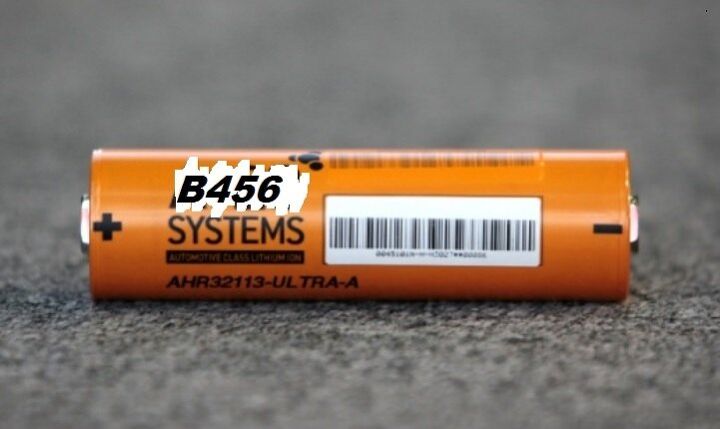

A123 B456 System Bankruptcy Plan Approved

B456 Systems, the lithium-ion battery maker formerly known as A123 Systems, won court approval for its bankruptcy plan. It gives unsecured creditors of the company about 65 cents for each dollar owed, Reuters says.

B456 had received a $249 million grant from the U.S. government. About half the money was never released. B456 received court approval to sell its automotive battery business and related assets to China’s Wanxiang Group.

B456 makes lithium-ion batteries for Fisker Automotive, BMW hybrid 3- and 5-Series cars, and General Motors Co’s all-electric Chevrolet Spark. The company filed for bankruptcy in October due to weaker-than-expected demand.

At least, they kept their humor when naming their new old company.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

I'll wait for the C789 batteries. Then for sure they'll be good.

While A123 did make some small appliance batteries, the company was mostly into big batteries for cars and the electrical grid. The demand for electric cars was grossly overestimated, as was the ripeness of the technology. Also, 65 cents on the dollar for unsecured creditors is pretty good for a bankruptcy. If there was some conspiracy to loot the company, you'd think they would have done a better job of it. More generally, apparently surprising events happen all the time, sometimes because of the sheer variety of ways things can go wrong, and sometimes because our expectations were wrong. The fact that an event defies your expectations is not a valid reason to assume that a conspiracy must be at work.

Electric cars, hybrid and otherwise, are still very much a niche product despite massive government subsidies to both makers and buyers. Current market share in the USA is about 4%. Europe, Japan and other counties report comparable numbers. All this with oil at $100 a barrel. Imho, oil prices are destined to fall in the fairly near future, maybe by as much as 50%. Bottom line, now as always before, Mr. Battery lets Mr. Electric Car down. I can see electrics becoming the dominant technology someday, but will that be in 2020 or 2060? I think 2020 is way too soon. Batteries continue to improve, but so do competing technologies. Plus, you gotta make the electricity some way.

Good automotive suppliers get driven out of business every day. The OEM demands that the supplier capitalize for a 'pie in the sky' volume projection. If the volume does not materialize the supplier gets crushed by the burden of the unutilized capital. Low sales of the Volt could easily have driven them out of production. The OEM will not let the capital be repurposed on the hopes that the volume will magically reappear.