Is It A Trend? Camaro Handily Beats Mustang In October With Big Discounts On Chevrolet's Side

Updated with additional October incentive numbers.

In theory, 2016 should have been the Chevrolet Camaro’s year. Although it’s not over, we already know it won’t be the Camaro’s year.

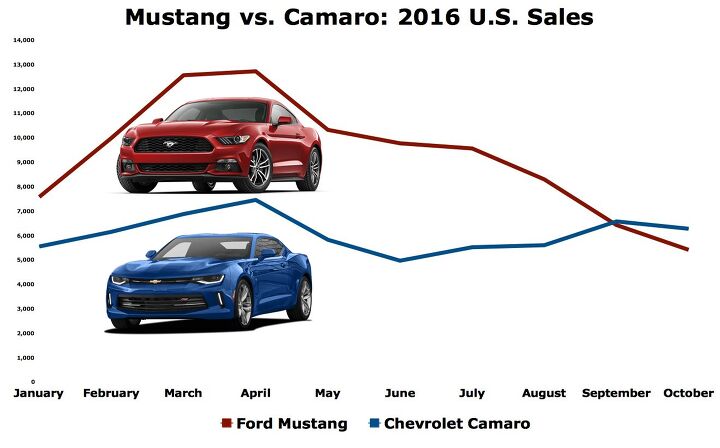

But the Chevrolet Camaro is making headway as 2016 comes to a close. October was the second consecutive month in which the Camaro outsold the Mustang.

The Chevrolet Camaro was America’s preeminent sports coupe for five years between 2010 and 2014. After the sixth-generation Ford Mustang launched to critical acclaim, marketplace success, and claimed sales leadership, the sixth-generation Chevrolet Camaro arrived to take back its crown in 2016.

Through the first-half of 2016, U.S. sales of the Chevrolet Camaro were down 14 percent compared with the same period one year earlier, when the Bowtie muscle coupe was halfway through its worst year since the nameplate returned in 2009.

Between January and June of this year, with the latest Mustang’s hype quotient diminished and the Camaro as fresh as a daisy, Mustang sales were 71-percent stronger. (And that’s just in the United States. The Camaro is largely non-existent globally, while the Mustang is increasingly a global force.)

General Motors was decreasing the automaker’s emphasis on sales to daily rental companies. The early product mix favored Camaros with higher-performance options.

Yet Chevrolet also launched an all-new Camaro that wasn’t visibly different from the fifth-generation Camaro that had lingered for seven years. Visibility is atrocious. And GM was wrong, at least to some degree, to assume that consumers would be willing to pay substantially more for Camaros than Mustangs.

As a result, Camaro inventories ballooned. GM was building Camaros at the car’s Lansing, Michigan, assembly plant as if the new car was going to be hugely popular. There was a 91-day supply of Camaros heading into June, smack in the middle of sports car buying season, and supply inflated to 136 days one month later.

Heading into September, with 139 days of supply — equal to roughly 30,000 Camaros — General Motors ramped up incentives to clear out the glut. With triple the average discount in September versus August, the Camaro (narrowly) outsold the Ford Mustang for the first time since October 2014.

Yet GM struggled to make much headway in clearing out Camaro inventory, simply because September is a low-volume month for vehicles of this type.

Thus, heading into October, with four months of Camaro stock, General Motors stuck with the incentive plan. Camaro discounts through the first three weeks of October, according to J.D. Power PIN data obtained by TTAC, increased marginally to roughly $3,500 per vehicle. But Camaro discounts exploded in the fourth week of the month, as the average monthly Camaro discount ended up at $4,700 per car.

As a result, year-over-year Camaro volume jumped 19 percent to 6,277 units, a seven-year October high and 863 more sales than the Mustang managed.

While GM’s plan to clear out Camaro inventory in the lead-up to the 2017 model year involves significant incentives, Ford briefly shut down the Mustang’s Flat Rock, Michigan, assembly plant to “match production with demand,” according to Ford. With the 2017 Mustang taking over in October, Ford cut its average Mustang incentive to $1,900 from $2,600 a month earlier. The result: a 46-percent year-over-year decline to 5,414 units, a two-year low.

Year-to-date, Ford has sold 92,672 Mustangs through the first ten months of 2016, a 10-percent drop compared with 2015’s first ten months. This will be the second consecutive year — and only the second year in the last nine — in which more than 100,000 Mustangs have been sold in America.

Camaro sales are now down 9 percent to 60,812 units so far this year. Chevrolet averaged 84,000 annual Camaro sales between 2010 and 2014.

Dodge Challenger sales, meanwhile, plunged 22 percent in October but are off last year’s pace by only 4 percent, with 55,268 sales through the end of October. 2015 was the Challenger’s seventh consecutive year of growth.

Challenger sales need to increase by more than 20 percent in the final two months of the year to turn 2016 into an eighth consecutive year of growth. Challenger incentives in October averaged approximately $4,000 per vehicle, on par with September.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

[Images: General Motors, Ford Motor Company]

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

- Formula m For the gas versions I like the Honda CRV. Haven’t driven the hybrids yet.

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

Comments

Join the conversation

There may be a ton of the cash on the hood, but no Camaro owner will ever be able to actually see it from the driver's seat...

Looking at that chart, it does't look like the story is how great the Camaro is doing but how badly the Mustang is stumbling. What's up with the sales crash?