Dealer Check-up Reveals Widespread Profit Loss

U.S. light-vehicle dealers reported an operating loss for the first time since the National Automobile Dealers Association (NADA) began collecting data in 2009. While everyone continues reporting pretax net profits, concerns are beginning to swell around their dependency on factory incentives, which are not included in operating tabulations.

NADA’s analysis of 2019’s first-quarter auto sales shows that incentive spending is down compared to the same period a year ago. The group expects above-average discipline from automakers in terms of incentive spending throughout the year. According to J.D. Power, average incentive spending per unit was down $119 to $3,821 through March 2019 — with the brunt of that going toward trucks. However, if sales remain low, spending may creep back up to help clear out languishing inventories.

NADA’s own report ( which can be found here) states that operating results shifted to an average loss of $13,338 in 2018, compared with a gain of $91,774 in 2017. Meanwhile, cumulative pretax profit slipped by 2.6 percent to $1.36 million.

Automotive News, which examined the issue in a recent article, noted that the gap between net and operating results has grown significantly — indicating an increasing reliance on incentives. Back in 2015, average net profits were estimated to be 3.1 times greater than operating profit. In 2016, the difference had grown to 5.3 times. By 2017, average net profit was estimated to be 15 times greater than operating results. But now dealers groups are reporting operating losses.

“Dealers are willing to dig deeper in their own pockets — sometimes operating at a loss — to go after those incentive targets that are set each month or each quarter,” Patrick Manzi, senior economist for NADA, told Automotive News in an interview. “That [operating] loss is indicating that almost all the profit comes from OEM money.”

Dealers are expected to slash their advertising budgets and cut costs wherever possible while leaning increasingly on servicing and parts to help them endure a less-than-optimistic 2019. Average advertising expenses already declined 3 percent last year and were down 1.4 percent in 2017 from the previous year.

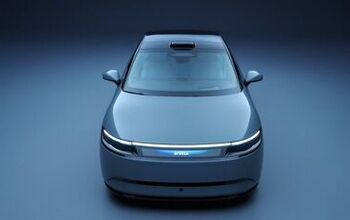

[Image: Nissan]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Honda1 More disposable junk from Hyundai.

- Analoggrotto The ORDER BOOKS in Australia have netted 300% above projection. Australia is so awesome and they are embracing the Telluride DIesel to overtake the Prado. Pentagon data, and eATPs rule the discussion, bar none. Toyota fans can go home with their sorry little turbo 4 cylinder.

- Analoggrotto Such a loving artful tribute to TTAC's greatest godfather is much welcomed. There's a new and better PORSCHE and they are from SOUTH KOREA baby! After years of Japanese oppression, SOUTH KOREA is the TIGER of the Far EAST. We just need a modern day James Dean and that would be Rhys Millen!

- Groza George Our roads and bridges are crumbling and increasing vehicle weight will only make bridges crumble faster. We need more infrastructure work.

- Wolfwagen Pennsylvania - Two long straights, 1 medium straight, 1 super short straight and a bunch of curves all on one end

Comments

Join the conversation

That NADA report is a good overview and commentators here should read it if they ever wondered why automakers don't actually want to own the sales channel.

We're getting back to "stacking 'em deep and selling 'em cheap" time again. Judging by the lots around here it doesn't even seem like "Tax Refund Time" made much of a dent in dealer inventory. GM rolled out 0% for 72 months a few months back and I've been supersized to see it hanging around. Good for me that I'm planning my next vehicle purchase within the next 3 or 4 months.