Cain's Segments: Return Of The Big, Bad, BOF SUVs

June hosted a dramatic decline in the U.S. sales of traditional full-size sport-utility vehicles but also marked the end of a successful first half in which sales of these seven SUVs rose 7.9%.

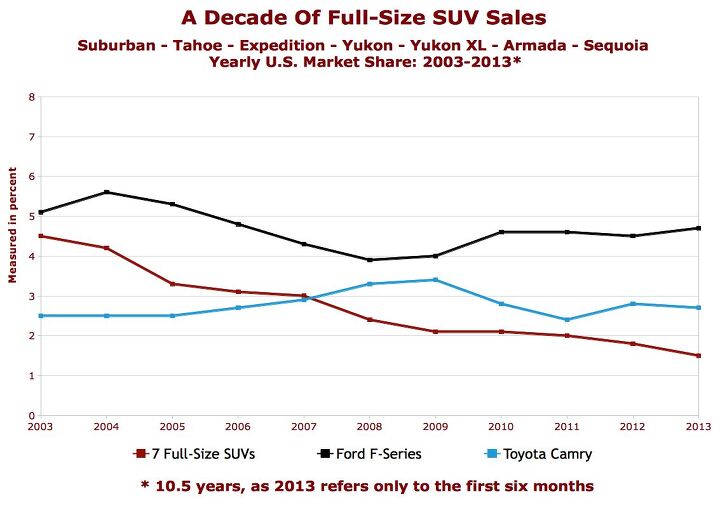

Through the first six months of 2013, the biggest, baddest, “truck-based” SUVs grew at a pace that exceeded the 7.5% growth rate achieved by the overall new vehicle market. 1.5% of the automobiles sold in America this year have been Armadas, Expeditions, Sequoias, Suburbans, Tahoes, Yukons, and Yukon XLs. As recently as 2010, more than 2% of the market belonged to these seven SUVs. As recently as 2006, they owned more than 3% of the market. And in 2003, little more than a decade ago, these seven SUVs accounted for 45 out of every 1000 new vehicles sold.

AutoJune 2013June 2012June % Change6 mos. 20136 mos. 2012YTD % ChangeChevrolet Suburban38135136– 25.8%21,66323,068– 6.1%Chevrolet Tahoe57906427– 9.9%40,85733,274+ 22.8%Ford Expedition32113361– 4.5%17,74118,613– 4.7%GMC Yukon17972279– 21.1%12,10512,662– 4.4%GMC Yukon XL18242343– 22.2%14,7048975+ 63.8%Nissan Armada11371763– 35.5%73819474– 22.1%Toyota Sequoia11451093+ 4.8%66936249+ 7.1%—— —————Total18,717 22,402 – 16.4%121,144 112,315+ 7.9%Times have changed. That’s not news to casual observers, at least the observers who live outside of Texas or D.C., where individual buyers and motorcade fabricators have helped to keep the big SUV alive.

If you can, forget fleet volume for a moment in order to consider the likelihood that the next full-size SUV you see will be a General Motors product. GM’s June market share in the category fell slightly to 70.7% from 72.2% a year ago and 76.1% in May, when the Chevrolet Tahoe and GMC Yukon XL both recorded significant upticks, the Yukon XL rising 182% year-over-year. All four GM nameplates recorded year-over-year decreases in June, as did the Ford Expedition and Nissan Armada.

Indeed, the majority of full-size SUV nameplates have recorded year-over-year decreases on year-to-date terms, as well. But the Tahoe’s extra 7583 sales, the Yukon XL’s extra 5729 sales, and the Toyota Sequoia’s slight 444-unit gains have propelled the segment forward.

The suggestion that fleet emphasis will destroy the large truck-based SUV segment ignores three key facts. First, automakers are capable of generating profits in smaller vehicle categories. Second, the whole commercial van category is designed for fleet customers or, at the very least, for clients who don’t use the vehicle as their personal car, and that’s a category that manufacturers are more hotly pursuing of late. Finally, these SUVs take their foundation from high-volume pickup trucks. Well, maybe not the Nissan, but you get the drift.

Including the Cadillac Escalade and Escalade ESV, General Motors has sold 98,833 SUVs off the GMT900 pickup truck platform in America in the last six months. If that number isn’t sufficiently meaningful, remember the 330,219 Silverados and Sierras General Motors has also sold.

That said, the chart you see here clearly shows that this is a dying breed, regardless of whether the Secret Service or individual Texans make up the majority of buyers. While America’s best-selling vehicle has improved its share of the overall market from a decade-low of 3.9% (in 2008) to 4.7% in the first half of this year; while America’s best-selling car has steadily recorded market share totals between 2.4% and 3.4% over the last 126 months, these SUVs have lost two-thirds of their market share since 2003.

Buyers of three-row crossovers are far more numerous. By way of GM’s three Lambda-platform utilities, the Ford Explorer, Nissan Pathfinder, and the Toyota Highlander, six car-like siblings of these seven full-size SUVs have attracted 341,180 in the last six months.

Independent analyst Timothy Cain is the founder and editor of GoodCarBadCar.net. His look at the important segments will be a permanent fixture at TTAC, along with a look at the market up North.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Akear Does anyone care how the world's sixth largest carmaker conducts business. Just a quarter century ago GM was the world's top carmaker. [list=1][*]Toyota Group: Sold 10.8 million vehicles, with a growth rate of 4.6%.[/*][*]Volkswagen Group: Achieved 8.8 million sales, growing sharply in America (+16.6%) and Europe (+20.3%).[/*][*]Hyundai-Kia: Reported 7.1 million sales, with surges in America (+7.9%) and Asia (+6.3%).[/*][*]Renault Nissan Alliance: Accumulated 6.9 million sales, balancing struggles in Asia and Africa with growth in the Americas and Europe.[/*][*]Stellantis: Maintained the fifth position with 6.5 million sales, despite substantial losses in Asia.[/*][*]General Motors, Honda Motor, and Ford followed closely with 6.2 million, 4.1 million, and 3.9 million sales, respectively.[/*][/list=1]

- THX1136 A Mr. J. Sangburg, professional manicurist, rust repairer and 3 times survivor is hoping to get in on the bottom level of this magnificent property. He has designs to open a tea shop and used auto parts store in the facility as soon as there is affordable space available. He has stated, for the record, "You ain't seen anything yet and you probably won't." Always one for understatement, Mr. Sangburg hasn't been forthcoming with any more information at this time. You can follow the any further developments @GotItFiguredOut.net.

- TheEndlessEnigma And yet government continues to grow....

- TheEndlessEnigma Not only do I not care about the move, I do not care about GM....gm...or whatever it calls itself.

- Redapple2 As stated above, gm now is not the GM of old. They say it themselves without realizing it. New logo: GM > gm. As much as I dislike my benefactor (gm spent ~ $200,000 on my BS and MS) I try to be fair, a smart business makes timely decisions based on the reality of the current (and future estimates) situation. The move is a good one.

Comments

Join the conversation

"Second, the whole commercial van category is designed for fleet customers or, at the very least, for clients who don’t use the vehicle as their personal car, and that’s a category that manufacturers are more hotly pursuing of late." You forgot one full size van target market: Polygamists.

Many of the above comments point out how a BOF SUV is appealing to someone who wants to carry more than five passengers, and wants to tow a heavy payload. But there is another demographic that is losing option choices: the off-road traveler. The Sequoia, Armada, Tahoe, Expedition, and other large SUVs are just too big to travel comfortably in the backcountry. Ten years ago, the options for midsized BOF SUVs with locking diffs and transfer cases was huge: Explorer, Trailblazer, Durango, Cherokee (not BOF but still trail worthy), 4Runner, Pathfinder, etc. Today, only the 4Runner and Xterra survived in their original forms. Every other competitor has gone crossover. The old Explorer was a highly capable rock-crawler, but I wouldn't dare take the new one off-road. There is still a market for an SUV between the behemoths and the CUVs, as obviously shown by the fact that you cannot get any incentive or markdown on a new 4Runner anywhere in the mountain states.