How Many Chevrolet Corvette C8 Stingrays is General Motors Going to Sell? A Lot, At First

In accordance with all that is true in the U.S. sports car market, General Motors is about to sell 2020 Chevrolet Corvette C8 Stingrays by the truckload before settling in to a few years of significantly less volume.

Even casual industry observers understand that trend. Between the hype, the early adoption fervor, and the performance leaps generally represented by a new species of sportus caricus, shoppers tend to turn en masse to the newest, flashiest, boldest two-door. That pattern is amplified by vehicles with legendary status.

Fortunately, the legends aren’t as inherently prone to suffering from dramatic, post-hype declines in demand (See: FR-S, Scion.) History tells us General Motors’ 66-year-old sports car will surge some 40 percent in 2020 and then continue rising in 2021 before dipping somewhat in 2022.

The Corvette average buyer age is a whole ‘nuther story.

One thing is certain: when it comes to publicizing expectations, GM doesn’t want to play ball. “We’re not discussing sales or production projections for the 2020 Corvette Stingray at this time,” Chevrolet spokesperson Kevin Kelly told TTAC last week. Kelly’s at this time phrase gave us cause for hope, so we asked again two minutes later, to no avail.

Looking back at the three most recent launches of new Corvettes therefore becomes a primary means of discovering what might happen with the C8.

During the first year of the C5, for example, sales rose 28 percent compared to the final year for the C4 before rising a further 29 percent in 1999.

The C6’s launch didn’t incite quite as much passion. To be fair, the C6 didn’t possess the same level of all-newness that the C5 (or the C8, for that matter) made so obvious. The ’04 launch spiked volume, but in its first full year of 2005, sales actually declined before rising modestly in 2006. (In fact, that ’06 total of 36,518 U.S. Corvette sales is the highest since the C4’s early 80s heyday.)

Venture only as far back as the C7’s launch and the demand deluge that came with the arrival of a new ‘Vette was easy to spot. U.S. sales in 2014 doubled 2013’s output before dipping in 2015.

With history in mind, can Chevrolet instantly return the Corvette to that annual 35,000/units that seems so otherworldly for a high-dollar sports car? Here are three key factors working against the C8.

- The C7’s decline has been more precipitous than the decline of its predecessors. Sales dropped in 2015, 2016, 2017, and 2018; falling 46 percent during that period. (2019 sales are down again.)

- Though arguably more of a performance bargain than ever before, the C8’s sub-$60K sticker is still higher than ever before.

- The typical Corvette buyer is aging out of the sports car market. The car’s average buyer is 61 years old; 60 percent of buyers are over 55. You can’t blame the expense of the car for that fact — the average Porsche 911 buyer is nearly a decade younger.

Yet it’s worth our while to strip away history and numbers. After all, GM threw decades of history into the dustbin just by creating the C8: a mid-engined car with a predictably-Xeroxed mid-engined silhouette and no manual transmission. The Corvette C8’s potential in a shrinking sports car market may well have no relation to the launch of any Corvette replacement in history. Here are three key factors working in the C8’s favor.

- The C8 is likely to shift the performance paradigm in an altogether different manner. Think of the Nissan GT-R in 2008.

- While clearly not shaped like a Corvette in the traditional sense, the new Corvette’s name recognition and vast dealer network work wonders when compared with, say, oh I don’t know, the rather more costly Alfa Romeo 4C Spider.

- GM is ready to build Corvettes. The Bowling Green, Kentucky, workforce has grown by 400 to 1,300 people. GM has also invested $900 million in Bowling Green since 2011. This isn’t one of those situations where an automaker is caught off guard by early demand for a previously unknown sports car.

There’s also the possibility that the gradual decline in interest for the existing Corvette has less to do with the shrinking sports car market and more to do with the ascendant buzz around the potential of a forthcoming mid-engined Corvette. In other words, the C7’s low U.S. sales totals could bode well for the C8. Don’t forget, too, that the new car’s potential for global demand (including right-hand drive) could limit U.S. capacity.

As a result, it’s entirely possible that GM will sell 30,000 Corvettes in the U.S. in 2020; not quite double the monthly output the C7 is currently producing. Given the conditions of the market and the age of the typical Corvette buyer, however, the Corvette’s rate of decline over the next half-decade is likely to be even sharper with the C8 than it was with the C7.

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

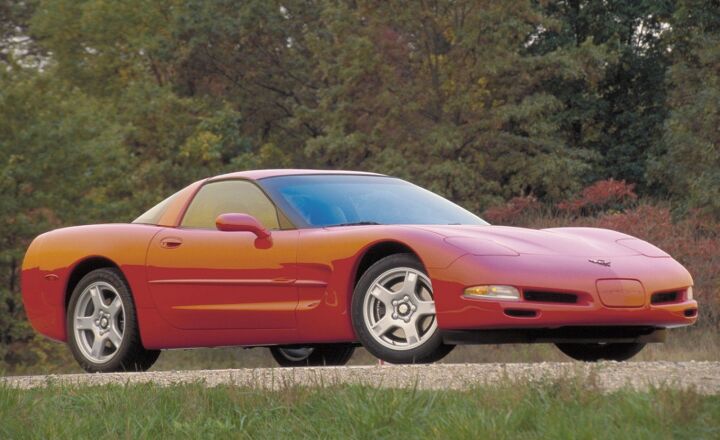

[Images: General Motors]

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX Range only matters if you need more of it - just like towing capacity in trucks.I have a short-range EV and still manage to put 1000 miles/month on it, because the car is perfectly suited to my use case.There is no such thing as one-size-fits all with vehicles.

- Doug brockman There will be many many people living in apartments without dedicated charging facilities in future who will need personal vehicles to get to work and school and for whom mass transit will be an annoying inconvenience

- Jeff Self driving cars are not ready for prime time.

- Lichtronamo Watch as the non-us based automakers shift more production to Mexico in the future.

- 28-Cars-Later " Electrek recently dug around in Tesla’s online parts catalog and found that the windshield costs a whopping $1,900 to replace.To be fair, that’s around what a Mercedes S-Class or Rivian windshield costs, but the Tesla’s glass is unique because of its shape. It’s also worth noting that most insurance plans have glass replacement options that can make the repair a low- or zero-cost issue. "Now I understand why my insurance is so high despite no claims for years and about 7,500 annual miles between three cars.

Comments

Join the conversation

Once those fools who bought the $60k entry Corvette find out that their orders are pushed behind the most expensively optioned ones, Chevrolet will have a problem. And even if the cheapo models get built, GM dealers will slather on a Market Adjustment of at least $10k. This is how this company does business. You might find pockets of dealers who won't jack the price on this car to high heaven, but most will. And I'm assuming that the most expensive WON'T get market value adjustments. They likely will. In 18 months, dealers will beg, borrow, and steal people to buy this hideous thing.

The day after it was release my three in town dealers said it was sold out for model year 2029 and 2021!