Volkswagen Under Attack In Brazil. Here is The Order Of Battle

According to Bloomberg, Volkswagen CEO Martin Winterkorn claimed that “Brazil is very much a cornerstone” in VW’s push to become the world’s largest car maker by 2018.

Herr Winterkorn is in São Paulo for the largest and most important Auto Show in Latin America. Striving to make the most of this unique opportunity, the Brazilian press was all over VW’s CEO. He didn’t disappoint. He announced investments of 4.4 billion dollars to expand VW’s model line and modernize their factories in Brazil until 2016.

Well, they better!

VW is under attack from all sides. Its Gol has been the market leader for over 25 years and this year will surely be again. How long, remains to be seen. Aptly named, it presents a prominent goal for an impressive array of hungry competitors.

With an eye on the ultimate bragging right and all the profit derived thereof, Hyundai, Toyota and General Motors are all contenders for Brazil’s best sold car. Hyundai recently launched the HB20. Toyota the Etios. GM is finally coming out with the Onix, a car that promises to eliminate their cheapest offerings, which are all based on the Opel Corsa from 30 years ago.

Hyundai is leading the charge. It benchmarked the Gol from the git-go of the HB20’s development. Close your eyes and the sensation (though not the engine note) is very similar. I see a lot of Gol in the HB20’s design as well. The HB20 is already making waves. There are lines at dealers and dealers are happy to charge anywhere from 2 to 4 thousand US dollars over list price.

Toyota is banking on its brand to win over consumers. All in all a competent car, the Etios is nonetheless quite dowdy looking. As it appeals to a more rational buyer, the Etios will make its mark slower.

GM has completely renovated their line. Gone are the Opel-based Astra, Corsa, Meriva, Vectra, Zafira. In are the Daewoo-engineered Cobalt, Sonic, Spin, Cruze. Though the GM fanboys are all over Brazilian sites lambasting the new reality, Brazilian consumers are shrugging that off and are happily putting their money into GM’s piggy bank. The Cobalt is selling more than 7,000 units a month making it the market leader in the oh-so-important, B-sized, A-priced sedan segment. I for one am impressed and for the first time in my life, I can actually recommend (with a clear conscience) GM cars over competitors.

Fiat’s offerings are becoming a little stale. Look for them to offer price cuts (like not raising prices when tax breaks end) in an attempt to counterbalance the competition.

Ford has finished expanding their factory in Bahia. It has launched the new mini-CUV, the EcoSport and is starting domestic production of the Aston Martin-inspired, face-lifted New Fiesta. Depending on price, Ford could even stave off Renault’s advances and hold on to their traditional fourth place in our market.

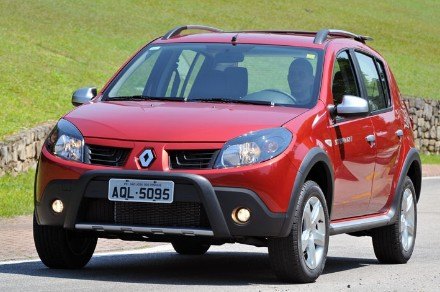

Renault should have the new Sandero and Logan out by the middle of next year. They carved out a niche for themselves based on good levels of content, space and aggressive pricing. Fourth place is within reach.

Nissan also is gaining ground and taking customers from VW. They are building their factory at breakneck speed and Versa and March sales are only hampered by the quotas imposed on imports.

Not to mention the Chinese. Though barely cracking 1% of the passenger car market, their main target are small, affordable cars. Chery, JAC, Great Wall and other assorted unknowns vie for a place under the hot Brazilian sun.

So as you can see, VW is facing tough competition. The Gol/Voyage/Fox are not enough anymore. The investment announced by Senhor Winterkorn is for VW to build here a simplified version of the Up!. That would allow them to position it under the Gol and get them into the 23 to 27 thousand real market. Whether the market will react positively remains to be seen. Considered a subcompact in Europe, the Up! would be sub-subcompact in America. This size of car faces an uphill battle in the Brazilian market. The Twingo’s and Ka’s example stand out. Though hugely successful in Europe, in Brazil they never sold as many as their makers intended.

The second car coming out of this investment is the Santana. Aimed squarely at the Logan, Versa, Cobalt and Grand Siena, it will be VW’s first foray into a growing and even more lucrative segment in Brazil. Many people here perceive such sedans as a step up from the lowlier, smaller and simpler hatchbacks and pay accordingly. In an evil twist and something of an oddball in VW’s sprawling empire, the Santana will not rest on the modular-whatever-thingy. It remains to be seen whether it will sit on the PQ24 or PQ25 platform. The former, a car from 20 years ago. The latter, a car from 10 years ago. As the Cobalt, Versa and even Siena are all new cars, I think VW will have trouble there. Besides, this platform will have to be heavily modified if the Santana wants to offer as much internal space as Cobalt and Logan, both of which are wider than the more traditionally subcompact-sedan-proportioned Versa and Siena.

VW is playing a risky game. They seem hell bent on producing only subcompacts and compacts in Brazil. Larger cars are drawn in from elsewhere in the Empire. The Golf, Touareg, Beetle, Passat among others all come or will come from Mexico and sell or will sell a conta-gotas. Maybe some of this money is destined to nationalize Golf in 2014 or later. They just have to do it to remain relevant in that important, image-building segment.

VW will continue to see its market share erode, as will the other 2.5 of the Big Brazilian 3.5. The Brazilian market is undergoing profound changes. It is now becoming more European in its make-up. Going fast is the old American style of 3 or 4 big makers dominating sales and calling the shots. An Euro-like scenario seems to be the future. In that case, more competitors have to make do with smaller slices of an ever-growing pie.

More by Marcelo de Vasconcellos

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh Market saturation .. nothing more

- Lou_BC I've been considering a 2nd set of tires and wheels. I got stuck in some gooie mud that turned my Duratrac's to slicks. I personally would stick to known brands and avoid Chinesium knock-offs.

- Carson D How do you maximize profits when you lost $60K on every vehicle you produce? I guess not producing any more vehicles would be a start.

- Carguy949 You point out that Rivian and Tesla lack hybrids to “bring home the bacon”, but I would clarify that Tesla currently makes a profit while Rivian doesn’t.

- Cprescott I'm sure this won't matter to the millions of deceived Honduh owners who think the company that once prided itself on quality has somehow slipped in the real world. Same for Toyoduhs. Resting on our Laurel's - Oh, what a feeling!

Comments

Join the conversation

Great post, Marcelo.

@Marcelo, the PQ24 and PQ25 aren't quite as old as 20 and 10 years -- they have been in production since 1999 and 2008 respectively. And one key point that you didn't mention is that Michael Macht did say that VW will be building MQB-based cars in Brazil. "VW's investment in Brazil will include standardizing factories and installing technology to build cars based on the company's MQB platform (...)" So the Golf and/or Jetta could well be built in Brazil, I didn't see anything elsewhere saying that they would continue to be imported -- did I miss it? Other than that, I very much agree with you that continued sales dominance in Brazil will be a big challenge for VW (and Fiat).