Is the Classic Sports Car Bubble About to Burst?

During the last week, much has been written about the “Driven By Disruption” auction Dec. 10 by RM Auction/Sotheby’s.

Most of that reporting was about Janis Joplin’s Porsche, which sold for a mildly outrageous sum of $1.6 million (plus fees), which beat the estimate about 2.5 times. Other top-dollar cars were mentioned as well, especially the first Aston Martin DB4GT Zagato sold in almost a decade, or the Ferrari 290 MM that was driven by the famous Juan Manuel Fangio in the Mille Miglia. Both cars brought even more eye-watering amounts of money – $13 million for the Aston, $25.5 million for the Ferrari. The Aston even set a historical record for the most expensive British car ever sold at auction.

The message is clear: The collector car market is not only alive and well, it’s thriving. Cars sell for ever-higher sums and they are a marvelous investment value. After all, they aren’t making any more classic Ferraris and Astons, are they? So the value can only go up, right?

As you probably guessed, my opinion on the matter is different.

For quite some time, the price of collector cars have skyrocketed 400 percent, and I’ve seen articles in mainstream media commenting about the great investment those cars present. But I simply don’t believe that a 1950s Porsche 356 Speedster or some old Ferrari or Jag is several times more valuable than it was three years ago — or ten years ago, for that matter.

What I see when I look at the hockey stick graphs at the Hagerty’s valuation tools is an investment bubble. Which leaves a simple question: when is it going to burst?

Watching the auction gave me some pointers. Originally, I only wanted to watch the Janis Porsche to see the price, and go to sleep or work after that. But I noticed something interesting, something that none of the recent reports about the auction mentioned: Almost none of the cars brought the estimated price.

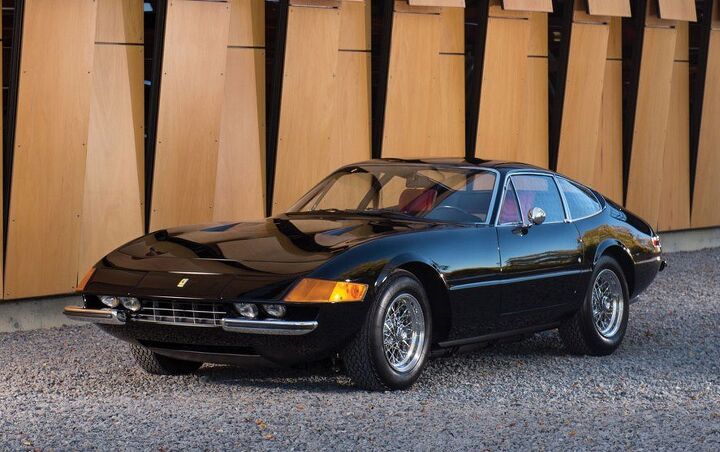

When I turned the video stream on, a really nice Ferrari Daytona was on the block. Its estimated value was between $800,000 and $1 million, but its final bid was $770,000. Not too shabby, to be honest. Then, one of the best Lamborghini Miuras in the world, restored under the supervision of none other than Valentino Balboni. Its estimated value was between $2.4 million to $2.8 million. Final bid? $2.2 million, which is still nice. Then, Bugatti 57C Atalante — a rare and collectible vehicle for several decades. Under $2 million, at least $250,000 short of the low estimate.

Then, 1991 Ferrari Testarossa: late-production model, first owner, perfectly serviced and almost never driven, which made it likely one of the finest examples in the world. And the 1980s are in vogue now, so Testarossas should be all the rage — or so we are told. Its estimate was $400,000 to $500,000 and, for a while, it looked that it will sell for a pitiful sum of $125,000. After some amazing work on part of the auctioneer, the bidding slowly crept up to $290,000, which is, to be honest, a hell of a lot of money for a 1990s Ferrari, but also much less than the original estimate.

So is it finally here? Are we going to see the bubble burst in the near future? I kept watching until the end, and the story kept repeating. Only one car made it past the high estimate – a custom-bodied 1933 Pierce-Arrow Silver Arrow that sold for a hefty sum of $3.4 million, much more than original estimate of $2.5 million to $3 million — but 1930s cars seem to be unaffected by the bubble.

Others, like an early Jaguar E-type roadster, sold at or around the low estimates. But most cars didn’t even get to the lowest estimate — some of them by a large margin.

The two cars that are talked about the most: the record-setting Aston Zagato and Ferrari 290 MM, sold under the estimate. Or, in case of the Ferrari, slightly above the low estimate, but only if you count in the fees, as most commentators do. If you only take the selling price itself into account, which seems logical, since the fees are not even mentioned during the auction itself and Sotheby’s website states that the estimate concerns bidding price only, without the buyer’s premium (fees), then the Ferrari sold for almost 10 percent less than the minimum price ($25.5 million vs. $28 million to $32 million range). The Aston sold for $13 million without fees ($14.3 million with fees included), far less than the estimated range of $15 million to $17 million.

Yes, the Aston’s price is still a record for a British car, but the Zagato is probably the most valuable British sportscar of the era, often compared to legendary Ferrari 250 GTO. And none of the 19 made were sold in many years – which means that the last recorded price predates the beginnings of the bubble. Even if the real market value of this car plummeted in recent months or years, we have no way to know. We can only compare what Sotheby’s experts thought it would be worth, and what someone paid for it, which is a difference of $2 million dollars.

Some other cars probably didn’t even reach the reserve price and were not sold, at least judging by the auction estimates left at the results page. Probably the most interesting of those cars was a 1955 Mercedes-Benz 300 SL “Sportabteilung” — a racing version of the famed “Gullwing.” That car is said to be (at least by the Sotheby’s description) the best Gullwing in the world. The estimate was that it will sell for $5 million to $7 million, but the bidding ended at $4.2 million, which probably wasn’t enough for the seller.

All this could probably be glossed over as a “bad day at auction,” and it’s still possible that next big auction will bring record bids again and the show will go on. But I don’t believe that.

Last week’s auction had air of anxiety and buyers not really wanting to go for it. Looking up values of classic cars at places such as Hagerty’s will show a hockey stick in last few months, followed by a plateau. It seems that the market is waiting to see what will happen.

Which reminds me of conversation I had, as chance had it, just a day before the auction. A friend e called me and we ended chatting about his cars and their value for a while. He has a nice collection of ’50s and ’60s machinery – mostly Cadillac and other fin-tailed land yachts, but also a few sportscars, including a 300SL Gullwing. He was talking about the market going crazy after one or two best Gullwings sold for huge money ($5 million or so), driving all the other cars to stratosphere. Suddenly, even the worst gullwing was worth $1 million or more.

The million-dollar question is: what will happen when it goes other way around? When a creme de la creme Gullwing or a Ferrari 250 GTO or other car like that sells for significantly less than expected? Or two, three or five cars like that?

At this moment, the classic sporst car market has all the signs of a bubble. The value of most cars, including fairly common ones like classic Porsche 911 or Jaguar E-type, have increased exponentially in last two or three years. This can be understood with automobiles that ceased to be “used cars” and became “young timers” or “classics.” It’s easy to see why a first-generation BMW M3 has skyrocketed in price. A few years ago, E30s were the cheapest BMW around and most of them ended up beaten to death by some young hoon. Now, they’re becoming valuable — and the king of the hill among them, the M3 — is soaring upward. Even here, though, I have my reservations about the rate of its climb.

With established classics, like the aforementioned 911, E-type or any kind of old Ferrari older than 1970, you can’t explain the price hike. Those cars are classics for as long as I can remember. In fact, with me being 31 years old, those things are revered classics for almost as long as I have been alive. These exact cars were even subject to one investment bubble already, in late 1980s and early 1990s. In 1988, Zagato even used four remaining DB4 GT chassis to build more Aston Zagatos – much like Jaguar today is building Lightweight E-types to utilize the “unused” chassis numbers.

Virtues of these old cars have been known for years — even for decades. That the old 911 is one of the best drivers cars ever built is not news. It’s not a new discovery that a Ferrari Daytona and Lamborghini Miura are one of the finest pieces of rolling artwork ever made.

So what made these cars so immensely valuable? Part of it can be attributed to the culture and fashion. Today, retro is cool. Hipsters are everywhere and anything can be made stylish with some over-exposed photographs including vintage stuff, like classic sports cars. Also, everyone is talking about the “pure driver’s experience” those old cars provide, leading to popularity of people like Magnus Walker and cars like Singer-modified Porsches.

Those factors make it cool to own a classic sporstcar from 1950s to 1980s (note that the skyrocketing prices do not concern 1930s antique cars or most American vehicles, including any kind of muscle cars and land yachts – which also disproves the theory about Chinese and Middle East buyers shifting the market) and helped push the prices upward. But that wouldn’t be enough to create a bubble.

To make that happen, you have to add a lot of people looking for a place to invest their money. And after the financial crisis, cars were considered to be such investment opportunity. Unlike stocks and bonds and derivates, they exist in physical world and will probably always have at least some value. And they are much cooler to own.

At this moment, though, the market shows all signs of being overheated, while other possibilities are opening – especially with Federal Reserve finally increasing the interest rates after almost a decade.

That sets the scene for the whole thing to come tumbling down. What we need is only a few auctions with same or worse results than the last week’s auction, a few high-profile cars selling at much lower price than expected, and the classic sports cars will follow the suit of muscle cars about a decade ago.

After the high-dollar cars come down, the less expensive ones will follow. And then the cheaper ones. And even the cheap ones — the cars ordinary joe can afford — won’t come back to, say, 2005 levels, but it is reasonable to expect that the crazy prices of last couple of years will not last. That’s great news if you missed on buying your dream Alfa Romeo, MG or even a Porsche.

By the way, have you ever though about what will happen to the muscle car prices when baby boomers (currently owning most of them) get really old?

I think that the good cars for us classic car lovers are not really over yet …

More by Vojta Dobe

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jrhurren Unions and ownership need to work towards the common good together. Shawn Fain is a clown who would love to drive the companies out of business (or offshored) just to claim victory.

- Redapple2 Tadge will be replaced with a girl. Even thought -today- only 13% of engineer -newly granted BS are female. So, a Tadge level job takes ~~ 25 yrs of experience, I d look at % in 2000. I d bet it was lower. Not higher. 10%. (You cannot believe what % of top jobs at gm are women. @ 10%. Jeez.)

- Redapple2 .....styling has moved into [s]exotic car territory[/s] tortured over done origami land. There; I fixed it. C 7 is best looking.

- TheEndlessEnigma Of course they should unionize. US based automotive production component production and auto assembly plants with unionized memberships produce the highest quality products in the automotive sector. Just look at the high quality products produced by GM, Ford and Chrysler!

- Redapple2 Got cha. No big.

Comments

Join the conversation

I doubt even the muscle cars of the 60's and 70's will get so cheap that they will become just an old car. When the baby boomers stop buying you still have European, Asian, and Middle East buyers with money who will buy them and keep the prices from cratering. Look at the Swedes who are scouring the salvage yards for old American cars as donors for restorations. The World population is growing with just more buyers. Muscle cars, sports cars, and even the less rare cars have a market overseas as well.

I'd predict that there will be an even bigger difference between the top and bottom ends of the market that there is now. This only follows from the emptying of the middle class. The 0.1% wouldn't be caught dead in a $50,000 '67 Mustang yet for the bottom half, $50,000 is more than their entire net worth. --> The top continues or goes up in price, while the bottom 90% of collectible car market sinks like a stone.