Bloomberg Buries The Lede: Cadillac Puff Piece Can't Hide ATS Incentive Spending, Lagging Sales

TTAC readers looking for a more pro-GM news source may want to check out Bloomberg for their next dose of pro-GM news. A story on Cadillac’s revived fortunes contains all kinds of enthusiastic copy and positive quotes, but still manages to bury the lede way down at the bottom of the story.

Take this quote for example

“Cadillac’s performance certainly exceeded expectations, and the ATS was the driving factor,” said Jeff Schuster, auto analyst with LMC Automotive in Troy, Michigan. “They have a lot happening with their lineup and the vehicles are hitting with consumers.”

Joel Ewanick himself couldn’t have come up with a better quote to feed to the industry price. The ATS is a nice car by all accounts. First drive impressions were positive, despite one of the buff books binning one into the red Georgia clay. But scroll a little further down past the ongoing textual fellatio and you’ll find the golden nugget.

Cadillac’s pricing problems show up in the incentives it offers. GM’s average incentive spending on the ATS in February was $3,700 per car, compared to $333 in September, when the new model went on sale, according to TrueCar Inc., a Santa Monica, California, researcher that tracks auto sales.

Uh oh. $3,700 just months after their crucial entry-level car was introduced? A nearly tenfold increase in incentive spending in just a few short months? Not good news at all. The incentives do explain why the ATS had a nice bump in sales right around February. It’s unfortunate that GM would have to spend so much per car to move a product as nice as the ATS.

Of course, Bloomberg handily explains away the unpleasant incentive information with this quote

Those discounts should decline as Cadillac’s redesigned models attract new buyers. GM said more than half the ATS buyers are coming from competitors such as BMW, Mercedes and Lexus. GM aims to increase sales of Cadillac in the U.S. by more than 30 percent this year, Bob Ferguson, global head of the brand, told reporters in New York last week.

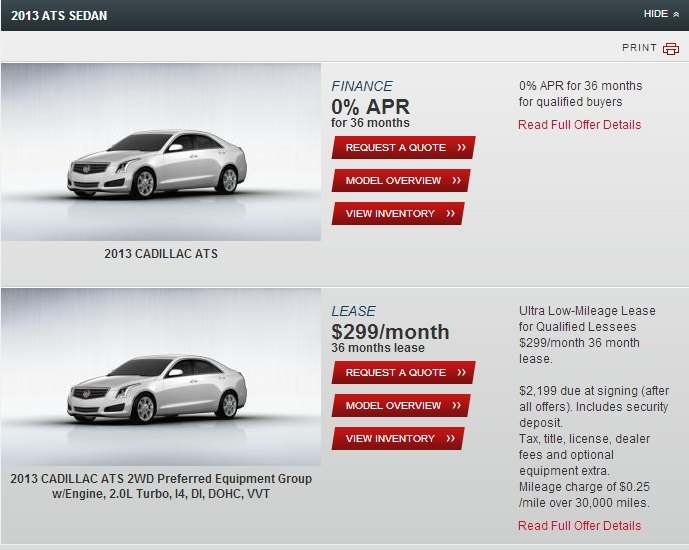

A look at incentive programs in the Miami/South Florida region (using ZIP Code 33180) as a sample shows that the ATS offering more aggressive incentive programs than its competitors. BMW is offering 3.1 percent APR financing for the new 3-Series (save for the Hybrid at 1.9 percent) versus 0 percent for the ATS. Audi offers no finance incentives for the A4 at all. While the ATS gets a $299/month lease for 36 months with $2,199 due at signing, a similarly equipped 328i would cost $349/month for 36 months with $3,824 due at signing. An A4 2.0T can be leased for $309/month for the same term with $3,719 due. Mercedes-Benz was not offering 36 month lease deals at the time of writing. Only Lexus came close to matching Cadillac’s offer, with a lease on an IS250 involving $309/month payment for 36 months, with $3,209 due at signing and a credit for the first month’s lease payment – on a model that is due to be replaced any day now, where dealers are desperate to get rid of the stock.

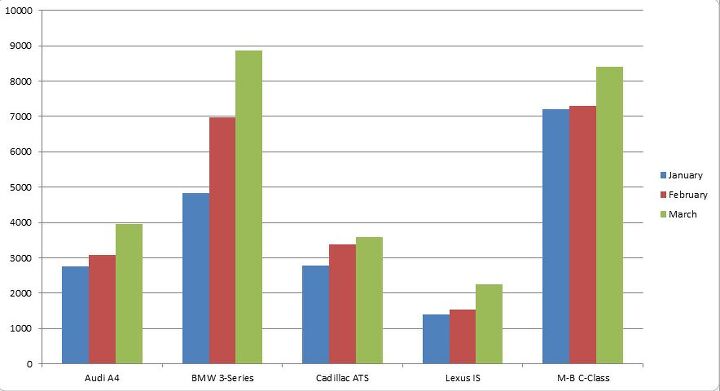

The incentive picture makes the Q1 2013 sales snapshot above even starker. The 3-Series and C-Class are way out in front. The C-Class is leading the segment with 22,912 units sold, with the 3-Series in second place with 20,662 units. Cadillac is in third place, but is beating the A4 by just 45 units as of the end of March (9795 units of the ATS sold versus 9750 A4s). The Lexus trails in fifth place with 5173.

The unfortunate thing here is that the ATS itself isn’t necessarily the reason for its lagging sales and heavy incentive spending. Rather it’s the result of the continued degradation of the Cadillac brand in the eyes of the consumer over the past few decades. I’m far from the only person that believes the ATS to be a superior product to the Mercedes-Benz C-Class, and there are plenty of knowledgeable respected auto critics who feel that is is just as dynamically competent as the BMW 3-Series. But these two products are crushing the ATS in the sales race, undoubtedly on the strength of their respective brands. The unfortunate relaity is that most consumers don’t care about whether or not their car is The Ultimate Driving Machine; they just want a fancy badge to show off to other people. Until Cadillac’s brand is on par with the Roundel or the Three Pointed Star, this scenario of significant incentive spending and lagging sales will likely continue to play out, no matter how good the product is.

More by Derek Kreindler

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo Massachusetts - with the start/finish line at the tip of Cape Cod.

- RHD Welcome to TTAH/K, also known as TTAUC (The truth about used cars). There is a hell of a lot of interesting auto news that does not make it to this website.

- Jkross22 EV makers are hosed. How much bigger is the EV market right now than it already is? Tesla is holding all the cards... existing customer base, no dealers to contend with, largest EV fleet and the only one with a reliable (although more crowded) charging network when you're on the road. They're also the most agile with pricing. I have no idea what BMW, Audi, H/K and Merc are thinking and their sales reflect that. Tesla isn't for me, but I see the appeal. They are the EV for people who really just want a Tesla, which is most EV customers. Rivian and Polestar and Lucid are all in trouble. They'll likely have to be acquired to survive. They probably know it too.

- Lorenzo The Renaissance Center was spearheaded by Henry Ford II to revitalize the Detroit waterfront. The round towers were a huge mistake, with inefficient floorplans. The space is largely unusable, and rental agents were having trouble renting it out.GM didn't know that, or do research, when they bought it. They just wanted to steal thunder from Ford by making it their new headquarters. Since they now own it, GM will need to tear down the "silver silos" as un-rentable, and take a financial bath.Somewhere, the ghost of Alfred P. Sloan is weeping.

- MrIcky I live in a desert- you can run sand in anything if you drop enough pressure. The bigger issue is cutting your sidewalls on sharp rocks. Im running 35x11.5r17 nittos, they're fine. I wouldn't mind trying the 255/85r17 Mickey Thompsons next time around, maybe the Toyo AT3s since they're 3peak. I like 'em skinny.

Comments

Join the conversation

BRAND VALUE is really all that matters here. The utility of the product can be met comfortably in the marketplace for about $20K, so that leaves about $20K of "other" value that the consumer has to justify to make their purchase. Product attributes alone can not, and will not drive Cadillac cars to leadership positions in the marketplace. This is a mature industry with essentially identical technologies driven by the IP of the various component suppliers. Decades of brand destruction have simply erased Cadillac and Lincoln from the minds of large percentage of buyers. In the meantime the marketplace has segmented and aligned behind the current incumbents: Simplified I think we can safely say that BMW is performance, Mercedes is Luxury, and Lexus is Luxury for those who don't trust European Electronics. Unable to find space in this order, Volvo and Jaguar are near death, Infinity has one model arguably a Japanese BMW, Acura is for Honda owners, and that leaves Audi which has had success largely in Asia by positioning itself as an alternative to the MB/BMW incumbancy. Sadly, what is left is that Cadillac and BMW are the cars who are biased to American cars. Keeping the hardware competitive only retains this pool of buyers, it is unlikely to win many converts given that $20K of the purchase price has to make a statement about who that buyer is to neighbors and friends? Right now consumers don't see a compelling reason to switch.

I think I just figured it out, it's NOT the car, it's the image.