Europe In April 2012: Car Sales Down 6.9 Percent

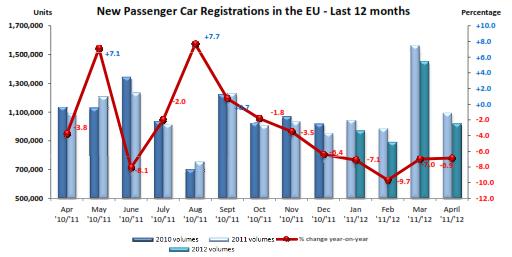

Listening to the news from Europe, one thinks that there is chaos in the streets of Europe. Not yet. But Europeans are clearing room for chaos by buying fewer cars. 1,017,912 new passenger cars were registered in the EU, or 6.9 percent less than in the same month of 2011. Four months into the year, new registrations in the EU were 7.5 percent lower than a year earlier, the European manufacturers association ACEA reports.

The UK (+3.3 percent) and Germany (+2.9 percent) were the only major markets to post growth. Sales in France contracted by 1.9 percent. Mediterranean Italy was down 18.0 percent, Spain 21.7 percent.

Not surprisingly, Greece was down-56 percent, Portugal lost 41 percent. Surprisingly, people in Finland went on a partial buyers strike (- 64.5 percent.)

April %ShareUnitsUnits% Chg’12’11’12’1112/11ALL BRANDS**1,017,9121,092,963-6.9VW Group24.624.3250,023265,524-5.8VOLKSWAGEN13.013.2131,885144,781-8.9AUDI5.85.258,84856,620+3.9SEAT2.02.419,90325,992-23.4SKODA3.83.539,17037,924+3.3Others (1)0.00.0217207+4.8PSA Group12.711.8129,576129,380+0.2PEUGEOT6.86.669,42171,970-3.5CITROEN5.95.360,15557,410+4.8RENAULT Group8.69.588,015103,682-15.1RENAULT6.77.668,65783,387-17.7DACIA1.91.919,35820,295-4.6GM Group8.28.683,75593,989-10.9OPEL/VAUXHALL6.57.366,16079,629-16.9CHEVROLET1.71.317,57414,339+22.6GM (US)0.00.02121+0.0FORD7.67.776,92184,155-8.6FIAT Group7.37.673,90683,491-11.5FIAT5.35.553,70360,339-11.0LANCIA/CHRYSLER0.90.89,2398,581+7.7ALFA ROMEO0.81.18,43612,249-31.1JEEP0.20.12,0891,639+27.5Others (2)0.00.1439683-35.7BMW Group6.55.965,68163,989+2.6BMW5.34.753,44251,697+3.4MINI1.21.112,23912,292-0.4DAIMLER5.45.054,52554,473+0.1MERCEDES4.74.347,77447,436+0.7SMART0.70.66,7517,037-4.1TOYOTA Group3.84.138,32444,758-14.4TOYOTA3.63.836,46841,722-12.6LEXUS0.20.31,8563,036-38.9NISSAN2.83.328,63235,779-20.0HYUNDAI3.43.134,40534,302+0.3KIA2.72.127,51723,096+19.1VOLVO CAR CORP.1.81.918,66720,500-8.9SUZUKI1.11.311,15414,355-22.3MAZDA0.90.98,7079,613-9.4MITSUBISHI0.60.95,8319,346-37.6JLR Group0.70.57,4865,792+29.3LAND ROVER0.60.45,9784,637+28.9JAGUAR0.10.11,5081,155+30.6HONDA1.00.99,7419,515+2.4OTHER**0.50.75,0467,224-30.2On the OEM front, Volkswagen shows the expected first symptoms of EU weakness. In Apri, the Volkswagen Group is down 5.8 percent in Europe. Many automakers, notably Renault, GM, and Fiat show double digit losses in April. Losing less than others, VW gained further market share.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh *Why would anyone buy this* when the 2025 RamCharger is right around the corner, *faster* with vastly *better mpg* and stupid amounts of torque using a proven engine layout and motivation drive in use since 1920.

- Kjhkjlhkjhkljh kljhjkhjklhkjh I hate this soooooooo much. but the 2025 RAMCHARGER is the CORRECT bridge for people to go electric. I hate dodge (thanks for making me buy 2 replacement 46RH's) .. but the ramcharger's electric drive layout is *vastly* superior to a full electric car in dense populous areas where charging is difficult and where moron luddite science hating trumpers sabotage charges or block them.If Toyota had a tundra in the same config i'd plop 75k cash down today and burn my pos chevy in the dealer parking lot

- Kjhkjlhkjhkljh kljhjkhjklhkjh I own my house 100% paid for at age 52. the answer is still NO.-28k (realistically) would take 8 years to offset my gas truck even with its constant repair bills (thanks chevy)-Still takes too long to charge UNTIL solidsate batteries are a thing and 80% in 15 minutes becomes a reality (for ME anyways, i get others are willing to wait)For the rest of the market, especially people in dense cityscape, apartments dens rentals it just isnt feasible yet IMO.

- ToolGuy I do like the fuel economy of a 6-cylinder engine. 😉

- Carson D I'd go with the RAV4. It will last forever, and someone will pay you for it if you ever lose your survival instincts.

Comments

Join the conversation

So Ford is down by 8 percent and JLR is up by almost 30 percent. Ford Europe barely makes a profit, JLR profits top a billion pounds a year now. And Ford was right to sell? JLR is the tiger car maker of the premium sector these days how many (apart from me) predicted that when Ford sold up?

The numbers for Finland should be no surprise after the buying spree in March (http://www.thetruthaboutcars.com/2012/04/europe-in-march-2012-car-nage/) and the taxation change in April. March+April is still up 30% over 2011, and numbers will likely stabilize in a few months' time.