Europe In June 2010: Back To The New Normal

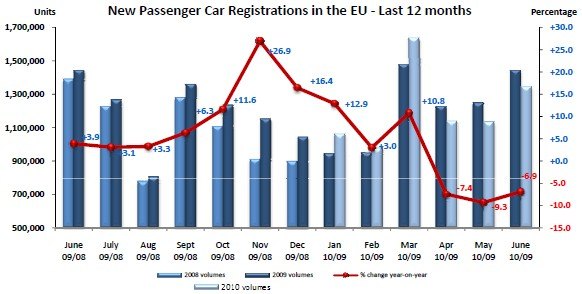

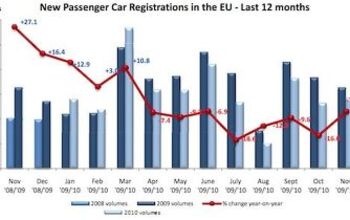

The ACEA has released their European new car statistics for the month of June. One look at the picture tells you what is happening: With the cash for clunkers effects slowly working their way out of the system, Europe is settling into a new normal. In June, the market was down 6.9 percent, but for the first six months, with 7,285,487 new cars registered, the market in the EU27 is pretty much what it was in the same period last year. Compared with the first six months of 2008, the market decreased by 10.3 percent, but those were the good old pre-carmageddon days.

Looking at car makers, no much change either. The Volkswagen group rules the roost with 20.9 percent market share for the first half year, with PSA (13.9 percent) and Renault (10.6 percent) getting friskier by the month. PSA (+0.9 percent) and Renault (+1.8 percent) were the big market share gainers for the first six month. The biggest losers were Fiat Group (-0.9 percent), GM Group (-0.6 percent), and Toyota Group (-0.6 percent).

Comparatively, the cash-for-clunkers effects will be haunting the European market for quite some time. Don’t let the distorted growth numbers distract you. Keep your eyes on total sales and market shares. 7.3m cars sold in the first six month isn’t glorious, but it isn’t the end of the world either. Combined with record export numbers, the European industry is doing just fine. It recovered earlier than many expected.

For detailed study, the June 2010 report can be downloaded as PDF or as Excel spreadsheet with the all-important manufacturer data.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Comments

Join the conversation

I wonder why Ford did so badly this month, though they've done less badly for the year. Hopefully the new Focus and C-Max will help things.

Ford benefited from the strong UK market earlier in the year. Now things are back to "normal" in the UK so Ford's overall market share is also down.