FCA Needs To Find The Hill Descent Control Button: Jeep Sales Slid Downhill Again In October

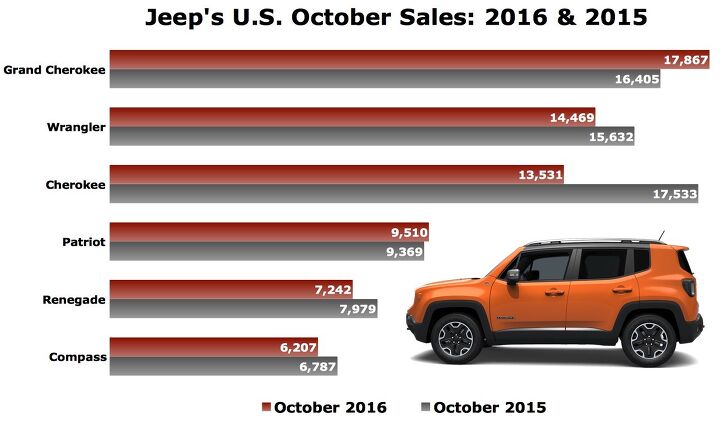

After ending a 35-month streak of improved U.S. sales with a 3-percent year-over-year decline in September, Jeep volume slid 7 percent in October 2016, the second consecutive month of decline for the previously white-hot SUV brand.

Jeep’s best-selling Cherokee recorded the most significant plunge in October 2016, falling 23 percent from year-ago levels to rank third in Jeep sales. Only the Grand Cherokee, quickly becoming Jeep’s top seller, and the departing Patriot posted October improvements.

Jeep, so often the engine behind FCA’s growth when Chrysler, Dodge, and Fiat have struggled, was instead partly to blame for FCA’s 10-percent October decline.

THE OTHER NUMBERS

With minivan sales at Chrysler down and the brand’s car division off last October’s pace by 56 percent, total Chrysler volume was down 45 percent.

Dodge, essentially flat through the first three-quarters of 2016, tumbled 16 percent in October because of Challenger, Charger, Dart, Grand Caravan, and Durango declines.

Fiat, which actually reported a passenger car uptick, nevertheless took a 24-percent dive because the 500X lost 1,211 sales.

To be fair to Jeep, those consistently struggling brands were far more responsible for FCA’s October downturn. Chrysler, Dodge, and Fiat produced 20,493 fewer sales in October 2016 than in October 2015, a 26-percent drop. Jeep volume decreased by only 4,879 units.

THE UGLY NUMBERS

Cherokee sales decreased for the sixth time in seven months. October’s 23-percent Cherokee drop followed an 11-percent decrease in September, a 7-percent drop in July, and a 12-percent June decline. After accounting for precisely one-quarter of Jeep’s U.S. sales in 2015’s first ten months, Cherokee volume is down 3 percent and its share of Jeep’s output is down to 22 percent.

Incidentally, the Cherokee’s eventual move to Belvidere, Illinois, will make possible the increased capacity Jeep also wants for the next-generation Wrangler at the off-roader’s Toledo, Ohio plant. But with the Wrangler nearing the end of its lifecycle, sales fell 7 percent in October. Wrangler volume is off last year’s pace by 6 percent so far in 2016.

The Jeep Compass, set to launch soon in second-generation form, also reported a 9 percent decrease. Sales of the Renegade, Jeep’s newest model, took a 9 percent hit. In fact, Renegade sales are down 7 percent over the last three months.

Jeep, which earned 5.9 percent of the overall U.S. market when sales hit a record all-time high in May, owned 5 percent of the market in October.

THE PRETTY NUMBERS

Much of the credit goes to the flagship Grand Cherokee, which now trails its less costly Cherokee sibling by fewer than 100 units in the familial race to end 2016 as Jeep’s best-selling model. The Grand Cherokee is on track for its first 200,000+ sales year since 2005. Grand Cherokee sales have increased, year-over-year, in 14 consecutive months.

The addition of the Renegade, America’s best-selling subcompact crossover, is also paying dividends. The Renegade is responsible for adding 40,000 sales to Jeep’s U.S. ledger in 2016.

With two months remaining on the calendar, Jeep has already reported record annual Compass volume and is likely to end the year with all-time best Patriot sales.

In October, specifically, four of America’s 18 top-selling utility vehicles were Jeeps.

THE HIDDEN NUMBERS

On a daily selling rate basis, then, Jeep sold 2,632 vehicles in October 2015; 2,647 in October 2016, a 0.6-percent improvement.

In fact, the industry as a whole was not as shaken as the red ink indicates. The daily selling rate improved 1 percent compared with October 2015 and October 2016’s annualized selling rate was the best so far this year.

Granted, any improvement can likely be traced back to incentives that jumped 16 percent from October 2015’s $3,100-per-vehicle rate, while decreasing 3 percent compared with September.

[Images: FCA]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts I hope they make it. The R1 series are a genuinely innovative, appealing product, and the smaller ones look that way too from the early information.

- MaintenanceCosts Me commenting on this topic would be exactly as well-informed as many of our overcaffeinated BEV comments, so I'll just sit here and watch.

- SCE to AUX This year is indeed key for them, but it's worth mentioning that Rivian is actually meeting its sales and production forecasts.

- Kjhkjlhkjhkljh kljhjkhjklhkjh a consideration should be tread gap and depth. had wildpeaks on 17 inch rims .. but they only had 14 mm depth and tread gap measured on truck was not enough to put my pinky into. they would gum up unless you spun the libing F$$k out of them. My new Miky's have 19mm depth and i can put my entire index finger in the tread gap and the cut outs are stupid huge. so far the Miky baja boss ATs are handing sand and mud snow here in oregon on trails way better than the WPs and dont require me to redline it to keep moving forward and have never gummed up yet

- Kjhkjlhkjhkljh kljhjkhjklhkjh Market saturation .. nothing more

Comments

Join the conversation

I'm not sure Chrysler (and what customers they have left) can much longer afford stay in business. Sell Jeep to Ford and kill the rest once and for all.

My wife's '15 Trailhawk V6 has been a steady and enjoyable ride. Since we lease, I have no long term fears, but the auto appears to work well and I think the angst is overblown. As someone who works for a number of dealer groups, there are many brands that have a similar performance in a number of vehicles (Nissan and its CVTs, Honda/Acura's 9 speed, BMW engine noise, MB and its 'A' vehicles), the trope that FCA is any worse is not borne out in any of those service departments.