Europe In August 2012: Downturn Accelerates

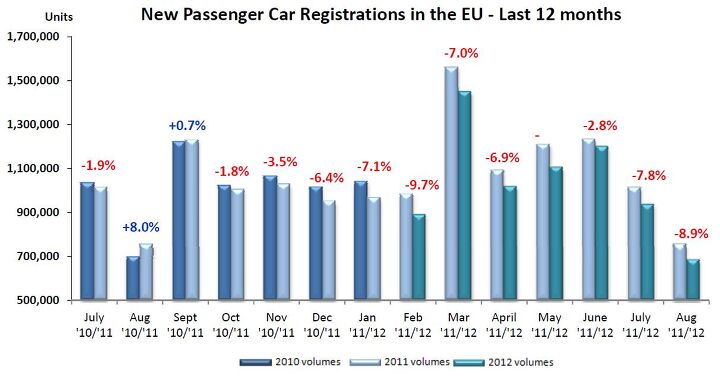

The European car market accelerates its race to the bottom. Back from a long vacation, the European car manufacturers association ACEA reports that the EU car market was down 8.9 percent in August, after having dropped 7.8 percent in July. Eight months into the year, European car sales are down 7.1 percent as Europeans registered 8,268,642 new cars so far.

In August, the gap between north and south widened. The UK eked out a small 0.1 percent gain, Germany saw its sales contract by 4.7 percent, while France (-11.4 percent) and Italy (-20.2 percent) faced double-digit downturns. The Spanish market expanded by 3.4, which will turn out as a flash in the pan. Spain increased its VAT in September, which resulted in a small August rush on car dealerships. The revenge will come this month. In the first two weeks of September, car sales in Spain were down 28 percent.

New Car Sales EU, August 2012AugustJan-Aug %Share %ShareUnitsUnits% Chg% Chg’12’11’12’1112/11+0.0ALL BRANDS**688,168755,732-8.9-7.1VW Group28.225.3194,063191,530+1.3-0.1VOLKSWAGEN14.513.699,661102,841-3.1-2.4AUDI6.45.544,27141,526+6.6+5.2SEAT2.62.417,89218,271-2.1-16.2SKODA4.33.829,89028,790+3.8+0.8Others (1)0.30.02,349102+2202.9+2433.8PSA Group11.411.978,51290,233-13.0-13.5PEUGEOT6.56.444,52648,617-8.4-14.6CITROEN4.95.533,98641,616-18.3-12.2RENAULT Group8.89.260,43869,363-12.9-16.3RENAULT6.27.142,34653,765-21.2-19.8DACIA2.62.118,09215,598+16.0-1.3GM Group7.68.452,13563,453-17.8-11.9OPEL/VAUXHALL6.26.942,38752,239-18.9-15.4CHEVROLET1.41.59,73811,183-12.9+7.5GM (US)0.00.01031-67.7-35.2FORD6.07.741,53658,403-28.9-12.3FIAT Group5.35.936,42244,541-18.2-17.1FIAT4.04.327,23132,303-15.7-17.2LANCIA/CHRYSLER0.50.63,6344,884-25.6-4.2ALFA ROMEO0.60.73,8415,649-32.0-31.2JEEP0.20.21,4971,469+1.9+24.6Others (2)0.00.0219236-7.2-41.2BMW Group5.96.240,63447,000-13.5-3.1BMW4.95.133,91238,743-12.5-3.0MINI1.01.16,7228,257-18.6-3.8DAIMLER5.55.137,71138,214-1.3-2.7MERCEDES5.04.634,17634,416-0.7-1.4SMART0.50.53,5353,798-6.9-11.6TOYOTA Group4.34.229,55031,454-6.1-1.0TOYOTA4.13.928,30129,747-4.9-1.6LEXUS0.20.21,2491,707-26.8+12.5NISSAN3.23.021,74822,920-5.1-4.3HYUNDAI3.73.525,31726,085-2.9+10.1KIA3.02.420,30818,077+12.3+23.1VOLVO CAR CORP.1.31.49,09110,756-15.5-11.6SUZUKI1.41.39,4219,858-4.4-10.8HONDA1.10.97,9056,596+19.8-5.8MAZDA1.01.06,7497,537-10.5-10.9JAGUAR LAND ROVER Group0.60.33,8492,601+48.0+35.5LAND ROVER0.50.23,2561,883+73.0+44.6JAGUAR0.10.1593718-17.4+6.4MITSUBISHI0.60.94,3776,441-32.0-33.4OTHER**1.21.48,40210,670-21.3-18.0On a manufacturer level, the Volkswagen Group holds its own with European sales up 1.3 percent in August and down only 0.1 percent for the first eight months. For the first time, the Volkswagen count also contains Porsche, in the “others” column together with Bentley, Bugatti and Lamborghini.

Sales of Ford were down drastically by 28.9 percent in August. GM is down 17.8 percent. The Fiat Group is down 18.2 percent. The two French makers slowed their descent in August.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

- Formula m For the gas versions I like the Honda CRV. Haven’t driven the hybrids yet.

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

Comments

Join the conversation

The Europeans need some good old sub prime lending like here in the U.S. to get the cars off the lots!

What? No big blaring headline about how Ford Europe sales have seen the biggest drop in sales YTD out of the main players?