J.D. Power Releases Brand Loyalty Study for 2019, Subaru Takes Top Honors

J.D. Power’s annual Automotive Brand Loyalty Study came out for 2019 this week. According to the outlet, Subaru outranks every other brand when it comes to consumer loyalty. That meshes with any anecdotal evidence I’ve accumulated by just speaking with people. Despite some nagging quality concerns stemming from the company’s swift sales growth, most people I know that have driven a Subaru still want one.

Subaru also has been running some of the best advertisements within the industry with the broadest possible appeal ( as they often feature dogs) over the last few years. Almost every woman I’ve spoken with feels positively about the brand and, while I can’t say the same about the men, it’s not a nameplate that receives much ire with laypersons — minus the odd tale of a tragic timing chain mishap (I told you to take it in, Sean).

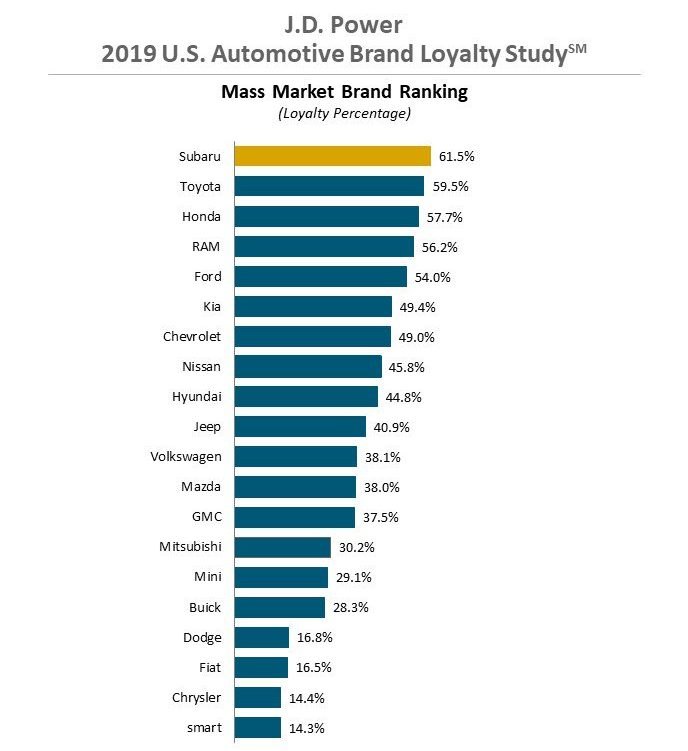

The J.D. Power study says Subaru ranks highest among mass-market brands and highest among all automakers with a loyalty rate of 61.5 percent. Toyota is in second with a 59.5 percent rating, while Honda comes in third with 57.7 percent. Ford and Ram, were the only other two mainstream brands that managed to stay above 50 percent.

However, you probably want to know which marques have settled at the bottom of the bowl. Mitsubishi, Buick, and Mini were all hovering around 30 percent. Digging a little deeper through the muck, we uncovered Dodge, Fiat, Chrysler and Smart. None of those brands broke the 17 percent loyalty barrier. Odd, considering FCA’s domestic nameplates have been getting more favorable reliability and quality rankings from outlets like Consumer Reports and J.D. Power of late. Dodge also has a pretty slick marketing team and, you know, Mopar fans — unfairly maligned by other auto communities for their deep-seated passion (don’t worry, brothers, the heretics will pay for their crimes against us). Though we suppose true advocates likely don’t factor in much when considering broader loyalty inclinations. It’s not like the general industry trend has had much to do with courting enthusiasts lately, anyway.

For luxury brands, J.D. Power placed Lexus at the top with 47 percent — followed by Mercedes-Benz, BMW, Porsche, and Audi. Land Rover was up next but the entire field was middling. No brand stood out as performing terribly well or poorly in terms of customer loyalty, with Jaguar being the only exception. It had a loyalty rate of 20 percent, when every other company managed 32 or better.

If you want to call J.D. Power out, which you are welcome to do, note that it states that the study’s findings are based on the percentage of vehicle owners who choose the same brand when trading in or purchasing their next vehicle using data from its own “Power Information Network.” As it relies heavily on trade-ins, brands that are more-likely to have been sold privately likely performed worse than those that aren’t. The 2019 U.S. Automotive Brand Loyalty Study calculations are based on transaction data from June 2018 through May 2019 and include all model years traded in.

[Images: Subaru; J.D. Power]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

I'd like to know how Tesla stacks up. Perhaps it's part of the 'conspiracy' against them. The other automakers let "others" do their dirty work--ie, state auto dealership laws--to make it very hard to buy or lease a Tesla. Perhaps Tesla doesn't play by JDP's rules. How does JDP work? Who funds them? How? How robust is their data? Is it like Consumer Reports? Better? Worse? Perhaps TTAC's diligent staff will answer these questions. And, for the record, I'm not keen on electric cars. But, anecdotally, Teslas are selling in credible volumes and people seem to love them. I've never seen an Tesla ad in Car and Driver, which is perhaps why Tesla doesn't really get much coverage, compared to other carmakers (who buy ads). Just saying.

I bought another Subaru after 12 good years from my Forester. Now three women close to me all want Subarus for their next car after time spent in mine. They're just likeable cars. Except the new Nav system. Simply horrible. Its just there to frustrate me. You can't zoom out when navigating, say, to see what towns are coming up on the route. The voice interface is horrible. When it does understand me, I can't name places (like a park or airport or restaurant), I have to tell it the exact street address, which I rarely know without consulting Google maps, so, I just use Google maps to navigate instead of the Subaru system. I have a 12-year old nav system in my other car that is 10X better than Subaru's current system. Don't pay for it. Just use Android Auto or Apple to navigate.