Hyundai's Record April Sales Bring Market Share Decline, Heavy Reliance On Cars

Hyundai USA reported record April sales last month, yet by only posting modest growth figures, Hyundai didn’t match the pace of the overall auto industry. As a result, Hyundai’s market share actually decreased in this record-setting month from 4.8% in April 2014 to 4.7% in April 2015.

Year-over-year, Hyundai volume increased 3% to 68,009 units in April 2015, a gain of 1,902 sales in a market which grew 5%, or 64,000 units. Compared with the prior month of March, during which Hyundai set an all-time sales record regardless of season, Hyundai’s market share slipped from 4.9%.

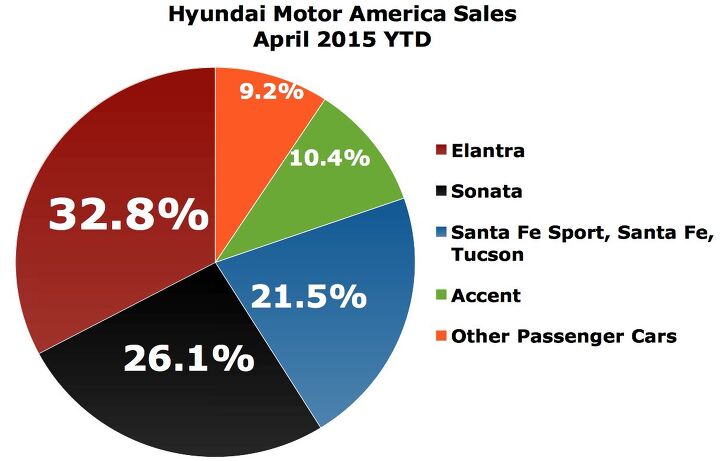

But in a market that’s increasingly favouring SUVs and crossovers and increasingly uninterested in passenger cars, Hyundai’s growth is notable because of the automaker’s reliance on passenger cars.

SUVs and crossovers accounted for 34% of all U.S. new vehicle sales in April 2015. At Hyundai, where the company’s smaller Tucson has aged and is about to be replaced, that figure stood at just 21%.

April sales of passenger cars across the industry slid 1%. At Hyundai, car sales increased by more than 1% thanks to especially strong performances by small cars. Accent sales jumped 28% to 8,208, well ahead of the fourth-best-selling subcompact, Honda’s Fit.

Although Hyundai says Elantra incentive spending decreased compared with March – when Elantra volume boomed to a second-in-class 28,794 units – the aging Hyundai compact still managed an 8% year-over-year improvement.

The Genesis (up 40%) and Azera (up 31%) both posted improvements. The new Sonata was the trouble spot for Hyundai’s car division. U.S. midsize car volume fell 7% in April 2015; Sonata sales tumbled 13%. Year-to-date, Sonata volume is up 3%.

In response to my questions on the subject of slowing growth, Hyundai Motor America’s VP of national sales, Bob Pradzinski, said, “Our production is contained at about 20% CUV. Our success as a company has to rely on car sales, specifically Elantra and Sonata, our volume models.”

The new Tucson launch will likely provide a big boost to Hyundai’s SUV/CUV total, but not to the extent that Hyundai won’t continue to be a hugely car-oriented automaker in a hugely light truck-oriented market.

Hyundai only sold 14,074 utility vehicles in April 2015, a 9% increase in a category which improved by 15%. But can Hyundai satisfy their dealers with a small crossover lineup: Santa Fe Sport, Santa Fe, Tucson? Nissan sells Jukes, Muranos, Pathfinders, Rogues, and Armadas. Toyota sold 45,311 4Runners, Highlanders, Land Cruisers, RAV4s, and Sequoias in April. Honda only sells two CUV nameplates – CR-V and Pilot – but they sold more than 40,000 CR-Vs and Pilots in April 2015.

Or is Hyundai simply primed for a new era? If, or when, the market reverts to car love, Hyundai is established as an automaker that competes largely on the strength of cars. That’s likely to remain true even if the brand expands their utility vehicle lineup.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 1995 SC I wish them the best. Based on the cluster that is Ford Motor Company at the moment and past efforts by others at this I am not optimistic. I wish they would focus on straigtening out the Myriad of issues with their core products first.

- El Kevarino There are already cheap EV's available. They're called "used cars". You can get a lightly used Kia Niro EV, which is a perfectly functional hatchback with lots of features, 230mi of range, and real buttons for around $20k. It won't solve the charging infrastructure problem, but if you can charge at home or work it can get you from A to B with a very low cost per mile.

- Kjhkjlhkjhkljh kljhjkhjklhkjh haaaaaaaaaaahahahahahahahaha

- Kjhkjlhkjhkljh kljhjkhjklhkjh *Why would anyone buy this* when the 2025 RamCharger is right around the corner, *faster* with vastly *better mpg* and stupid amounts of torque using a proven engine layout and motivation drive in use since 1920.

- Kjhkjlhkjhkljh kljhjkhjklhkjh I hate this soooooooo much. but the 2025 RAMCHARGER is the CORRECT bridge for people to go electric. I hate dodge (thanks for making me buy 2 replacement 46RH's) .. but the ramcharger's electric drive layout is *vastly* superior to a full electric car in dense populous areas where charging is difficult and where moron luddite science hating trumpers sabotage charges or block them.If Toyota had a tundra in the same config i'd plop 75k cash down today and burn my pos chevy in the dealer parking lot

Comments

Join the conversation

Perhaps America has realized that it doesn't take the 100,000 mile warranty as a strong selling point. Consumers are doing just fine without it. I also don't see Hyundai/Kia doing things "better" in terms of engineering and quality that sets them apart .

This is surprising -- at least on the West Coast, Hyundai's pneumatic-look Santa Fe was to the early/mid 2000s what Ford's brick-look Exploder was to the mid/late 1990s: the default family wagon. It made the marketplace take Hyundai and CUVs alike seriously. What happened?