1 View

US Auto Sales In November: SAAR Flat At 12.2m

by

Edward Niedermeyer

(IC: employee)

Published: December 1st, 2010

Share

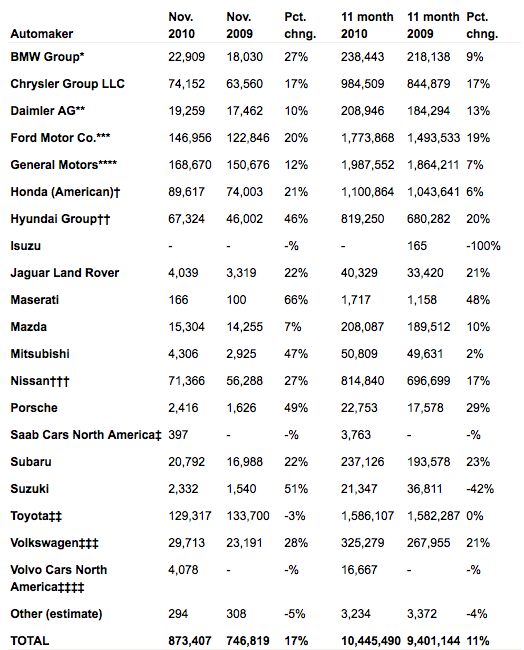

Automotive News [sub] reports that October’s Seasonally Adjusted Annual Selling Rate (SAAR) hit 12.2m last month, making November the market’s second month back over the 12m mark since last year’s Cash For Clunkers-fueled buying spree. Analysts are calling the 12m mark an “important psychological level,” although sales appear to be essentially flat compared to last month. Check back for an updated chart as more automakers report their sales.

Edward Niedermeyer

More by Edward Niedermeyer

Published December 1st, 2010 12:29 PM

Comments

Join the conversation

Looks like the US has settled into a distinct three-tier market. GM, Ford, and Toyota have just over 51% of the market; then a second tier of Honda, Chrysler, Hyundai, and Nissan have 36% to share, then everyone else gets to scrap over the last 13% or so.

What sticks out most to me is how Ford, with only two "core" brands (and one of them a very weak Lincoln,) is slowly but surely gaining ground against GM's four. Someone at RenCen should be scared to death of that trend. New GM suckers -- er, shareholders -- should probably be worried, too.

VW is doing well, outperforming the market. I am surprised by Mazda's weak 7% gain (below the market), especially since they have recently expanded their lineup with the 2.

Way to go SAAB! :D