Hammer Time: Is America Becoming The Land Of The Suckers?

Suckers come in all shapes and sizes.

They can be a young guy with college loans in his mid-20’s who is charged $800+ for a $100 repair. Or an elderly couple on a fixed income who is encouraged to sign on the dotted line with a malevolent seller.

Every single American has probably been a sucker at some point in their lives when it comes to cars. Young, old, smart, not so smart, confident, fearful… and in all cases, struggling with the unfamiliar. Our society is not one that de-fangs the predators or educates the victims. It is a debtful and litigious one that encourages money to be thrown into every which direction but personal accountability.

Or does it? Frugality is supposedly the in thing these days… and cars are now kept longer than ever. As a life long debt hater, I would like to think that there are far fewer suckers than before. Especially when it comes to cars.

But the numbers tell me otherwise.

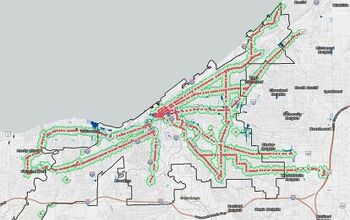

This recession has yielded some unusual results in two industries that reflect the lack of change within the American automotive lifestyle. Take a look at this graph for instance.

Autozone is the largest auto parts retailer in the United States. Not to be outdone by a long list of other competitors. It has been a bellweather of success along with many of the other publicly traded auto parts retailers during this recession. Since 2008 this market segment has yielded a 125% return vs. the S&P 500 index.

So should we all just toss in our proverbial ponchos of stock portfolios and start chasing after companies that embrace Americas newfound penchant for frugality? Not quite yet. Any investment we do in life has to require far more than a few blips worth of data.

The idea of buying a parts retailer may be lucrative to the ‘keepers’ amongst us who believe in investing in our cars for the long haul. But the three most dominant and successful auto parts retailers have only seen annual revenue growth of 4% to 7% over the last five years (Click symbols: AAP, AZO, GPC.)

Without going too deep into the rabbit hole of data, success in the auto parts business has more to do with managing inventory and costs than the sudden enlightment of the general public.

As far as it pains me to say it, most Americans are not pursuing the path to wisdom at all. At least as it relates to cars. In fact everything on the wholesale side of the world points to a public that is increasingly dependent on barnacle levels of debt for their roadside freedom.

Go to page 18 of the 2012 Data Source Book for Used Car News and you will see the nasty reality of a ‘sucker’ infested marketplace. According to Experian Automotive, loans for used cars that are for 60 months or less are becoming far fewer in number. In their place are 5+ year loans. The 61 to 72 month term is now the most common one in the United States with loans beyond 72 months up a startling 41.1% just in the last year (see page 18).

There are now more auto loans for used cars that are six years and longer, than those that are three years or less.

The average term has gone up (page 17). The average payment has only declined for the most creditworthy (see page 16). While those who are the most credit challenged are putting nearly 15% less of a down payment since 2008 ($959 down in 2011 vs $1130 down in 2008, see page 23).

From these numbers, it appears like a lot of folks are going to be bordering on the broke for a very long time. But it gets worse. Far, far worse for the unfortunate among us who happen to live from paycheck to pawn debt.

For more Americans than ever before, the cycle of ‘debt to equity’ has become a ‘debt to debt’ trap. That will be shown in detail come Wednesday. But for now let me ask you a question. How can we reduce the number of suckers in our society? Jokes are welcome as always. But serious answers would be even better.

More by Steven Lang

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

- SCE to AUX My son cross-shopped the RAV4 and Model Y, then bought the Y. To their surprise, they hated the RAV4.

- SCE to AUX I'm already driving the cheap EV (19 Ioniq EV).$30k MSRP in late 2018, $23k after subsidy at lease (no tax hassle)$549/year insurance$40 in electricity to drive 1000 miles/month66k miles, no range lossAffordable 16" tiresVirtually no maintenance expensesHyundai (for example) has dramatically cut prices on their EVs, so you can get a 361-mile Ioniq 6 in the high 30s right now.But ask me if I'd go to the Subaru brand if one was affordable, and the answer is no.

- David Murilee Martin, These Toyota Vans were absolute garbage. As the labor even basic service cost 400% as much as servicing a VW Vanagon or American minivan. A skilled Toyota tech would take about 2.5 hours just to change the air cleaner. Also they also broke often, as they overheated and warped the engine and boiled the automatic transmission...

- Marcr My wife and I mostly work from home (or use public transit), the kid is grown, and we no longer do road trips of more than 150 miles or so. Our one car mostly gets used for local errands and the occasional airport pickup. The first non-Tesla, non-Mini, non-Fiat, non-Kia/Hyundai, non-GM (I do have my biases) small fun-to-drive hatchback EV with 200+ mile range, instrument display behind the wheel where it belongs and actual knobs for oft-used functions for under $35K will get our money. What we really want is a proper 21st century equivalent of the original Honda Civic. The Volvo EX30 is close and may end up being the compromise choice.

Comments

Join the conversation

Here in the NY metro area, you can't find anything like that, even if you are willing to give up personal security and live in the ghetto. The only other alternate is to live far upstate, but can you tolerate a 2.5 hour commute each way every day ? The real driver of home prices are school districts. You will pay to live somewhere your kids will get a decent public education. You might get that upstate, and you won't in the ghetto-so it's private school. You have just not saved much and now live in an unsafe place. My street has million dollar homes (not mine) with low end subarus out front. The money goes for mortgage and taxes (ow ow ow) not car payments.

In my opinion, one of the biggest issues that's leading to problematic vehicle loans is that so many consumers simply don't know any better. You don't want to be spending more than 18% of your monthly budget on transportation in total - not just car payment, but fuel, maintenance, parking, public transit passes, and all that jazz. And that's at a maximum. Most experts will tell you that no more than 8% should be allocated to your actual car payment itself. Unfortunately, that doesn't get a lot of consumers the car they want, and dealers/lenders are incentivized to go with the biggest loan/most expensive vehicle possible. That means prolonging the lending term, so that the monthly payment is effectively lowered (and increasing the risk of negative equity, etc). We could hope that they would not do this out of simple kindness, but in a free market economy, you can't realistically rely on that. What people need are cars they can afford, financed with the smallest and shortest loans possible (if a cash purchase isn't an option financially). AND they need to know that this is the right, best, smartest option. I don't think we're a nation of suckers. But I do think that financial education is sorely lacking.