while established automakers don’t receive nearly the same kind of love — even when transitioning toward EVs.

There’s a logic behind this, however. Green tech is overwhelmingly trendy at the moment, even if some of it lacks a comprehensive game plan to actually save the environment, and financial backers are always looking to get in on the next big thing before anybody else — resulting in scattershot investing that sometimes coalesces into a major victory for new firms possessing sufficient moxie.

But it hasn’t helped the auto industry’s largest players, who are seen as dinosaurs using the blood of their forebears to amass their fortunes. They lack the presumed purity of brands like Tesla or Nikola (clever name), even though their financial goals seem largely the same.

A potential solution to this problem is to distance tech-focused entities from the core business.

We’ve already seen both Toyota and Volkswagen Group rebrand/expand their software and mobility development teams into slickly named side projects. Intentionally designed to have as little to do with the parent company as possible, they’re assumed to draw in outside support and fuel the companies’ push into electrification and data acquisition. General Motors participated in this behavior when it bought Cruise Automation, only to put it back on the market to sell minority stakes to others. Apparently, GM’s leadership is considering doing something with its electric vehicle program, as well.

According to Bloomberg, GM has been considering spinning off its electric ambitions for a while after seeing startups attract billions of dollars of investment without offering more than a sales pitch. Selling a bunch of real cars to customers is fine, but GM really wants to get back into the good graces of Wall Street, if that’s possible.

During last week’s earnings call, analysts asked CEO Mary Barra if GM would spin off its electric-vehicle operations as a standalone entity.

“We are open to looking at and evaluate anything that we think is going to drive long-term shareholder value,” she said, noting that no options had been removed from the table.

From Bloomberg:

GM now is war-gaming the idea as the company ponders different ways to get credit for its EV plans, though a spinoff isn’t actively being prepared, said the people, who asked not to be identified discussing internal deliberations. Barra was publicly asked about it in light of Tesla Inc.’s soaring valuation and the easy access to capital that unproven EV startups such as Nikola Corp. have pulled off by merging with blank-check companies.

“Investors are telling us every day that they are willing to invest in electric vehicles,” said Emmanuel Rosner, the Deutsche Bank analyst who asked Barra about the idea of a spinoff on July 29. “But they are doing it with electric-vehicle companies, not legacy companies.”

The outlet reported unnamed sources who claimed the view within GM is that these tech startups are attracting billions of dollars in investment while lacking the same tangible might of legacy automakers. It also said to look at the messaging used by General Motors over the last few years, in which it characterizes itself less as a carmaker and more as a technology firm that happens to build automobiles.

This is absolutely not limited to GM, however. The term “mobility company” has been thrown around quite liberally within the industry ever since former Ford CEO Mark Fields toyed with the concept half a decade ago. Despite failing in his quest, Fields’ general strategy has become so commonplace within the automotive sector that someone probably owes him an apology. This will be especially true when/if legacy automakers finally manage to convince investors that their stocks deserve to be as overblown as those belonging to some of these startups. But they’ve yet to find the secret sauce to get Wall Street’s mouth watering thus far.

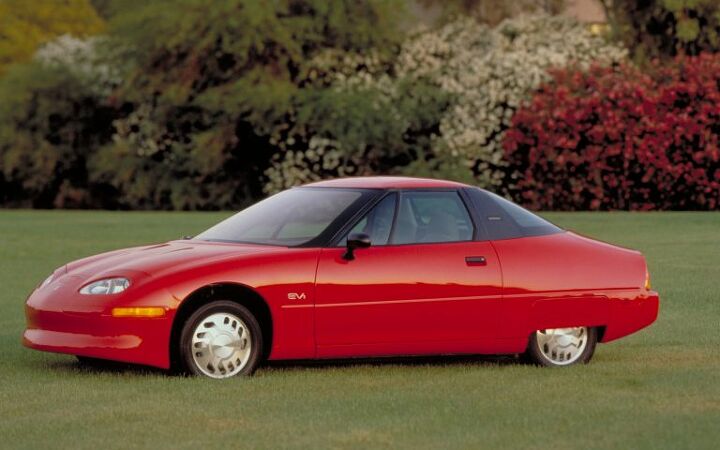

[Image: General Motors]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Funky D The problem is not exclusively the cost of the vehicle. The problem is that there are too few use cases for BEVs that couldn't be done by a plug-in hybrid, with the latter having the ability to do long-range trips without requiring lengthy recharging and being better able to function in really cold climates.In our particular case, a plug-in hybrid would run in all electric mode for the vast majority of the miles we would drive on a regular basis. It would also charge faster and the battery replacement should be less expensive than its BEV counterpart.So the answer for me is a polite, but firm NO.

- 3SpeedAutomatic 2012 Ford Escape V6 FWD at 147k miles:Just went thru a heavy maintenance cycle: full brake job with rotors and drums, replace top & bottom radiator hoses, radiator flush, transmission flush, replace valve cover gaskets (still leaks oil, but not as bad as before), & fan belt. Also, #4 fuel injector locked up. About $4.5k spread over 19 months. Sole means of transportation, so don't mind spending the money for reliability. Was going to replace prior to the above maintenance cycle, but COVID screwed up the market ( $4k markup over sticker including $400 for nitrogen in the tires), so bit the bullet. Now serious about replacing, but waiting for used and/or new car prices to fall a bit more. Have my eye on a particular SUV. Last I checked, had a $2.5k discount with great interest rate (better than my CU) for financing. Will keep on driving Escape as long as A/C works. 🚗🚗🚗

- Rna65689660 For such a flat surface, why not get smoke tint, Rtint or Rvynil. Starts at $8. I used to use a company called Lamin-x, but I think they are gone. Has held up great.

- Cprescott A cheaper golf cart will not make me more inclined to screw up my life. I can go 500 plus miles on a tank of gas with my 2016 ICE car that is paid off. I get two weeks out of a tank that takes from start to finish less than 10 minutes to refill. At no point with golf cart technology as we know it can they match what my ICE vehicle can do. Hell no. Absolutely never.

- Cprescott People do silly things to their cars.

Comments

Join the conversation

Fender skirts (and squared-off rear wheelwells) on the EV1 set back any progress against climate change by at least a decade. (GM Design Staff - why do you hate our planet?)

Basic industries like cars, steel, aluminum, energy producers, consumer durables, etc., need to discount the opinions of analysts. They cater to short term investors and rising/large-swing stock prices for large, quick returns. Basic industries with large capital investments and slow, steady growth over the long haul will never be favored by such analysts. There will always be investment capital available from insurance companies, retirement systems, bond trusts, and the like, who invest for the long term. Since even basic industries are subject to the business cycle, they should keep an eye on stock prices to buy stock when times are good and maintain dividends on a smaller stock base in bad times. That will keep the long term investors happy, and insulate them from the quick buck investors and their analysts.