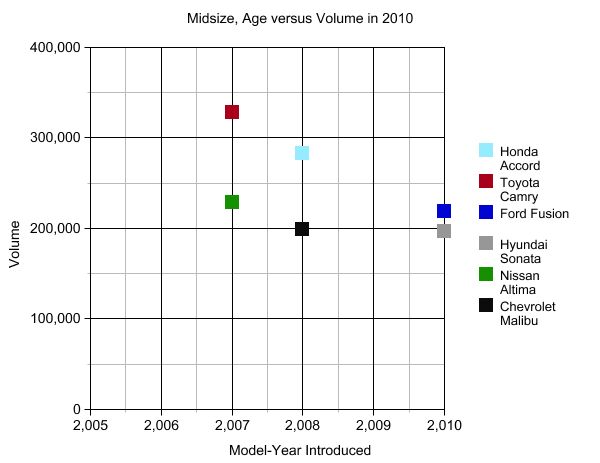

Chart Of The Day: Does Age Matter? Edition

Ignore the commas in the X-axis labeling, and you’ll see that this graph compares total sales volume for last year against each model’s year-of-introduction as we hunt for the missing links between product cadence and sales performance. Above, you can see that none of the major D-Segment competitors was introduced before 2007, and that newness alone is not linked to sales volume. In fact, in the D-Segment, volume seems to decrease with newness (although historical data indicates that this is a brand-loyalty issue rather than a consumer preference for older vehicles). Moreover, it appears that more recent introductions are merely narrowing the competitive gaps in the midsized sedan segment (although we’ll need new Accord and Camry replacements to tell if that trend is for real).

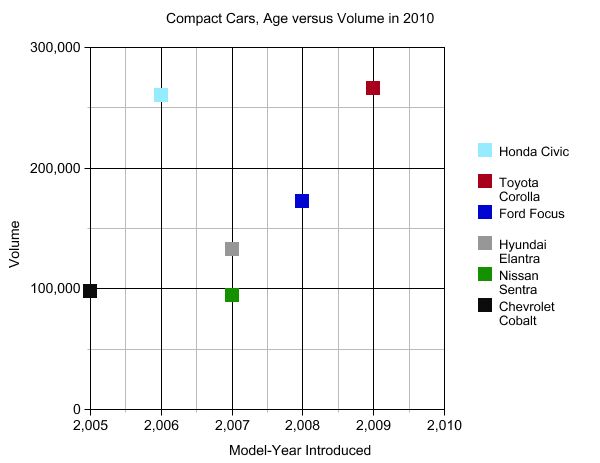

The compact segment, on the other hand, shows a far less surprising correlation between year-of-introduction and sales, as sales grow in a fairly consistent manner as you move across the x axis from older to newer nameplates. The major lesson from these graphs: Honda and Toyota continue to enjoy a “reverse perception gap” in which their aging models tend to most dramatically defy volume expectations relative to the age of the competition. But with more competition coming this year, as Chevy’s Cruze, Hyundai’s Elantra and Ford’s Focus come into the market, the consumer’s tendency to give Honda and Toyota “the benefit of the doubt” could well be tested. And once perceptions start shifting, there’s no telling where they might end up.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo I'm not surprised. They needed to drop the "four-door coupe", or as I call it, the Dove soap bar shape, and put a formal flat roof over the rear seats, to call it a sedan. The Legacy hasn't had decent back seat headroom since the 1990s, except for the wagons. Nobody wants to drive with granny in the front passenger seat!

- Analoggrotto GM is probably reinventing it as their next electric.

- Vatchy What is the difference between a car dealer and a drug dealer? Not much - you can end up dead using what they sell you. The real difference is that one is legal and one is not.

- Theflyersfan Pros: Stick shift, turbo wagonExtra tires and wheelsBody is in decent shape (although picture shows a little rust)Interior is in decent shapeService records so can see if big $$$ is coming upCan handle brutal "roads" in Uganda, Rwanda, and Tanzania, although the spare wheels and tires will be needed. (See picture)Cons:Mileage is high Other Volvos on the site are going for less moneyAnyone's guess what an Ontario-driven in the winter vehicle looks like on the lift.Why wasn't the interior cleaned?Clear the stability control message please...Of course it needs to cross the border if it comes down here. She lowers the price a bit and this could be a diamond in the rough. It isn't brown and doesn't have a diesel, but this checks most TTAC wagon buyer boxes!

- Spookiness They'll keep chasing this dream/fantasy*, but maybe someday they'll realize their most valuable asset is their charging network.(*kind of like Mazda with rotary engines. just give up already.)

Comments

Join the conversation

I agree with John Horner. The other fact missing here is the effectiveness of the new model. 2008 Accord was a nice improvement over the prior. The 2010 Fusion fixed a very ugly front end on the prior and an outdated interior. The Malibu got better, but was just less far behind than before. The 2007 Camry? It got bigger and uglier. The Altima just got bigger and looks the same. The Sonata change was truly dramatic in every way, inside, outside, drivetrain. New only helps when it helps. Ford was smart. The shape and size was good. The headlights and interior were not. So they fixed what was broken. There are few innovations needed now. You can no longer buy a new car because it has ABS and your old one doesn't. Maybe the iPod connection is similar, but for the most part, cars today have everything needed and then some.

For the record, the Altima actually got slightly smaller in exterior dimensions from the previous generation. Other than that the years appear to be meaningless. The Camry and Accord have been sales leaders for years...When they introduce new models this will probably continue. What the graph fails to note because of its short time duration is that 5-6 years ago Chevy and Ford were hardly players....The vastly improved Malibu and the second generation Fusion have proven the Americans are now players.