The Rise And Fall Of The Suburban

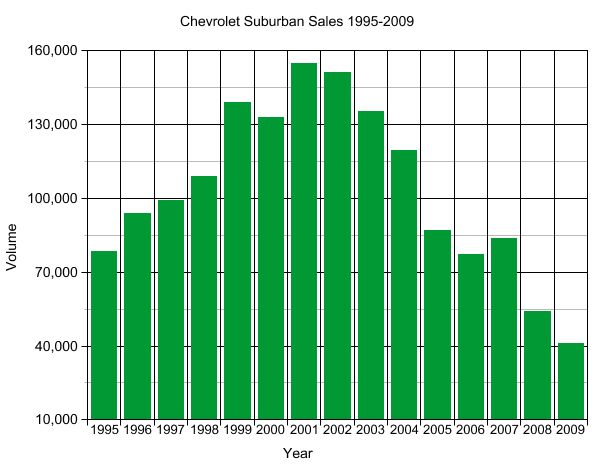

Considering the Suburban so essentially captures the tenuous line between myth and reality in American life, it’s a pity we don’t have 75 years of sales data to put some hard numbers behind the nameplate’s 75 years of history. Luckily, our data does go back to 1995, when America’s whirlwind romance with the SUV was just beginning to get serious. Given that, as Paul points out in today’s history, Suburbans didn’t become popular as family haulers until sometime in the early eighties, it’s safe to assume that 1996-2004 represents the absolute high-water mark for the nameplate’s volume. And ye gods has that volume dropped off ever since.

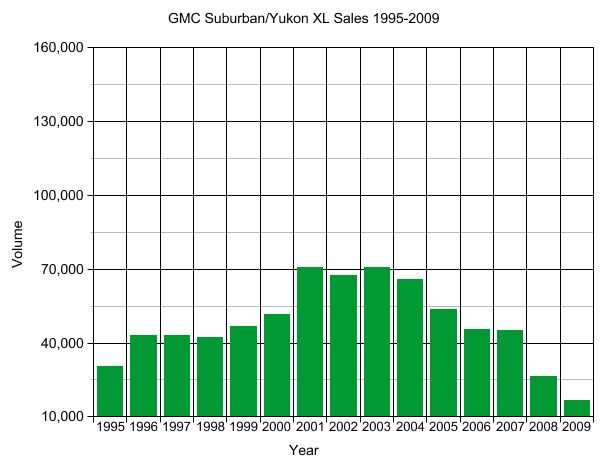

Of course, those number don’t represent the whole picture. The GMC brand added volume to the Suburban nameplate until GMC renamed its version “Yukon XL” for the 2000 model-year GMT800 machines.

Looking at the data, it appears that the name change didn’t help the GMC version initially. Apparently GM’s logic that

Yukon is a name that clearly means “GMC,” and GMC means “trucks that deliver”

didn’t quite pan out. Launching late in 1999, the un-Suburban didn’t see dramatic sales improvements until SUV mania hit a fever pitch in 2001. Like its Chevy-branded twin though, the bloom was off the Yukon XL by 2005 albeit in slightly less dramatic fashion. This 2004-2006 decline in Suburban/Yukon XL sales roughly coincides with GM’s first major assault on the crossover segment (the Aztek having died out by 2005). Equinox was introduced in 2004, and by 2005 was pulling in over 130k units. Saturn’s Vue was introduced even earlier, and recorded its best-ever volume in 2005 with 0ver 90k units. On the other end of the spectrum, the HUMMER brand was introduced in 2000 and hit its best-ever sales numbers in 2006 (71,524 units), before dropping like a stone ever since.

Nor can we blame the 2004-2006 declines in GM’s full-size SUVs on cannibalism alone, although direct competition wasn’t as big a factor as one might expect. GM’s main competition in the über-SUV segment, the Ford Excursion, peaked at just under 50k units in 2000 (though smaller, the Expedition also peaked in 2000 at 233,125 and has plummeted ever since). Intriguingly though, Ford’s Freestyle saw its best numbers ever in 2005 (76,739), providing more evidence for the theory that crossovers played a major role in this period of Suburban sales declines. That the granddaddy of crossovers, the Lexus RX, crested the 100k unit annual volume mark in 2004 seems to confirm this suspicion. If we take this theory one step further, and accept that the SUV boom was caused by buyers who might otherwise have bought a sedan, it’s possible that record volume for the just-introduced Ford 500 (just under 108k units), Chrysler 300 (144k units) and Buick LaCrosse (92,669 units) played a role in the 2005 Suburban flight as well.

Whatever caused the Suburban bubble to burst shortly after soaring to record highs, a gas price spike in 2005 clearly delineates the beginning of the end.

Already played out as a cultural icon, and under attack from a new breed of crossover competitors, 2008’s gas price shock emphatically ended the Suburban and Yukon XL’s brief tenure as a mainstream transportation option. With gas prices higher than pre-2005 levels and trending upwards, the Suburban would be a lot less popular even if CAFE increases weren’t looming. If GM is going to keep the “longest running continually-built vehicle in America” around much longer, one has to assume that a “if you can’t beat them, join them” strategy is in order. GM has said that the Suburban likely won’t change until 2013. From there, the question is simple: does the Suburban stay body-on-frame and return to its historic commercial-duty volumes, or does Chevy adapt the once-dominant nameplate to the unibody times in order to preserve it as a mainstream model?

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

- Formula m Same as Ford, withholding billions in development because they want to rearrange the furniture.

- EV-Guy I would care more about the Detroit downtown core. Who else would possibly be able to occupy this space? GM bought this complex - correct? If they can't fill it, how do they find tenants that can? Is the plan to just tear it down and sell to developers?

- EBFlex Demand is so high for EVs they are having to lay people off. Layoffs are the ultimate sign of an rapidly expanding market.

- Thomas I thought about buying an EV, but the more I learned about them, the less I wanted one. Maybe I'll reconsider in 5 or 10 years if technology improves. I don't think EVs are good enough yet for my use case. Pricing and infrastructure needs to improve too.

Comments

Join the conversation

What continues to amaze me is that GM had this market completely to itself from the time that the International Travelall got axed around 1976 or so until the Expedition EL in 2007. Dodge was rumored to have a Suburban-fighter after its 94 pickup came out, but killed the project. That decision had to have cost Chrysler a LOT of money. Ford never scored a direct hit before the 07 EL. The Excursion was bigger (and more expensive, IIRC) while the Expedition was smaller, particularly in the cargo area aft of the rear seats. Neither hit that happy medium for hauling, towing, family comfort, performance and looks. I think that the fall of the Suburban is about two things - first, gas prices. If gas were still $1.25/gal, I would probably own one of these right now. (Either that or another Club Wagon). The other factor is demographics. There was quite a baby boomlet in the early-mid 90s. Most of the owners of these vehicles that I knew had 3-4-5 kids, dogs, carpools, baseball teams, and all of that. My kids are in this demographic, and with the kids being older and doing less family stuff, lots of folks are either keeping their old Burbs on the road or downsizing, but they are not investing in a $50k gas hog that they will not need in another year or three.

Deception thru bad graphing, please contact your Jr. High Math teacher and do better. Thankyou