Detroit Tops May Incentives, Residuals Rise Regardless

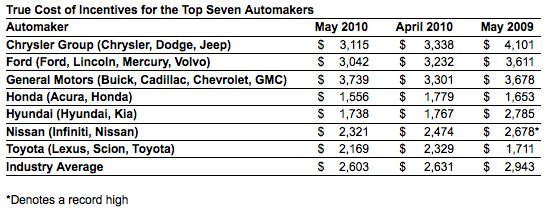

Once again Detroit finds itself atop Edmunds’ True Cost of Incentive ranking of the top seven automakers [via earthtimes], as the domestic OEMs spent about $1.7b (or, about 60 percent) of the $2.8b paid out by the entire industry on incentives last month. Trucks were the most heavily discounted segment, with average incentives running around $4,650, or nearly 13 percent of the average segment sticker price. Saab spent the most by brand, slapping an average of $6,813 on its vehicles, with Lincoln coming in second at $4,987 per vehicle sold. Saab’s incentives equaled 17.1 percent of its average vehicle price, while Chrysler gave away about 12.2 percent of its average vehicle price last month.

Despite giving away more of their vehicles’ value than the foreign competition, Detroit has some surprisingly good news on the resale value front. Well, Ford and GM, anyway, and really, the resale news couldn’t have been much worse. According to Automotive News [sub]:

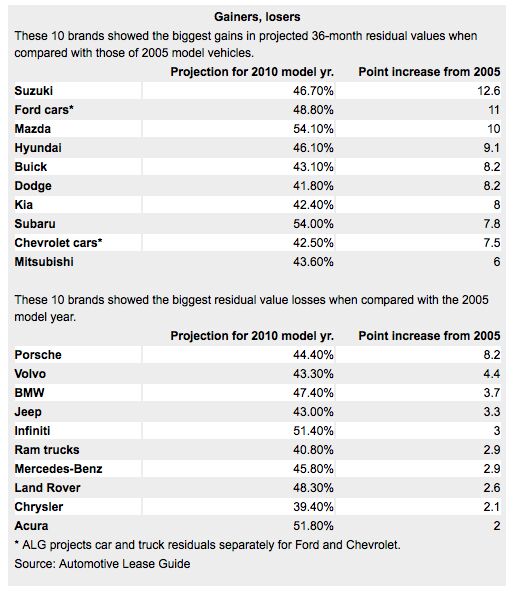

Automotive Lease Guide projects that 2010 vehicles from continuing GM brands and 2010 Ford brand cars will retain more than 40 percent of their sticker prices after 36 months. Five years ago, the residual forecasts for those brands’ cars except Cadillac were under 40 percent.

So, considering that Toyota and Honda enjoy about 51 and 54 percent of their original value after 36 months respectively, that’s not exactly break-out-the-champagne news… but it could have been worse. It could have been Chrysler:

Chrysler brand 2010 vehicles, in aggregate, have the industry’s lowest projected residual among continuing brands at 39.4 percent after 36 months, 2.1 percentage points lower than its 2005 projection. But the aggregate residual value for Chrysler Group’s Dodge brand is up a dramatic 8.2 percentage points to 41.8 percent. This does not include Ram brand trucks.

Ay Caramba! Needless to say, both Ford and GM’s resale value improvement (and Chrysler’s lack thereof) is largely attributed to new product. According to ALG’s chief economist:

All new models always have a price bump. The average is a 7 or 8 percentage-point bump for an all-new model compared with the old one

Lower inventories aren’t hurting either, and Edmunds is projecting that late-summer incentives won’t reach their typically fire-sale-like levels because automakers simply don’t have the inventories to shift. But as Detroit makes a slow comeback on resale, other firms are charging ahead. And until incentive discipline on the ground matches the tough talk of sales and marketing execs, these minor gains based on product cadence won’t be enough to keep up with the competition. After all, the three-year resale on a Chevy car is only .10 percent better than a Kia. The work is not over.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ltcmgm78 Just what we need to do: add more EVs that require a charging station! We own a Volt. We charge at home. We bought the Volt off-lease. We're retired and can do all our daily errands without burning any gasoline. For us this works, but we no longer have a work commute.

- Michael S6 Given the choice between the Hornet R/T and the Alfa, I'd pick an Uber.

- Michael S6 Nissan seems to be doing well at the low end of the market with their small cars and cuv. Competitiveness evaporates as you move up to larger size cars and suvs.

- Cprescott As long as they infest their products with CVT's, there is no reason to buy their products. Nissan's execution of CVT's is lackluster on a good day - not dependable and bad in experience of use. The brand has become like Mitsubishi - will sell to anyone with a pulse to get financed.

- Lorenzo I'd like to believe, I want to believe, having had good FoMoCo vehicles - my aunt's old 1956 Fairlane, 1963 Falcon, 1968 Montego - but if Jim Farley is saying it, I can't believe it. It's been said that he goes with whatever the last person he talked to suggested. That's not the kind of guy you want running a $180 billion dollar company.

Comments

Join the conversation

The trends in the incentives (2010 vs. 2009)are interesting: -Hyundai has slashed theirs, but Chrysler's are down considerably too. -Toyota's have increased significantly, while GM's is virtually flat. Plus, I wonder why Mazda has the highest projected residual value?

Interesting that Chrysler had such a good month with incentives only $500 (or about 20%) over industry average in incentives. This is not much over Ford's position. GM is about $1100 (or over 40%) above the industry's incentive average. As stale as Chrysler's current lineup is, and as fresh as GM's is, I would be a bit concerned if I were Ed Whitacre.