Nissan Leaf: The Governments Giveth And The Governments Taketh Away

Nissan made quite a stir in EV-watcher circles by announcing that its UK-produced Leaf battery packs would cost under $400/kWh, but as we noted at the time, those numbers are being supported by various government incentives. Now, with a new government taking over number 10 Downing Street, Nissan’s UK Leaf production incentive might be on its way out. With the UK’s new Conservative-led government facing profound budget challenges (try a $240b deficit on for size), The Telegraph reports that a $30.5m grant approved by the outgoing government could fall victim to an overarching review of new expenditures by the incoming government. And that’s just the beginning…

Nissan responded to the possibility of losing these grant funds by stating its “confidence” that its Leaf manufacturing program would benefit the new government’s economic and environmental goals. Spokesfolks tell Reuters:

It is our understanding that an agreement has been made with the Department of Business, Innovation and Skills (BIS) and that the new coalition government is fully supportive of progressing a greener economy and zero emission transport will be at the heart of that. We would be disappointed if these agreements were withdrawn. The Government is fully supportive of progressing a greener economy and what Nissan is doing is at the heart of that.

Perhaps at even greater risk is a nearly $400m loan guarantee program pledged by the last government to GM’s efforts to restructure Vauxhall operations. More on that as it develops.

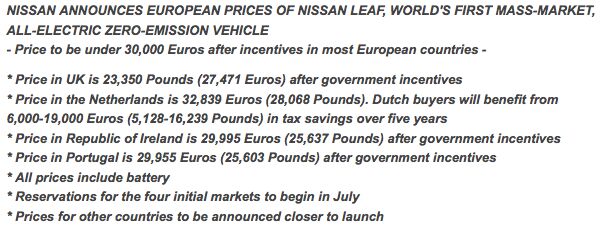

Meanwhile, despite apparently undercutting GM’s Volt EV in price and beating it to market, Nissan is worried that expiring EV tax credits could leave its ambitious Leaf gambit high and dry. As in the US, Nissan announced European prices for the Leaf by highlighting what the car would cost after government incentives, in hopes of improving mass-market consideration of the EV hatch.

In fact, Nissan is initially only launching the Leaf in countries that agreed to introduce credits of about $5,000 to incentivize its purchase. But, as Nissan’s Senior VP Simon Thomas tells Bloomberg BusinessWeek, those incentives won’t be around forever.

My assumption is that they won’t be cut off but they might be pared back. There’s no obligation for governments to extend those programs beyond the definitive agreement — and in some countries we don’t have a definitive agreement

Thomas points to Europe’s post-Cash-for-Clunker sales decline as an example of the kind of bubble scenario that haunts his firm. And with European governments facing huge bailout bills to keep their weaker neighbors from dragging the Euro Zone into a debt crisis, it’s safe to assume that those incentives will face fiscal pressure sooner rather than later.

The real question for Nissan is when those incentives will expire. In the short term, it will be literally dependent on them to get its European Leaf effort off the ground, as it will be shipping batteries from Japan until 2012 when production in the UK and Portugal comes online. At that point, shipping and tariff costs will be greatly reduced. Says Pierre Loing, Nissan vice president for product planning:

Between these savings, technology improvements and economies of scale as production ramps up, we should be able to avoid losing money even as incentives are phased out,

The nightmare scenario, however, is that sales drop off after incentives expire leaving Nissan with full-strength volume and insufficient demand. With Germany’s government squarely in the electro-skeptic camp, at least one of Europe’s major markets is going to be a tough nut for Nissan to crack anyway… and no wonder, considering Europe’s dirty electricity sources make EVs a less than ideal option for C02 reductions.

Meanwhile, even assuming production supports and consumer incentives remain strong Nissan has a lot of cost-control work to do. Previously, Nissan had said it would make money in the US-market based on pre-orders at incentivized rate, a statement that’s now being walked back. According to Nissan’s US sales and marketing chief Brian Carolin, that trend will take three years to bring the Lead program to break-even. He admits:

All we can say is that the program will be profitable over its life cycle

And making that happen will require even further price cuts to the already-impressive battery price structure. Bloomberg BusinessWeek reports that Nissan’s battery price target is “a lot tougher” than even the $370/kWh number it had been touting, depending on unknown factors like the scale of production and resale value for recycling. And make no mistake: production scale still is very much an unknown. Nissan reckons EVs will make up ten percent of the market by 2020, but other estimates say that number should be closer to one percent.

If Nissan has overestimated the market for its Leaf, if fiscal pressure on European governments end incentives early, if costs can’t be further reduced, and if performance problems emerge after launch, Nissan’s big gamble will collapse in a flash of hubris and underutilized production capacity. If those problems don’t materialize, Nissan could have a Toyota Prius-like advantage as the pioneer of a new era of electric vehicles. The stakes couldn’t be any higher.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- FreedMike Apparently this car, which doesn't comply to U.S. regs, is in Nogales, Mexico. What could possibly go wrong with this transaction?

- El scotto Under NAFTA II or the USMCA basically the US and Canada do all the designing, planning, and high tech work and high skilled work. Mexico does all the medium-skilled work.Your favorite vehicle that has an Assembled in Mexico label may actually cross the border several times. High tech stuff is installed in the US, medium tech stuff gets done in Mexico, then the vehicle goes back across the border for more high tech stuff the back to Mexico for some nuts n bolts stuff.All of the vehicle manufacturers pass parts and vehicles between factories and countries. It's thought out, it's planned, it's coordinated and they all do it.Northern Mexico consists of a few big towns controlled by a few families. Those families already have deals with Texan and American companies that can truck their products back and forth over the border. The Chinese are the last to show up at the party. They're getting the worst land, the worst factories, and the worst employees. All the good stuff and people have been taken care of in the above paragraph.Lastly, the Chinese will have to make their parts in Mexico or the US or Canada. If not, they have to pay tariffs. High tariffs. It's all for one and one for all under the USMCA.Now evil El Scotto is thinking of the fusion of Chinese and Mexican cuisine and some darn good beer.

- FreedMike I care SO deeply!

- ClayT Listing is still up.Price has been updated too.1983 VW Rabbit pickup for sale Updated ad For Sale Message Seller [url=https://www.vwvortex.com/members/633147/] [/url] jellowsubmarine 0.00 star(s) (0.0) 0 reviews [h2]$19,000 USD Check price[/h2][list][*] [url=https://www.ebay.com/sch/i.html?_nkw=1983 VW Rabbit pickup for sale Updated ad] eBay [/url][/*][/list] Ceres, California Apr 4, 2024 (Edited Apr 7, 2024)

- KOKing Unless you're an employee (or even if you are) does anyone care where physically any company is headquartered? Until I saw this story pop up, I'd forgotten that GM used to be in the 'Cadillac Building' until whenever it was they moved into RenCen (and that RenCen wasn't even built for GM). It's not like GM moved to Bermuda or something for a tax shelter (and I dunno maybe they ARE incorporated there legally?)

Comments

Join the conversation

It seems that Nissan is using all government rebate-included dollar/pound figures to quote prices for their Leaf and related components just to hype his product and how cheap and affordable it is. HEY EVERYBODY, I got a big bottle of Old Spice body wash for ONLY FIFTY CENTS last week... (After in-store sale price and a coupon I had).

The problem with everything green right now is that it all relies on government subsidies and/or mandates. Those things can change on a dime. The auto companies should be very cautious about sinking tons of money into this type of technology that is not really being driven my consumer demand. At least not demand based on market prices.