China's Car Market: Bust Or Boom?

Many pronounced the end of China’s torrid growth of car sales after they slowed to just 4.57 percent in February. Xing Huang, chairman of state-owned auto parts maker China Auto Parts & Accessories Corp (CAPAC), thinks otherwise. He expects the Chinese auto market to grow at the same speed in 2011 as in the year before, says Reuters. That would be 32 percent.

CAPAC President Kangren Chen points at 150 million motorcycle owners in China who want to own cars. That actually is a good indicator. Once people have money, they change from 2 wheels to 4.

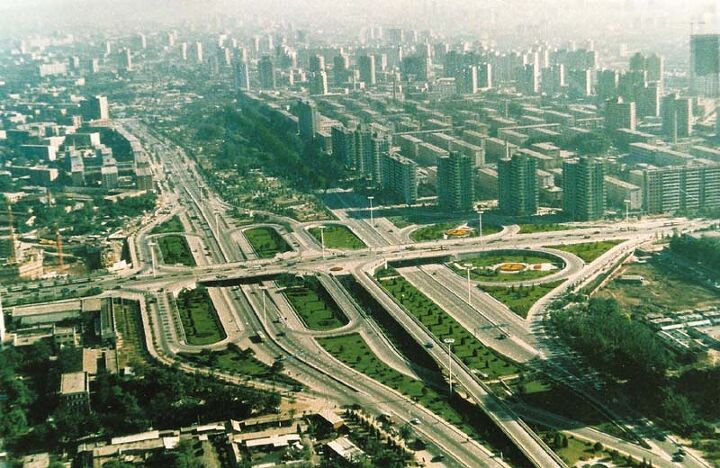

In the meantime, the car market in Beijing is in total disarray. As reported before, only 2,000 of the 20,000 license plates awarded in the lottery have been converted into car sales. The used car market has collapsed, because license plates are no transferable. A lot of people in Beijing expect the rules to change the soon the city can backpedal without a huge loss of face.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

It's always very amusing to see that people assume the Chinese will stop buying cars because we might run out of oil. At the same time, this argument never comes up when we cheer U,S. auto sales on. It also doesn't bother us that the U.S. consumes more than twice the amount of oil than China,, and that with a quarter of the population. On a per capita basis, China doesn't even enter the Top 20.

What happens in China and India with their 3 billion people dictates the future everywhere in the world. It's just going to take one bee in the bonnet of a higher-up Chinese politician to immediately begin transferring all ground transportation to all-electric. The cause could be high petroleum prices; higher demand for air travel (which needs hydrocarbon fuel); embarrassment that a quarter of all deaths are air pollution-related; understanding what is the practical meaning of "thermal bottleneck" and realizing that it is ultimately futile to run vehicles based on controlled explosions of fuel; showing up the USA (as in showing the West how the future should be done); or a combination....

While China has a degree of free enterprise, it still has massive government participation in the economy, and a choke hold on the financials that make any economy run. Right now, the government is trying to tamp down inflation concerns, and it also has a goal of shaking out the auto industry into fewer, larger automakers. Suppressing car demand helps achieve both. Government efforts that produce one month, or two, of suppressd auto sales aren't going to be that effective. The government may be right that once the anti-inflation measures are relaxed, car sales will rebound, but six months or more of tighter financial controls to fight inflation are going to have an effect on the year's totals. The Chinese have more tools than the west to manipulate their economy, but they also have less experience. Western governments with much more experience "fine tuning" their economies still manage to make a hash of things more often than not. The Chinese government would do well to realize that the law of unintended consequences applies to them too.