Midsize Sedan Deathwatch #9: Detroit's Participants Tumble At Double Speed In February 2017

Aside from the Volkswagen Passat’s 40-percent year-over-year uptick, every automaker competing in America’s midsize sedan segment suffered from declining volume in February 2017.

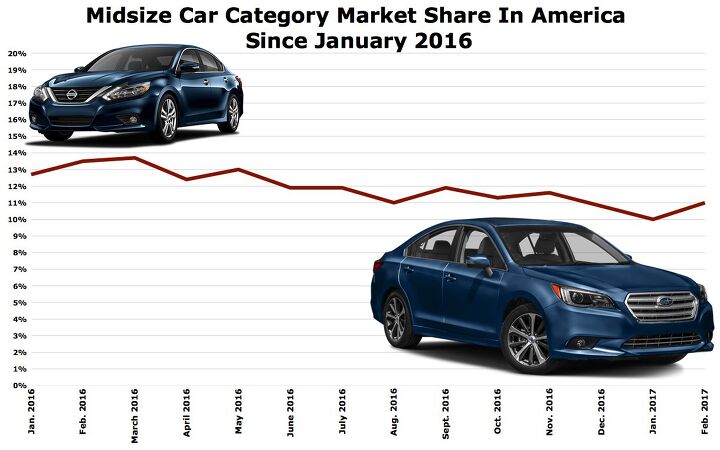

The midsize car category tumbled 19 percent, a loss of more than 34,000 sales.

February 2017 marked the twelfth consecutive month of year-over-year declines for midsize car sales in America.

This is the ninth edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

The Passat’s exceptional year-over-year uptick by no means represents healthy volume for the big Volkswagen. But the bigger story from February’s results was the horrific nosedive performed by Detroit nameplates: one discontinued nameplate, one of the older members of the midsize fleet, the newest member of the midsize fleet, and one semi-premium niche player.

Combined, the Chrysler 200, Chevrolet Malibu and Ford Fusion lost 22,592 sales in February 2017, a frightening 41-percent decline compared with February 2016.

FCA

Naturally, the 200 skews the overall picture. But removing the Chrysler from the equation does not alter the overall midsize segment’s rapid decrease in demand. Nor does it change the fact that the 200’s Detroit rivals likewise reported awful February sales figures while continuing their own downward trends.

FoMoCo

Prior to the current streak, Fusion sales crested the 20K mark in 40 out of 45 months.

Year-over-year, Fusion sales in February slid 35 percent, a loss of nearly 9,000 sales. After averaging 24,000 February Fusion sales over the previous five years, only 16,512 were sold in February 2017, as total Ford division car volume slid 26 percent.

The Fusion isn’t the freshest face on the runway, however. That title belongs, for the moment, to the Chevrolet Malibu. Last year, U.S. Malibu volume grew quickly even as the segment declined thanks to the launch of a well-received ninth-generation model.

GM

Remember, these are the results for the segment’s recently redesigned model.

Together, the Malibu, the soon-to-be-replaced Buick Regal that we covered earlier today, the discontinued Chrysler 200, and the Ford Fusion that’s now in its fifth model year, traditional Detroit nameplates owned only 22 percent of the midsize sedan market in the United States in February 2017, down from 30 percent in each of the two previous Februarys and 34 percent February 2014.

Three years ago, more than one in three midsize cars sold in America was a Buick, Chevrolet, Chrysler, Dodge, or Ford. Now, barely more than one in five come from those same brands.

Yet while traditional Detroit marques suffered most last month, almost all of the made-in-America “imports” reported fewer sales than in February 2016, as well. The Honda Accord fell 9 percent. Hyundai Sonata volume was down 16 percent for an 11th consecutive month of decline. The Subaru Legacy and Toyota Camry both reported double-digit percentage losses.

Gone are the glory days of 2012 and 2013 when Volkswagen could sell nearly 10,000 Passats in America each month. Over the last four months, Volkswagen of America has averaged fewer than 6,500 Passat sales per month.

Is the Passat the future of Volkswagen in America? Will Volkswagen again decide that building a distinct Passat in North America for North America is worth it in a market gone mad for SUVs?

It’s certainly not a Passat-exclusive line of questioning. Barely one in ten new vehicles sold in the U.S. in February were midsize cars. If sales continue to fall by one-fifth, month after month after month, automakers will lose 425,000 midsize car sales in 2017 after losing more than 250,000 in 2016.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto I hope the walls of Mary Barra's office are covered in crushed velvet.

- Mikey For 36.4 years i punched the clock at GM Canada.. For the last 15.5 years (frozen at 2008 rates) my GM pension shows up in my account. I flirted with Fords for a couple of years but these days I'm back to GM vehicles and still qualify for employee price. Speaking as a High School drop out ..GM provided myself and family a middle class lifestyle.. And still does .. Sorry if i don't join in to the ever present TTAC ..GM Bash fest

- Akear Does anyone care how the world's sixth largest carmaker conducts business. Just a quarter century ago GM was the world's top carmaker. [list=1][*]Toyota Group: Sold 10.8 million vehicles, with a growth rate of 4.6%.[/*][*]Volkswagen Group: Achieved 8.8 million sales, growing sharply in America (+16.6%) and Europe (+20.3%).[/*][*]Hyundai-Kia: Reported 7.1 million sales, with surges in America (+7.9%) and Asia (+6.3%).[/*][*]Renault Nissan Alliance: Accumulated 6.9 million sales, balancing struggles in Asia and Africa with growth in the Americas and Europe.[/*][*]Stellantis: Maintained the fifth position with 6.5 million sales, despite substantial losses in Asia.[/*][*]General Motors, Honda Motor, and Ford followed closely with 6.2 million, 4.1 million, and 3.9 million sales, respectively.[/*][/list=1]

- THX1136 A Mr. J. Sangburg, professional manicurist, rust repairer and 3 times survivor is hoping to get in on the bottom level of this magnificent property. He has designs to open a tea shop and used auto parts store in the facility as soon as there is affordable space available. He has stated, for the record, "You ain't seen anything yet and you probably won't." Always one for understatement, Mr. Sangburg hasn't been forthcoming with any more information at this time. You can follow the any further developments @GotItFiguredOut.net.

- TheEndlessEnigma And yet government continues to grow....

Comments

Join the conversation

GM midsize sedans drive as bad as minivans anyway - so you might as well make them as high as minivans also.

I really like my 2016 Fusion. If I had to buy another mid-size today the 2017 Fusion would be at the top of the list.