Edmunds Traffic Forecast For August: Stop And No Go

Michelle Krebs and Lacey Plache of Edmunds.com, decorated heroes of the TTAC “rate the analysts” contest (to be repeated) are raining on the parade of good sales forceasts, definitely for August, possibly for the year. Edmunds thinks that August sales will be flat. Customers are hearing mixed signals, and being confused, they do nothing. Says Lacey Plache:

“Stronger buying conditions are telling consumers to go ahead and make their car purchases, but a weak economic landscape is telling them to wait until later this year, or even longer. This is the battle that will determine exactly how much the auto industry will grow this year.”

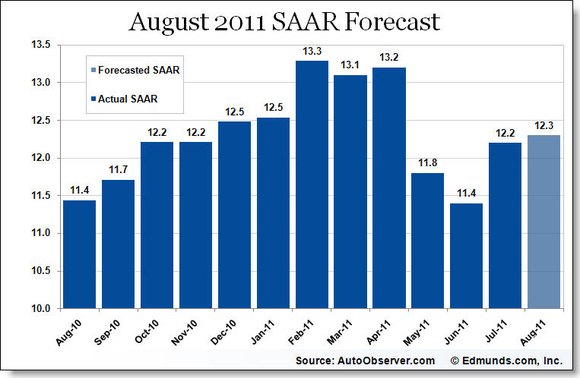

For August, Edmunds expects car and truck sales to come in at a smidgen over a million (1,087,000 FWIW), up 2.6 percent from July and 9 percent from August 2010, not adjusted for the different number of selling days in the months. If that number prints, the Seasonally Adjusted Annualized Rate of car sales (SAAR) will stand at 12.3 million vehicles. “Stand” is the operative word, because is would be roughly the same as July.

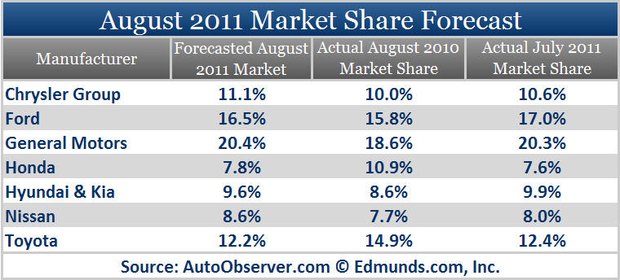

Like us, Edmunds.com has its sights on underestimated Nissan. Edmunds gives Nissan ”the biggest month-over-month gains among the top six automakers. Nissan is projected to sell 10.4 percent more vehicles in August than July, and 21.5 percent more vehicles than in August 2010.”

Like us, Edmunds praises Nissan for dealing best with the obstacles thrown up by a huge tidal wave in Japan. Says Jessica Caldwell:

“Nissan’s market share growth is a testament to how well it has recovered from the March earthquake compared to its chief Japanese rivals. In recent marketing campaigns, Nissan has been directly targeting shoppers who have trouble finding Toyota and Honda vehicles in stock, while further enticing them with juicy incentives like zero percent financing on a majority of their models.”

On the overrated side, Edmunds forecasts that Ford will be the only major automaker this month to report a decline in sales from July to August. Ford’s sales are expected to be down 0.5 percent from July, leading to a market share loss of 0.5 points. Edmunds sees Ford struggling with inventory, notably of its hottest-selling models – the Ford Fiesta, Ford Focus and Ford Explorer.

Hyundai is expected to sell 60,839 vehicles this month, a 13.5 percent gain over August 2010. Hyundai’s inventories also show signs of strain. In early August, Hyundai’s CEO John Krafcik told Edmunds that Hyundai had only 37,000 vehicles in inventory – barely a 20 days supply. The Elantra was down to a 3 days supply.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG likes price reductions.

- ToolGuy I could go for a Mustang with a Subaru powertrain. (Maybe some additional ground clearance.)

- ToolGuy Does Tim Healey care about TTAC? 😉

- ToolGuy I am slashing my food budget by 1%.

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

Comments

Join the conversation

Who survived the Great Depression, and why? Whatever they did to succeed, they will need to do so again. 2012 doesn't look much better. And neither does 2013.

Agree that, from my perspective and location, 2012 and 2013 don't look much better than 2011. But we have to hope that the US auto industry, and especially GM, does well for it is the only way for we, the people, to get some of that money back that we showered on them during the Great Bailout. We already know what we lost on what was once called Chrysler, and what it took to get Fiat to take that loser off our hands. I learned yesterday that the US Treasury has already made more than $150B on the financial industry/banks it bailed out, and there's still more to come. That's the good news. But in the case of the US auto industry we, the people, will never recoup all the money that was wasted on failed giants, just to keep the UAW working at the expense of the tax payers. Somehow the UAW felt it was owed them because the taxpayers enjoyed the privilege of having the UAW build cars for them. I never understood that. But it was a great deal, for them! What helped turn America around after the Great Depression was the onset of WWII. Everybody who wanted a job, got a job. In fact, labor was in such short supply in 1942-1944 that it was imported from Mexico and anywhere else we could find people to come to the US Mainland. Many of them overstayed their welcome and didn't go home. Some even came here involuntarily, like the Issei and Nissei forced to relocate from Hawaii. While we have a dire need for certain jobs in America, we do not want to repeat the factors that created jobs after the Great Depression. We already are involved in too many wars that will not yield any return on investment to the tax payers. WWII yielded enormous returns on the taxpayers' investment. Iraq, Afghanistan and Libya are, and will always be, losses to the US taxpayers and the Treasury. It may come as a surprise but there are many, well-paying jobs in America that go unfilled these days because we don't have the talent to fill them. That's why, even today, we import people from overseas with our various visa-programs to fill those jobs that are critical to America. To wit, jobs in research, medicine and engineering. It's a sad day when America has to import brains as well as manufactured goods. Yet we are doing it. Until the economy, and the housing industry, gets better and improves the lives of Joe Sixpack and Sally Housewife, fewer people will feel inclined to stick themselves in debt to buy that new car. I envision a depressed SAAR of 12.1M for 2011. It's too early to tell about 2012 but I would be surprised if it is much higher. Economic forecasts are for very slow growth for two to three years.