Europe In November 2011: Germany Saves The Month

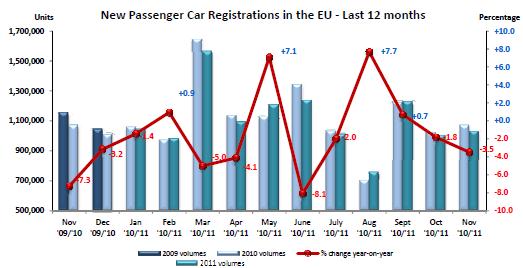

Demand for new cars in the EU decreased by 3.5 percent in November, amounting to 1,030,414 units. Eleven months into the year, registrations stand at 12,157,119, that is 1.4 percent less than in the same period in 2010. Basically, the European market remains flat with a slight downward bias. This according to data released by the European manufacturers’ association ACEA.

The picture would look worse, would it not be for Germany. Germany was the only volume market to post growth (+2.6 percent). Downturn ranged from -4.2 percent in the UK to -6.4 percent in Spain, -7.7 percent in France and -9.2 percent in Italy.

From January to November, the German market expanded by 9.1 percent. In France (-0.3 percent), the UK (-4.5 percent), Italy (-10.6 percent) and Spain (-18.8 percent) , results were all negative.

New Passenger Car Registrations EU

January – November %ShareUnitsUnits% Chg’11’10’11’1011/10ALL BRANDS12,157,11912,324,863-1.4VW Group23.221.32,824,3072,630,633+7.4VOLKSWAGEN12.411.31,503,3221,387,349+8.4AUDI5.04.5608,585555,736+9.5SEAT2.32.2275,439273,592+0.7SKODA3.63.3435,111412,230+5.6Others (1)0.00.01,8501,726+7.2PSA Group12.613.51,533,2741,669,327-8.2PEUGEOT6.87.4830,322907,337-8.5CITROEN5.86.2702,952761,990-7.7RENAULT Group9.710.41,180,4711,281,361-7.9RENAULT7.88.5952,6321,042,550-8.6DACIA1.91.9227,839238,811-4.6GM Group8.78.61,054,7181,062,478-0.7OPEL/VAUXHALL7.47.3897,416900,901-0.4CHEVROLET1.31.3156,851160,578-2.3GM (US)0.00.0451999-54.9FORD8.08.2974,8221,011,956-3.7FIAT Group7.18.0868,620985,456-11.9FIAT5.26.2628,560759,143-17.2LANCIA/CHRYSLER0.80.894,866101,157-6.2ALFA ROMEO1.00.8118,12296,795+22.0JEEP0.20.120,25312,320+64.4Others (2)0.10.16,81916,041-57.5BMW Group5.95.4718,051661,082+8.6BMW4.74.4568,985539,055+5.6MINI1.21.0149,066122,027+22.2DAIMLER5.04.9601,825604,574-0.5MERCEDES4.44.3529,328529,234+0.0SMART0.60.672,49775,340-3.8TOYOTA Group3.94.2477,225519,259-8.1TOYOTA3.74.1454,001503,659-9.9LEXUS0.20.123,22415,600+48.9NISSAN3.42.9412,758360,762+14.4HYUNDAI2.92.6351,579318,978+10.2KIA2.21.9264,689237,128+11.6VOLVO CAR CORP.1.81.6217,669191,848+13.5SUZUKI1.31.4153,892171,196-10.1HONDA1.11.3132,093163,984-19.4MAZDA1.01.3121,385161,483-24.8MITSUBISHI0.80.795,04988,661+7.2JAGUAR LAND ROVER Group0.70.786,94785,582+1.6LAND ROVER0.50.566,02760,954+8.3JAGUAR0.20.220,92024,628-15.1OTHER**0.71.087,744119,116-26.3All data can be retrieved here as PDF, and here as Excel file.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- JMII Hyundai Santa Cruz, which doesn't do "truck" things as well as the Maverick does.How so? I see this repeated often with no reference to exactly what it does better.As a Santa Cruz owner the only things the Mav does better is price on lower trims and fuel economy with the hybrid. The Mav's bed is a bit bigger but only when the SC has the roll-top bed cover, without this they are the same size. The Mav has an off road package and a towing package the SC lacks but these are just some parts differences. And even with the tow package the Hyundai is rated to tow 1,000lbs more then the Ford. The SC now has XRT trim that beefs up the looks if your into the off-roader vibe. As both vehicles are soft-roaders neither are rock crawling just because of some extra bits Ford tacked on.I'm still loving my SC (at 9k in mileage). I don't see any advantages to the Ford when you are looking at the medium to top end trims of both vehicles. If you want to save money and gas then the Ford becomes the right choice. You will get a cheaper interior but many are fine with this, especially if don't like the all touch controls on the SC. However this has been changed in the '25 models in which buttons and knobs have returned.

- Analoggrotto I'd feel proper silly staring at an LCD pretending to be real gauges.

- Gray gm should hang their wimpy logo on a strip mall next to Saul Goodman's office.

- 1995 SC No

- Analoggrotto I hope the walls of Mary Barra's office are covered in crushed velvet.

Comments

Join the conversation

wow Honda took a dump. When Kia outsells you 2 to 1 and Suzuki too, you have issues. Hyundai outsells them 3 to 1 and Nissan 4 to 1!! Wonder if they will pull the plug on EU operations soon? Can someone explain GM's EU numbers. Is GM's definition of EU different from this list. Cause in their press release they mention GME sold 1,319,000 cars for Jan to Sep period, 85000 more than last year. Page 6 : http://media.gm.com/content/dam/Media/gmcom/investor/2011/Q3-2011-Highlights.pdf However, in this list it says they sold 1,054,000 for Jan to Nov. (two additional months). Maybe GM's EU unit includes sales for Russia, etc? but this list does not?

In putting their resource behind breaking the US market, the Japanese forgot to develop diesels properly. With our high fuel prices, and tax structures based around co2 emissions, diesel is the best financial option for most. Small LPT petrol units are catching up, but the Japanese don't do them either. So, if their cars don't make a financial case, do they otherwise have the design, utility, or perceived quality to compete in other ways? Generally speaking, they do not. And clearly the Euro market puts less of a premium on reliability, how else do you explain over a million Renaults? The Camry is not even sold in the UK anymore, they gave up on that a decade ago. The Euro-specific Avensis is a 90% facsimile of an average Euro mid-sized car, so there's no reason to buy one in light of the arguments above. Honda, for their part, seem hell bent on producing ever more underwhelming versions of the Civic, Accord, and CRV, Mazda was always a bit-part player. We're also pretty snobby about brands over here, so add that to the reasons. Merc C Class and BMW in UK top 10 sellers, for example.