Subaru USA CEO Tom Doll Gets Specific About COVID and Post-COVID U.S. Sales Goals

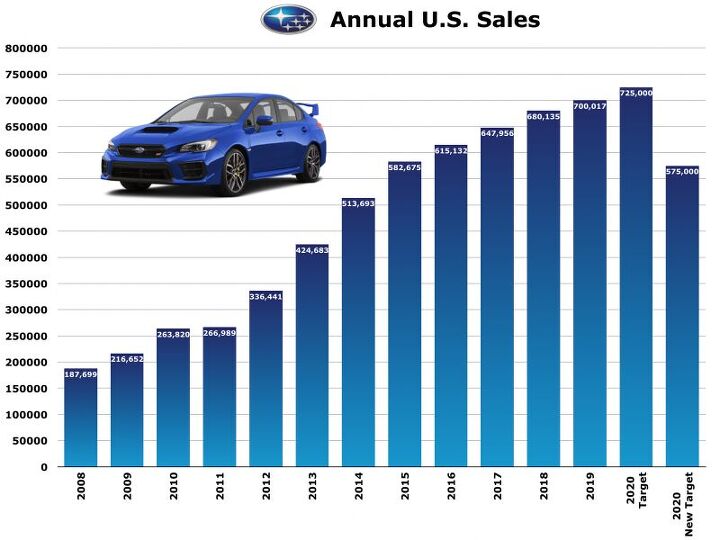

After a streak of 11 consecutive years of U.S. sales growth for Subaru, a period in which the brand doubled its market share to 4.1 percent, “We’ll start a new streak next year,” the brand’s U.S. CEO Tom Doll says of 2020.

At any other point in history, the declines reported by Subaru over the last few months would be calamitous. Yet Subaru’s year-over-year losses in 2020, a year torn to shreds by COVID-19, have not been as severe as anticipated. Moreover, bright spots have been more numerous than expected.

The company, as a result, is now planning for 2020 to end as the brand’s sixth-best on record.

In an interview with Automotive News, Doll was relatively transparent about Subaru’s current state of affairs and the automaker’s plans for recovery. Doll is in an unusual position in the industry – he began his tenure with Subaru in 1982, helping to craft four decades of history at one brand. Johan de Nysschen he is not. Doll has seen the company falter (fewer than 100,000 Subarus were sold in 1994 and again in 1995), he’s seen the company grow in the midst of turmoil (Subaru sales soared to a then record high in the midst of 2009’s economic collapse), and he’s seen his share of flops (Baja, Tribeca, Legacy SUS) and hits (Outback, Forester, Crosstrek).

That kind of perspective isn’t just useful in terms of Doll’s understanding of Subaru, but of the industry as a whole. It’s the kind of perspective that causes Doll to believe that government intervention would be better employed across the economy at large rather than targeting the auto industry in a Cash For Clunkers repeat.

“I think we’re probably in favor of really helping the overall economy get back,” Doll says, “because that’ll help everything: It’ll help used cars, new cars and other industries besides just autos.”

Economic prudence aside, it’s worth noting that Subaru is hardly in a position to take advantage in a Cash For Clunkers scenario. Inventory is low at Subaru — just 60 days’ supply overall and lower for some models such as the Outback, which is just the way the company likes it in normal circumstances. Given the limited stock, how much market share does Subaru potentially stand to lose if it doesn’t have the vehicles to sell during a period of artificially inflated demand? Doll doesn’t expect to see inventories rise to reasonable levels until mid-August.

Although plant shutdowns quite obviously limit inventory, the main reason Subaru was caught off guard heading into the summer was unexpectedly high demand through the spring. June, says Doll, is “going better than we thought.” That’s after March and April sales slid “just” 47 percent. Doll, who’s been the president and CEO for two years, says Subaru sold 8,000 more vehicles in April than the brand anticipated. Then in May, despite a 19-percent year-over-year decline, Subaru still sold nearly 52,000 vehicles. This comes from a brand that, up until August 2014, had never sold 50,000 vehicles in a single month, a brand that didn’t begin averaging more than 50,000 monthly sales until 2016.

No matter how good 2020 will look by the standards of not-so-ancient history, no brand that’s on an upward trajectory this steep plans for a rapid economic shutdown.

“It just came upon us so quickly that there really wasn’t much time to adjust,” Doll says, while also pointing out that the brand is in a markedly different position now compared to the recession of 11 years ago. “During these very good years we’ve had, particularly in the last five or six years, we were able to fortify our balance sheet in such a way that we can withstand this type of a situation.”

This means that Subaru, which intended to sell 725,000 vehicles in 2020 – a modest 4-percent uptick – is now targeting 575,000 vehicles, an 18-percent year-over-year decline. In the bizarre world in which the auto industry finds itself, an 18-percent downturn is actually representative of cautious optimism.

Doll and Subaru certainly have reason for optimism. The brand’s No.1 best seller, the fifth-generation Forester, generated its highest-volume month in history in May: 17,859 sales. Subaru, a brand steeped in the tradition of limiting incentives, is temporarily hooked on 0-percent financing on 63-month terms in order to curry favor with consumers. It’s an especially tantalizing offer at Subaru precisely because it’s unexpected. According to ALG, the average Subaru was discounted by $1,848 in May 2020, 60 percent less than the industry average but 21 percent higher than Subaru incentives one year earlier.

In the current environment, Subaru can excuse its own out-of-character behavior. There are headwinds the likes of which no industry veteran has ever encountered. Through those headwinds, Doll just wants to maintain a level footing.

“Our goal is to maintain our share of the market, whatever the market is.”

Whatever the market is. Surely a fitting title for 2020.

[Images: Subaru]

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dave Holzman '08 Civic (stick) that I bought used 1/31/12 with 35k on the clock. Now at 159k.It runs as nicely as it did when I bought it. I love the feel of the car. The most expensive replacement was the AC compressor, I think, but something to do with the AC that went at 80k and cost $1300 to replace. It's had more stuff replaced than I expected, but not enough to make me want to ditch a car that I truly enjoy driving.

- ToolGuy Let's review: I am a poor unsuccessful loser. Any car company which introduced an EV which I could afford would earn my contempt. Of course I would buy it, but I wouldn't respect them. 😉

- ToolGuy Correct answer is the one that isn't a Honda.

- 1995 SC Man it isn't even the weekend yet

- ToolGuy Is the idle high? How many codes are behind the check engine light? How many millions to address the traction issue? What's the little triangular warning lamp about?

Comments

Join the conversation

I hate Subaru. I prefer cats. Communists are dogs, capitalists are cats.

Wow, 18 comments and no mention of Subaru's flannel wearing women who love dogs customer base, now that's progress :)