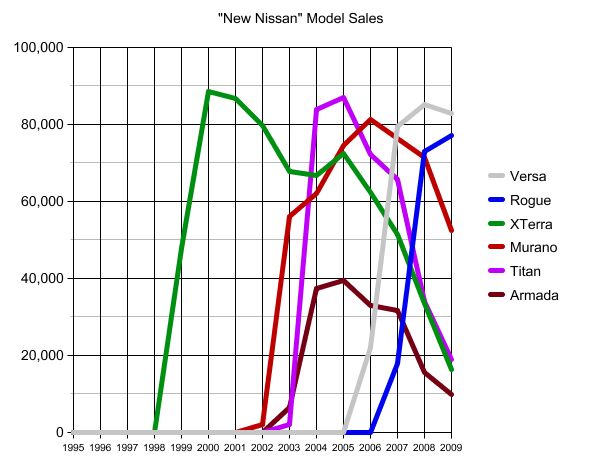

Chart Of The Day: A Changing Nissan? Part Two

As a Nissan rep pointed out via email last night, yesterday’s Chart Of The Day hardly tells the whole story of “the other Japanese brand.” Since 1995, Nissan has made up for declining “core model” sales by catching the tail end of the SUV/Truck craze with its Titan/Armada/XTerra/Murano combo. And, as this graph shows, those four models gave the brand a big spike for most of the last decade before diving unceremoniously towards oblivion (with the exception of Murano). Since then, Nissan seems to be targeting the niche left open by Honda: small, value-laden, efficient cars like the Rogue and Versa are Nissan’s new meal ticket (in addition to the still-soaring Altima). With a new Versa-based Juke mini-CUV launching this Summer, Nissan is poised to continue building on that image, but it still has to contend with remnants of its “Japanese Pontiac” and “Mainstream BOF-slinger” identities. Can Nissan be all of these things at the same time? Or will the Leaf EV halo push Nissan towards ever smaller, more efficient offerings and a neo-Honda emphasis on compact value? We’re hearing that changes are underway at the highest levels of Nissan’s leadership… coming up with a coherent brand vision and product plan for Nissan North America will have to be one of the new team’s top priorities.

More by Edward Niedermeyer

Comments

Join the conversation

I think one of the big things that everyone is missing (due to the scaling of the two charts) is that Nissan only has 1 vehicle that can sell over 100K units in a year vs 11 (or 13 if you include the Z and the Cube) that sell less than 100K units. Where as, back in 1995, they had 4 cars that could sell over the threshold. They need to do something with these vehicles to push their sales (not at the expense of profits) so that they are not relying on the Altima to provide all of their volume.

I feel smug for saying pretty much exactly this: Nissan is tracking where the market is going, and the market is going away from what they used to make and to what they make now. There is nothing wrong with this. There is everything wrong with sticking to your stalwarts when it's not selling, nor increasing in volume. If anything, Nissan isn't trimming the deadwood fast enough. Nissan has, at this time, the top-rated family sedan per Consumer Reports, besting the Accord, Passat and Camry. That's huge, and the Altima's sales show it. Nissan needs to grow from that (and already have with the Versa and Roigue), specifically by offering a competitive compact car (the Sentra is middling) and a three-row people mover, preferably a refreshed Quest and a crossover to be named later. What's also interesting is they're showing some chutzpah in terms of product development. The Cube, Juke and Leaf will get them noticed without costing much, as the Murano did previously. And this has all happened relatively quietly and without the gong-banging that GM and VW resort to.

Nissan's weak position product-wise is reflected in its poor profitability. Further, Nissan's 2nd-tier status is reflected in its huge incentives - and that's retail. Nissan does fleet huge in comparison to a top-tier company like Honda. http://www.thetruthaboutcars.com/gm-tops-june-incentive-spending/ Nissan spends roughly 2/3 more than Honda per car on incentives. Nissan is currently a blue-light special company.

Me thinks the Titan needs help. Forget the niche or wanna-be city tough-guy. The vehicle must focus on becoming a serious consideration for the real truck buying consumer (commercial, farm, construction, etc). When these guys start driving them the wanna-bees will follow. The front grill and front profile are too different from the competition. Especially the grill which I'd change first and save the sheetmetal costs of changes to the fenders and hood. Peddle the truck in car-marts where it can mingle with the competition as opposed to franchises which scream "I'm different". Volume to the important truck buyers is paramount. Then can come volume and profits from the wanna-bees.