Cain's Segments: Trucks In 2013

The 234,066 extra new truck registrations in 2013 came about despite the loss of 70,077 sales from trucks that had either died off, been discontinued, or were on hiatus in 2013.

Excluding the Chevrolet Avalanche, Chevrolet Colorado, GMC Canyon, Suzuki Equator, Ford Ranger, and Dodge Dakota from the equation results in a 16.4% year-over-year increase in truck sales.

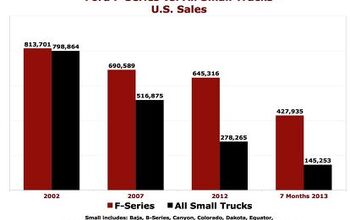

America’s top-selling vehicle line, the Ford F-Series, owned 35% of the truck market in 2013, up from 33% in 2012. F-Series volume was higher than it’s been since 2006, when nearly 800,000 were sold. (Ford sold more than 900,000 F-Series pickups in 2004 and again in 2005.) In each of the last eight months, Ford sold more than 60,000 copies of the F-Series, a feat Ford had accomplished only three times in the previous 40 months. In fact, Ford sold more than 70,000 F-Series’ at three different junctures in 2013: May, August, and December, the highest-volume month of all.

GM truck sales tanked in December, as the Silverado and Sierra combined for a 13% decline. But the transition period from GMT900 to GMTK2XX didn’t harm GM’s volume in 2013. Joint Silverado/Sierra market share in the whole truck category increased by one percentage point to 31%. 2013 marked a six-year high for the Silverado, although sales haven’t returned to the 2005 glory days when 706,000 were sold. Meanwhile, GMC’s Sierra last topped 2013’s 184,389-unit achievement in 2007, when 204,243 were sold. GMC sold more than 200,000 Sierras annually from 2004 to 2007.

Chrysler’s Ram truck lineup accounted for 20%, or one in five, Chrysler Group sales in 2013, up from 18% in 2012. December’s 11% increase marked the 44th consecutive month in which Ram sales have improved, year-over-year. This many Rams haven’t been sold since 2007. In 2003, 2004, and 2005, Chrysler sold more than 400,000 Ram trucks annually.

America’s leading non-full-size truck, sales of the “midsize” Toyota Tacoma shot up to a six-year high in 2013. (The Tacoma was America’s 14th-best-selling vehicle in 2006; 24th in 2013.) Not often was a small truck sold in 2013 that wasn’t a Tacoma – it owned 65% of the small/midsize truck market, the part that didn’t already belong to the F-Series, Silverado, Ram, Sierra, Tundra, Avalanche, Titan, and Escalade EXT. That’s up from 51% in 2012, when the Colorado and Ranger put up small but meaningful numbers.

Sales of the Nissan Frontier and Honda Ridgeline increased in 2013, at 13% and 26%, respectively. Yet two Tacomas were sold for every one Frontier or Ridgeline. In 2006, the year that the Tacoma became America’s 14th-best-selling vehicle, the Chevrolet Colorado ranked 51st, ahead of the Ford Ranger but 81,475 sales back of the Toyota.

The Frontier-based Suzuki Equator died in 2013. Sales of the dying Chevrolet Avalanche – 15,618 through the first three quarters; just 908 in the fourth quarter – were an afterthought. The Avalanche and its Cadillac sibling, along with the Nissan Titan and Toyota Tundra and the four big “domestics”, controlled 89% of America’s truck market in 2013, up from 86% in 2012, up from 84% in 2011.

Naturally, this leads to questions regarding the chance for Colorado success in 2014 and 2015. Basing expectations on what we’ve witnessed over the last twelve months, while not pointless, may prove to be lacking a solid foundation.

The truck market, strong as it is, with 14% of the auto industry’s sales, has been in a perpetual state of upheaval. Nameplates are being killed off left, right, and center. The dominant midsize truck isn’t exactly fresh as a daisy. The best-selling truck, Ford’s F-Series, will feature an awful lot of aluminum later this year. There’s now a light-duty diesel option.

There appears to be more than enough evidence to point to a continuation of this trend, the trend that shows potential truck market growth fuelled by full-size trucks. But there are chips up in the air, and with countless variables, we don’t really know where they’ll fall.

RankTruck20132012% Change F-Series763,402645,316+ 18.3% Silverado480,414418,312+ 14.8% Pickup355,673293,363+ 21.2% Sierra184,389157,185+ 17.3% Tacoma159,485141,365+ 12.8% Tundra112,732101,621+ 10.9% Frontier62,83755,435+ 13.4% Ridgeline17,72314,068+ 26.0% Avalanche16,52623,995– 31.1% Titan15,69121,576– 27.3% Colorado341236,840– 90.7% Escalade EXT19721934+ 2.0% Canyon9298735-89.4% Equator4481966– 77.2%—Ford Ranger—19,366– 100%—Dodge Dakota—490– 100%—— ————Total 2,175,6331,941,567+ 12.1%More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Drnoose Tim, perhaps you should prepare for a conversation like that BEFORE you go on. The reality is, range and charging is everything, and you know that. Better luck next time!

- Buickman burn that oil!

- Jkross22 Meant to ask.... what's the best oil to use in a popcorn popper? I've been wanting to try peanut oil, but can't find anything smaller than the huge container at smart n final.

- Ajla A union fight? How retro 😎

- Analoggrotto Finally, some real entertainment: the Communists versus the MAGAs. FIGHT!

Comments

Join the conversation

Truck makers may think they can sell de-contented or smaller engined full size trucks instead of the compacts, but the size of full size trucks, especially the height, makes them impractical for those who had a Ranger. It may be time to fashion a new El Camino out of a midsize or even compact sedan. For what the Ranger was used, even a FWD Focus-based Ranchero would work.

For whatever reason, the manufacturers work hard on year over year improvement in their trucks instead of striving to cut every single corner. It accounts for their huge brand loyalty and Its the secret to their long-term success.