Autos In America: A 2018 Year-end Sales Roundup

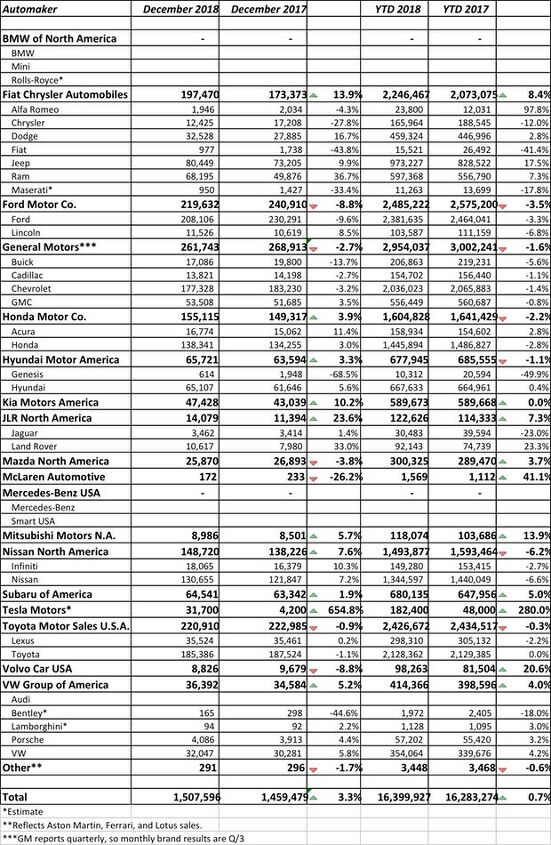

Most manufacturers were awash in red by the end of 2018, either from the ink on their ledgers or the rose-colored glasses they were wearing while trying to assure themselves that all was well. Ford, GM, Honda, Hyundai … all ceded ground over the last twelve months.

Those seeking the brightest light in 2018 need look no further than our own backyard. Fiat Chrysler climbed the sales chart in a big way. Predictably, that charge was led by Jeep. The numbers put forth by the Trail Rated brand did hold one very surprising statistic, however.

Jeep moved no fewer than 973,227 vehicles last year. Think about that for a second. Nearly a million new Jeeps rolled onto the streets and trails of America in 2018. To put that in perspective, the brand outsold the F-Series line by about 64,000 units. In 2017, the Jeep brand was adrift of the F-Series by approximately the same amount. That’s huge growth.

And, yes, before you hammer away at your keyboard and/or hurl stale Vachon cakes in my general direction, I know I’m comparing an entire brand (Jeep) to a single model (F-Series). The point is still valid – FCA is selling a metric ton of the things and will continue to do so next year once the Gladiator comes online. A seven-digit final total for 2019 is not out of the question.

Elsewhere in Detroit, Ford’s fortunes slipped by 3.5 percent last year, but company brass were quick to point out a stronger mix of trucks and SUVs expanded transaction pricing to another new record of $38,400, a $1,600 increase over December of last year. This compares to a $470 increase for the overall industry, which rests around $34,000 per vehicle. For comparison, GM reported an average transaction price of $36,974 in the fourth quarter and $35,839 for the year.

“December capped another strong year for Ford and the industry – Ford sold more than 900,000 F-Series trucks in 2018 to extend our leadership position to 42 consecutive years as America’s best-selling pickup,” said Mark LaNeve, veep of U.S. Marketing, Sales and Service. You can be assured that the gravelly voice of Denis Leary will be announcing this fact in ads on your television very soon.

Note that fleet sales at Ford made up 29.3 percent of its numbers this year. GM said its retail mix stands at 79 percent.

In terms of specific models at Ford and GM, it is unsurprising that Focus has become a dead car walking, down 67 percent last month and 28 percent on the year (that’s a loss of about 45k units). This volume was more than made up for by the – wait for it – EcoSport! It’s easy to tell to which vehicles sales staff at Ford dealers are flipping car shoppers, then. Fiesta sales rose, somehow, by about 5,000 units to about 52,000. The aging Escape was off by 11 percent.

In a comparison similar to the Jeep/F-Series contrast above, all the trucks at GM (Silverado, Sierra, Colorado, Canyon) tallied up a total of 973,463 sales in 2018. The General reports delivery of than a million crossovers last year, up 7 percent. The quartet of Terrain, Traverse, Equinox, and Trax all showed double-digit percentage increases compared to their performance in 2017.

At Toyota, the namesake brand posted December sales of 185,386 units, down 1.1 percent. For the year, Toyota division reported sales of 2,128,362 vehicles, roughly flat on a volume basis. Its light truck division, which includes trucks and crossovers, was up 8.0 percent, making for a best-ever December, quarter, and year. Nearly a quarter million people bought a Tacoma, while RAV4 sales were up 18.8 percent to about 427,170 units, a 4.8 percent increase.

Compact crossovers are a tough segment, as for the third consecutive year, Nissan’s Rogue was that company’s top-selling model. Its 412,110 sales, an increase of 2 percent, was just pipped by the Toyota RAV. It was, however, the best calendar year for Rogue sales yet. Un-weirding the Leaf worked, as sales of the all-electric hatch grew 31 percent over last year.

What’s ahead for 2019? We’re more than happy to speculate – and will do so in the coming days.

[Note: This chart will be updated as missing numbers become available]

Matthew buys, sells, fixes, & races cars. As a human index of auto & auction knowledge, he is fond of making money and offering loud opinions.

More by Matthew Guy

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- THX1136 While reading the article a thought crossed my mind. Does Mexico have a fairly good charging infrastructure in place? Knowing that it is a bit poorer economy than the US relatively speaking, that thought along with who's buying came to mind.

- Lou_BC Maybe if I ever buy a new car or CUV

- Lou_BC How about telling China and Mexico, we'll accept 1 EV for every illegal you take off our hands ;)

- Analoggrotto The original Tassos was likely conceived in one of these.

- Lorenzo The unspoken killer is that batteries can't be repaired after a fender-bender and the cars are totaled by insurance companies. Very quickly, insurance premiums will be bigger than the the monthly payment, killing all sales. People will be snapping up all the clunkers Tim Healey can find.

Comments

Join the conversation

"it is unsurprising that Focus has become a dead car walking, down 67 percent last month and 28 percent on the year (that’s a loss of about 45k units). This volume was more than made up for by the – wait for it – EcoSport!" People never learn.

"Ford’s fortunes slipped by 3.5 percent last year, but company brass were quick to point out a stronger mix of trucks and SUVs expanded transaction pricing to another new record of $38,400, a $1,600 increase over December of last year." That is not going to fly very well with the new Democratic Socalists being elected!