European New Car Sales Reach New Lows

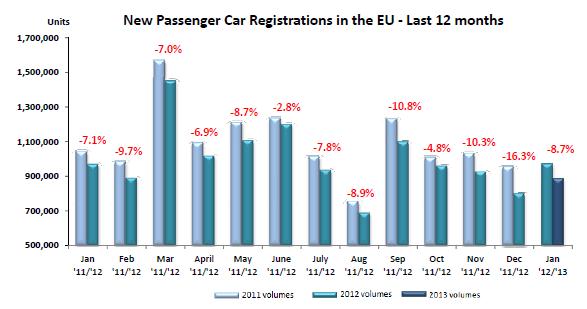

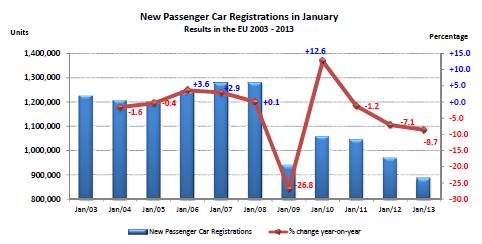

European new car sales had their worst January in recorded history. The European manufacturers organization ACEA started recording in 1990, and it had never seen a January as bad. New car registrations were down 8.7 percent to 885,159 units in the EU.

TTAC readers were pre-warned. As reported earlier in the month, volume markets such as Germany (-8.6%), Spain (-9.6%), France (-15.1%) and Italy (-17.6%) were down by the double digits. Only the UK (+11.5%) posted growth.

Ford, down 25.5 percent, is hard hit. GM is down only 5.5 percent, with Chevrolet down a whopping 40.2 percent, Opel is up 4.5 percent. PSA, down 16.3 percent, continues its swirl down the drain. Renault is down a benign 5.6 percent, Fiat lost 12.3 percent. Volkswagen, down 5.2 percent, keeps gaining market share. (Volkswagen’s odd “others” number is mostly Porsche, which became a Volkswagen brand in August 2012.)

New Car Sales EU January 2013January %ShareUnitsUnits% Chg’13’12’13’1213/12ALL BRANDS**885,159969,219-8.7VW Group24.423.5215,861227,728-5.2VOLKSWAGEN12.312.8108,744123,660-12.1AUDI5.45.148,11549,033-1.9SEAT2.21.919,77618,655+6.0SKODA4.03.735,75336,182-1.2Others (1)0.40.03,473198+1654.0PSA Group11.512.5101,680121,475-16.3PEUGEOT6.26.854,84565,762-16.6CITROEN5.35.746,83555,713-15.9RENAULT Group8.68.376,20680,751-5.6RENAULT6.36.455,92162,115-10.0DACIA2.31.920,28518,636+8.8GM Group7.77.468,17972,114-5.5OPEL/VAUXHALL6.65.858,63756,130+4.5CHEVROLET1.11.69,52115,930-40.2GM (US)0.00.02154-61.1FORD6.88.360,03680,635-25.5FIAT Group6.77.059,70468,090-12.3FIAT5.25.046,09448,014-4.0LANCIA/CHRYSLER0.70.96,1208,929-31.5ALFA ROMEO0.60.95,4128,616-37.2JEEP0.20.21,7912,128-15.8Others (2)0.00.0287403-28.8BMW Group6.25.354,65151,272+6.6BMW5.24.345,80941,737+9.8MINI1.01.08,8429,535-7.3DAIMLER5.64.949,22447,469+3.7MERCEDES5.04.343,91141,947+4.7SMART0.60.65,3135,522-3.8TOYOTA Group4.34.737,71545,337-16.8TOYOTA4.14.436,07442,219-14.6LEXUS0.20.31,6413,118-47.4NISSAN3.73.632,95735,057-6.0HYUNDAI3.63.331,72232,379-2.0KIA2.62.223,17421,609+7.2VOLVO CAR CORP.1.71.915,25318,559-17.8JAGUAR LAND ROVER Group1.31.011,4779,641+19.0LAND ROVER1.10.89,4467,970+18.5JAGUAR0.20.22,0311,671+21.5SUZUKI1.21.310,29912,695-18.9HONDA1.10.99,4148,535+10.3MAZDA1.00.99,2418,294+11.4MITSUBISHI0.50.74,5187,214-37.4OTHER**1.62.113,84820,365-32.0Data can be downloaded as PDF and as Excel sheet.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts If only it had a hatch. The Model S is so much more practical, has similar performance in non-Plaid form, and is $20k more - and the $20k premium seems almost worth it just for the hatch.

- Lorenzo I'm not surprised. They needed to drop the "four-door coupe", or as I call it, the Dove soap bar shape, and put a formal flat roof over the rear seats, to call it a sedan. The Legacy hasn't had decent back seat headroom since the 1990s, except for the wagons. Nobody wants to drive with granny in the front passenger seat!

- Analoggrotto GM is probably reinventing it as their next electric.

- Vatchy What is the difference between a car dealer and a drug dealer? Not much - you can end up dead using what they sell you. The real difference is that one is legal and one is not.

- Theflyersfan Pros: Stick shift, turbo wagonExtra tires and wheelsBody is in decent shape (although picture shows a little rust)Interior is in decent shapeService records so can see if big $$$ is coming upCan handle brutal "roads" in Uganda, Rwanda, and Tanzania, although the spare wheels and tires will be needed. (See picture)Cons:Mileage is high Other Volvos on the site are going for less moneyAnyone's guess what an Ontario-driven in the winter vehicle looks like on the lift.Why wasn't the interior cleaned?Clear the stability control message please...Of course it needs to cross the border if it comes down here. She lowers the price a bit and this could be a diamond in the rough. It isn't brown and doesn't have a diesel, but this checks most TTAC wagon buyer boxes!

Comments

Join the conversation

Thanks for the historical data going back to 2003. Looks like there's been a 7% YOY drop over the last 5 years. Sergio is right about overcapacity. Moreover, this slump is sure to affect the US market soon.

Go Dacia !!! What has been said over and over is coming true - only premium and low cost brands will have growth in Europe. Look at the table, BMW, Mercedes and JLR group are up, Dacia too. Honda and Mazda are up due to their very good reliability right now, what little is left of the middle class buyers is migrating to them from VW, Ford, etc.