GM "Core Brand" Sales Up 30 Percent, Reported Retail Sales Up Only 3 Percent

Corporate fleet sales were back with a vengeance last month, as GM admitted that these lower-profit fleet sales made up a full 29 percent of its total sales in January. Those total sales, including the winding-down Pontiac, Saturn, Saab and HUMMER brands were up only 13.6 percent. Core brand sales were up 30 percent in total, but again, most of those gains were in fleet sales, as core brand retail sales gained only 3 percent over GM’s moribund performance in January 2009. Zoinks! Full release in PDF format here, details after the jump.

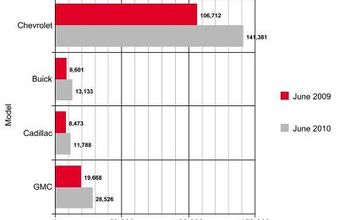

Chevrolet saw total sales rise 36.4 percent (105,294 units), with its car sales up 102 percent, truck sales falling 11.9 percent and CUVS up 68 percent. Cobalt was a strong seller, up 149.7 percent to 12,962 units, likely driven by fleet sales. Malibu (+76.5%, 16,439 units) and Impala (+55%, 10,939 units) were the other major drivers of Chevy car volume. Avalanche and Silverado dropped single-digit percentages, while Suburban (+8%, 2,315 units) and Tahoe (+18.4%, 4,556 units) rescued Chevy trucks from disaster. Equinox (+76%, 9,513) and HHR (+220%, 5,452) enjoyed robust growth, while Traverse increased slightly to 5,724 units.

Buick was up 44 percent altogether, with cars up 40 percent and CUVs up 50 percent. Predictably, the new LaCrosse (+185%, 4,246 units) and the Enclave (+50%, 4,075) were up, and Lucerne (-37, 1,740) was way down.

Cadillac actually dropped .7 percent, as it continues to be one of GM’s most problematic brands sales-wise. Every Caddy car nameplate was down by double digits, from CTS (-25%, 2,565) to DTS (-54%, 618). Collectively the Escalade triplets were off 25.7 percent with total volume of 1,754 units, but SRX made up for the drop, rising 264 percent to 3,234 units.

Overall GMC sales volume was up 11 percent, with core truck sales falling 27 percent and CUVs making up for them with 201 percent growth. Canyon fell below 1,00 units, Sierra slid 9.3 percent to 7,271 units, while Yukon and Yukon XL fell by about a third, ending up with 1,503 and 1,222 units respectively. Acadia was up 68 percent to 5,460, while Terrain logged 4,302 units.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Oberkanone Tesla license their skateboard platforms to other manufacturers. Great. Better yet, Tesla manufacture and sell the platforms and auto manufacturers manufacture the body and interiors. Fantastic.

- ToolGuy As of right now, Tesla is convinced that their old approach to FSD doesn't work, and that their new approach to FSD will work. I ain't saying I agree or disagree, just telling you where they are.

- Jalop1991 Is this the beginning of the culmination of a very long game by Tesla?Build stuff, prove that it works. Sell the razors, sure, but pay close attention to the blades (charging network) that make the razors useful. Design features no one else is bothering with, and market the hell out of them.In other words, create demand for what you have.Then back out of manufacturing completely, because that's hard and expensive. License your stuff to legacy carmakers that (a) are able to build cars well, and (b) are too lazy to create the things and customer demand you did.Sit back and cash the checks.

- FreedMike People give this company a lot of crap, but the slow rollout might actually be a smart move in the long run - they can iron out the kinks in the product while it's still not a widely known brand. Complaints on a low volume product are bad, but the same complaints hit differently if there are hundreds of thousands of them on the road. And good on them for building a plant here - that's how it should be done, and not just for the tax incentives. It'll be interesting to see how these guys do.

- Buickman more likely Dunfast.

Comments

Join the conversation

Please explain to me how "3% RISE IN RETAIL SALES" can be credited to fleets. I understand I am an evil GM fanboy/apologist (LOL) but I cannot understand how this can be a negative somehow. Sure it's against a horrible jan 2009 but then again aren't every automakers stats versus a horrible 2009? Deal with it GM haters! GM took 1 small step in the right direction this month. Get over yourselves, we (GM employees/supporters) understand there is a LONG, LONG road ahead. Also, just to clarify something GM isn't exactly at the brink any longer now that they have been restructured/propped up (whatever you wanna call it) with YOUR generous donations. Remember this is the exuse the Ford haters use to explain why Ford is doomed. YOU GOTTA KEEP YOUR DOOMSDAY STORYLINES STRAIGHT!

"And, let’s face it, 535xi is a far more sophisticated car – drivetrain speaking." Yes, the BMW breaks a lot more!