Scion Rising - If IA and IM Help, Imagine What C-HR Could Do

We haven’t held back our critique of Toyota’s handling of its Scion sub-brand.

Though Scion held such promise a decade ago, replacing the hot-selling first-generation xB with a mostly ignored, overweight, second-generation xB was a ticket to failure. Allowing the once-popular tC to linger mostly unchanged and mostly unathletic for more than a decade is akin to snatching defeat from the jaws of victory. A flash in the pan sports car, the FR-S, wasn’t – couldn’t be – the answer to the brand’s troubles.

Signs of life are once again appearing at Scion, however, and not from the most expected places.

Historically speaking, Scion made a name for itself with unconventional machinery. Suddenly, over the last two months, the brand’s two most popular vehicles are a subcompact sedan and a thoroughly conventional, Corolla-related hatchback.

As a result, Scion’s year-over-year U.S. sales growth in October 2015 trailed only Land Rover, which nearly doubled its October volume, and Volvo, which achieved its best XC90 sales month since December 2007. Scion sales jumped 50 percent in October, a gain of 2,088 sales for a brand which only sells cars in a market which generated a modest four-percent car sales improvement.

Now, we expect to see Scion launch a new vehicle at the Los Angeles auto show. Will the C-HR crossover finally be an unconventional Scion answer to the SUV/CUV juggernaut gripping the auto industry?

Setting aside a potential launch, consider the backdrop of Scion’s recent surge. Annual U.S. volume for the brand declined from a peak of 173,000 units in 2006 to fewer than 50,000 in 2010 and 2011 before spiking in 2012 — to less than half the 2006 total — before falling again in 2013 and 2014. Sales through the first eight months of 2015, before two recent launches, were down 22 percent in a market which had climbed four percent. Only Smart, which offers just one car and is in the midst of transitioning between generations, had suffered a more dramatic sales slowdown.

In September of this year, however, Scion was the second-fastest-growing auto brand in America on year-over-year percentage terms. And though the brand’s year-to-date tally remains 10 percent lower in 2015 than it was during the first ten months of 2014, Scion could end 2015 with slightly greater volume than last year if the pace from the last two months holds.

The most recent improvement, October’s 50-percent uptick, occurred despite a combined 31-percent decline from Scion’s five established models — three of which have been formally discontinued. In other words, Scion basically produced its huge October increase with a new lineup, a sudden overhaul that reflects a whole new direction for the brand. Subtract the trio of departing models from the equation – xD, xB, iQ – and Scion’s going-forward lineup actually produced a collective 123-percent year-over-year improvement.

Granted, that’s not a fair year-over-year comparison. Scion did sell more than 1,000 copies of the xB, xD, and iQ in October; that fact can’t be changed. But the fact the brand new Scions instantly took over and displayed an ability to attract a reasonable number of consumers suggests that Scion does, in fact, possess a measure of staying power.

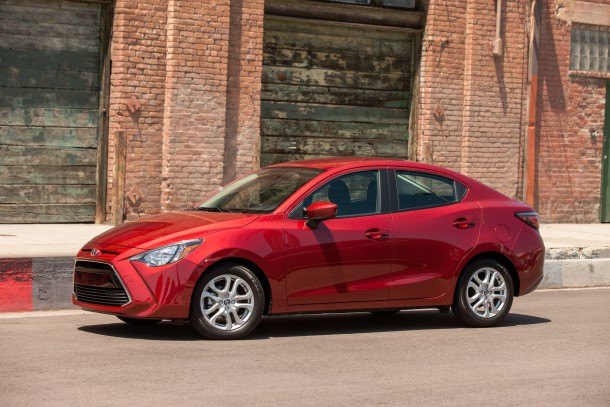

A decade ago, it would have been laughable to think that Scion would one day need to be rescued by a Mazda2-based sedan that even Mazda doesn’t sell in the United States. But the iA is now Scion’s top-selling model, both in September and in October. Indeed, nearly one-third of all Scions sold in October were iA sedans, and the iA outsold the FR-S and tC combined. (The tC is Scion’s top-selling model year-to-date.)

Assisting in the rejuvenation of Scion is the compact iM hatch, sales of which increased from 1,353 units in September to 1,408 in October.

These aren’t big numbers. While the iA outsold the Toyota Yaris by nearly four-to-one last month, the iA ranked fifth in the segment and owned just six percent of the subcompact category in October. Among conventional compact cars, the iM was roundly outsold by virtually all potential competitors, sedan and hatchbacks alike, except the Mitsubishi Lancer.

This Toyota attempt to breathe life back into Scion is only just beginning. The iA and iM could climb higher. Yet Scion has fallen so far that now, even if a production C-HR is little more than a moderately popular subcompact crossover, total Scion volume could nearly double with the addition of just one model.

Only three-tenths of one percent of the new vehicles sold in America in the first ten months of 2015 were Scions. Scion won’t become the next Subaru, nor does Toyota need it to be. But there are very few lingering signs that suggest Scion will shortly need to be extinguished.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

- Formula m For the gas versions I like the Honda CRV. Haven’t driven the hybrids yet.

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

Comments

Join the conversation

Bring the S-FR and all will be forgiven.

No! I can't be the only one who looks at that iM and sees a Fit that got its nose smacked with a rolled-up newspaper! (I'd like to see them try that on the Littlest Angry Car!)