Industry: Bailout? What Bailout?

TTAC has always taken pride in its outsider status, and we’ve taken pains to cover the industry from a safe distance in order to continually bring a fresh perspective to developments. As a result, we’re not always on the same page as trends in the industry at large, which tends to be far more given to wild optimism than the average TTAC analysis. But, based on a new study by Booz & Company [ PDF], it seems that the “carpocalypse” of recent years has driven the industry to a more TTAC-esque pessimism. According to responses by executives at both OEMs and suppliers, the industry generally feels that the bailout was either a missed opportunity or it didn’t do enough to address fundamental weaknesses… and as a result, executives see challenges ahead.

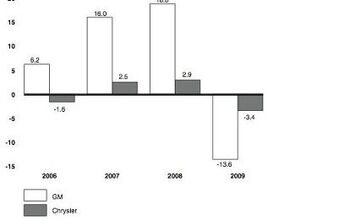

So, where is the industry now? Not much better than it was at the height of the “carpocalypse,” when GM and Chrysler were going through bankruptcy on the government’s dime. And though OEMs generally benefited more than the suppliers, the automakers themselves are less optimistic about the current state of the industry… although that might be a function of the fact that suppliers were going bankrupt by the 12-pack before the industry recognized that it was in crisis.

So, what did the bailout do right? Cutting capacity, or in less politically-palatable terms, firing people. Ironic, isn’t it, that a policy that’s being defended as a jobs-saving measure did its best work (at least according to the OEMs) when it put people out of work? Meanwhile, feel free to draw your own conclusions about the fact that the industry liked the “capacity rationalization” aspects of the bailout, while feeling like the bailout didn’t do enough. Saving jobs, as we’ve pointed out for some time, is not the same as saving companies… in fact, the two goals often clash significantly.

In any case, both OEMs and suppliers picked the government’s rescue of Chrysler as the least-positive impact of the auto industry rescue. Some 42% of OEMs feel rescuing Chrysler was negative for the industry, while 20% of suppliers sign on to the same sentiments, despite being largely positive about the GM bailout.

And here’s where the rubber hits the road: nearly 30% of the industry thinks another OEM will fail within the next two years. Risk is fundamental to every industry, but the fact that almost a third of industry execs expecting an OEM failure within the next 24 months is a searing indictment of the bailout, which was supposed to create a sense of confidence. And if GM or Chrysler fail again, all those rescue efforts will have been wasted, and every job “created or saved” will be in jeopardy again.

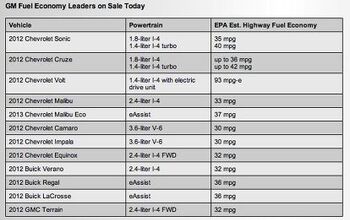

So what to do now? Incentive and pricing discipline, long a TTAC hobbyhorse, is identified by both sides of the industry as being one of the most important tasks (the most important for OEMs). Production discipline is also identified as a key consideration, something the bailout also hasn’t been able to change. In short, the easy cuts and consolidation have been achieved, leaving only the tough challenges that require a focused, disciplined culture… and the bailout still hasn’t made a demonstrable difference in the culture of the industry, which has been flirting with a price war since the beginning of this year. The lesson: you can cut, rinse and inject cash, but ultimately, success in this industry comes down to focus and discipline, neither of which can be provided by a government bailout.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy First picture: I realize that opinions vary on the height of modern trucks, but that entry door on the building is 80 inches tall and hits just below the headlights. Does anyone really believe this is reasonable?Second picture: I do not believe that is a good parking spot to be able to access the bed storage. More specifically, how do you plan to unload topsoil with the truck parked like that? Maybe you kids are taller than me.

- ToolGuy The other day I attempted to check the engine oil in one of my old embarrassing vehicles and I guess the red shop towel I used wasn't genuine Snap-on (lots of counterfeits floating around) plus my driveway isn't completely level and long story short, the engine seized 3 minutes later.No more used cars for me, and nothing but dealer service from here on in (the journalists were right).

- Doughboy Wow, Merc knocks it out of the park with their naming convention… again. /s

- Doughboy I’ve seen car bras before, but never car beards. ZZ Top would be proud.

- Bkojote Allright, actual person who knows trucks here, the article gets it a bit wrong.First off, the Maverick is not at all comparable to a Tacoma just because they're both Hybrids. Or lemme be blunt, the butch-est non-hybrid Maverick Tremor is suitable for 2/10 difficulty trails, a Trailhunter is for about 5/10 or maybe 6/10, just about the upper end of any stock vehicle you're buying from the factory. Aside from a Sasquatch Bronco or Rubicon Jeep Wrangler you're looking at something you're towing back if you want more capability (or perhaps something you /wish/ you were towing back.)Now, where the real world difference should play out is on the trail, where a lot of low speed crawling usually saps efficiency, especially when loaded to the gills. Real world MPG from a 4Runner is about 12-13mpg, So if this loaded-with-overlander-catalog Trailhunter is still pulling in the 20's - or even 18-19, that's a massive improvement.

Comments

Join the conversation

It will take some sort of Black Swan event for someone to fail within the next two years but after that, it's a matter of time. I am talking about the domestic companies of course, worldwide it could happen within that time. Ford is pretty safe for time being. If the UAW destroys them it will sow the seeds for the union's destruction which would help the entire industry out. Fiat actually has a good chance to save Chrysler, not trying to compete with every brand in every segment is a great idea for them. GM is still the mostly likely to have an event at some point.

We are already getting much more back from the US Auto bail out than I ever expected. I had assumed that nothing would be paid back. The logic was more as a jobs program than an 'investment'. It was the worst possible time for the US industry to implode, and kicking the can down the road wasn't a negative. I thought it was a good idea at the time. It has worked out better than I thought, with a decent chunk of the government money being returned. I suggest that the conflict between 'too big to fail' and 'the need for more consolidation' needs to be considered. Too big to fail yet too small to succeed? The real story is how Hyundai managed to kick ass during a massive cyclical downturn. As far as the future of GM and Ford, that is up to them, the marketplace, and how they perform.