Europe In October 2010: Hangover

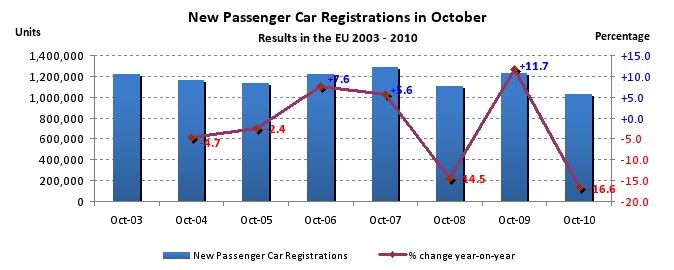

New car registrations in the 27 countries of the EU crashed by 16.6 percent to 1,027,036 units in October. That according to the latest statistics of the European manufacturer organization ACEA. The year looks a bit better: In the first 10 months, demand for new cars has decreased by 5.5 percent, totaling 11,279,542 new vehicles registered.

Europe is in the throes of a big cash for clunker induced hangover. It will take a lot of Aspirin, and into 2011 to get over it. Even compared with October 2008, the market in the EU27 is down 9.4 percent. Compared with the first ten months of 2008, sales are down 12 percent.

Any way you look at it: It’s down.

Double digit contractions are being reported from all major markets in Europe, ranging from -18.5 percent in France, to -20.0 percent in Germany, -22.2 percent in the UK, -28.8 percent in Italy and -37.6 percent in Spain.

Two markets registered triple digit gains: Ireland’s new car sales rose 114.6 percent (from 1,530 last year to 3,284 this time around.) Estonia’s car market exploded by 121.2 percent. They sold 993 cars this October, compared to 449 in October last year.

If you look at the data ( here in PDF and here as Excel,) you will see the markets that didn’t receive steroid injections last year slowly recover. You also see the drug recipients exhibiting serious withdrawal symptoms.

On the manufacturer front, not much to report. VW remains the emperor of Europe with a more or less unchanged market share of 21.3 percent for the year. Next is PSA, up half a percent to 13.5 percent. Renault keeps gaining market share, up to 10.3 from 9.1 in the first ten months. GM is holding its own (8.6 percent compared to 9.1, but Saab is gone). Fiat loses a good percent of share to 7.8. And so on. The field hasn’t changed dramatically. If you look at all the Octobers for the last years, matters appear less dramatic than they may sound.

What has changed is not on the list: The makers with heavy exports to China, notably the Germans, are doing much better than the numbers make you believe.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo They won't be sold just in Beverly Hills - there's a Nieman-Marcus in nearly every big city. When they're finally junked, the transfer case will be first to be salvaged, since it'll be unused.

- Ltcmgm78 Just what we need to do: add more EVs that require a charging station! We own a Volt. We charge at home. We bought the Volt off-lease. We're retired and can do all our daily errands without burning any gasoline. For us this works, but we no longer have a work commute.

- Michael S6 Given the choice between the Hornet R/T and the Alfa, I'd pick an Uber.

- Michael S6 Nissan seems to be doing well at the low end of the market with their small cars and cuv. Competitiveness evaporates as you move up to larger size cars and suvs.

- Cprescott As long as they infest their products with CVT's, there is no reason to buy their products. Nissan's execution of CVT's is lackluster on a good day - not dependable and bad in experience of use. The brand has become like Mitsubishi - will sell to anyone with a pulse to get financed.

Comments

Join the conversation