Detroit's Small-Town Luxury Lament

It’s a little-known fact that nearly half of the 2,000 or so dealer franchises that GM began winding down during bankruptcy were Cadillac stores, most of them located in rural areas. The General’s plan was to focus Cadillac’s dealer network on standalone stores in major metropolitan areas, following the strategies of more premium luxury competitors like BMW and Lexus. But having marked 922 largely small-town Caddy dealers for death, GM saw 2009 sales of its luxury brand fall 15 percent, or twice the rate of Buick and Chevrolet in the same period. The lesson: small-town Cadillac dealers (like attempts to sell the brand in Europe) are worthwhile after all. Automotive News [sub] reports, the majority of those dealers being reinstated are small-town Cadillac dealers. Will Cadillac’s brand integrity suffer by having to serve the small-town American market as well as competing with the European brands? Probably, but at least Caddy dealers can take heart knowing that things could still be worse: they could be Lincoln-Mercury dealers.

While GM flip-flops on whether it wants small-town dealers representing its “world-class luxury” brand, Lincoln-Mercury’s dealers are sticking with their long-standing strategy: survival by any means. Undistracted by esoteric debates over the importance of dealer network image to the overall brand, Ford’s L-M dealers are desperate for anything to keep their cashflows steady. Literally, anything. One dealer tells Automotive News [sub]:

The only other answer is to find another franchise, any other type of franchise — Suzuki, Honda — you name it. We’re a dwindling group of dealers.

You know you’re in trouble when selling Suzukis starts to sound good. Ford is technically working to consolidate its L-M network in metro areas, although without the bankruptcy dealer-culls enjoyed (but since reversed) by GM, the work has been more methodical. In further contrast to GM’s post-bankruptcy strategy, Ford is focusing on eliminating standalone Lincoln-Mercury dealers, and was down to 292 at the end of 2009, down from 357 at the end of 2008. Also, consolidation is focusing on metropolitan areas, as Ford would likely prefer to allow its rural dealers to die of natural causes and sell as many cars as possible first.

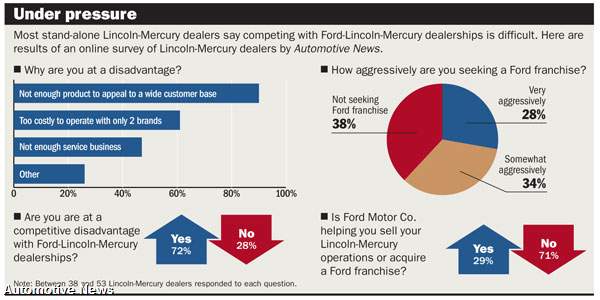

And dying they are. An Automotive News [sub] survey shows that nearly all Lincoln-Mercury dealers believe that their two brands don’t have enough products to attract the kind of customers they need to survive, and most believe themselves to be at a disadvantage compared to Ford’s three-brand stores. High costs and insufficient service business are similarly hurting Lincoln-Mercury dealers, and most report no assistance from Ford in breaking out of the L-M ghetto.

Though the cases of Cadillac and Lincoln-Mercury are different, they both speak to Detroit’s inability to pull off modern luxury brands. And in both cases, dealer woes reflect larger issues surrounding each brand. In the case of Cadillac, the story is of identity crisis. Is Cadillac a European-grade maker of world-class, dynamically-focused and fashion-forward driving machines, or the small-town America symbol symbol of petty-bourgeois success, with an emphasis on the old-school American values of wide seats, big power, and a cosseting ride? The brand’s product line displays this identity crisis (compare CTS and DTS) as much as the dealer network does.

That volume is dictating a pendulum swing back to the small-town strategy (or at least an embrace of this split-identity) shows that GM is no closer to figuring out what it wants out of Cadillac than it did pre-bankruptcy. In fairness, the next two products coming down Cadillac’s development pipe show that Cadillac’s schizophrenia is here to stay: a “true 3-series killer” known as the ATS isn’t going to set rural markets on fire, but an Epsilon II-based XTS “flagship” isn’t going to do much for Caddy’s Euro-appeal either.

In the case of Lincoln-Mercury, the problem is of not-so-benign neglect rather than disjointed leadership and vision. Ford’s luxury brands are, in many ways, sticking with the old-school Detroit formula for luxury even as the Ford brand emerges as a paragon of global brand-management. Ford has eschewed heavy investments in Lincoln-Mercury product lines of late, and as its “luxury” options have stagnated into the most obvious bunch of rebadges to come out of Detroit, it’s allowed its dealers to suffer along with them. Ford insists that there are no plans to consolidate rural dealers, but that it also wants to cut the number of standalone dealers.

With only one Mercury product rumored ( a variant of the forthcoming Focus), Lincoln-Mercury dealers won’t have much choice but to consolidate into three-brand dealerships, as no dealer will survive much longer on the thin gruel of L-M’s current product portfolio. Once that transition is complete, expect Mercury to die, and Lincoln to begin slowly rebuilding some luxury credentials. If this is in fact Ford’s gameplan, it will be a long, slow strategy to implement, but at least it heads in a sustainable direction. With Cadillac bouncing back and forth between missions, visions and dealership strategies, Lincoln-Mercury’s product neglect and dealer starvation almost seems like the rational approach.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

- Formula m Same as Ford, withholding billions in development because they want to rearrange the furniture.

- EV-Guy I would care more about the Detroit downtown core. Who else would possibly be able to occupy this space? GM bought this complex - correct? If they can't fill it, how do they find tenants that can? Is the plan to just tear it down and sell to developers?

- EBFlex Demand is so high for EVs they are having to lay people off. Layoffs are the ultimate sign of an rapidly expanding market.

Comments

Join the conversation

If my guess is correct, educatordan lives in Gallup. So the drive to those Honda, Hyundai, Subaru, etc., dealers is 121 or 138 miles. Even though the traffic would be light (especially on Rte. 666 -- hey, that's Tony Hillerman country!) either way, it'd be about four hours round trip. So yes, SOME people will go that far to get the brand they want. Most won't. Gallup has stores for Chevy, Buick, GMC, Ford, Mercury, Lincoln, Chrysler, Dodge, Jeep and Toyota. I certainly could find among that group something I like. A four hour round trip for warranty work or recall fix? Not for me. And John Horner: you said it perfectly. I bet Buickman agrees, too.

What Cadillac/GM underestimated was the influence of the local dealer. In many small towns across America, the affluent residents bought from their friend the Cadillac dealer often because it made their social life easier. Close the dealership and make him drive fifty miles to purchase and obtain service from strangers, everybody with a luxury brand enters the picture. As we all know, Cadillac is really short today on actual world class luxury product.