Editorial: The Truth About Rare Earths and Hybrids

There’s no doubt about it: the automotive landscape is changing. Carmakers around the globe are embracing electric propulsion, whether the volts are generated by a gasoline motor, a fuel cell, a distant power plant or a combination thereof. New companies seem to be springing up overnight to take advantage of the government’s desire (and money) to wean motorists from their petrochemical “addiction.” While everyone rushes to produce politically-correct powerplants, one fundamental question that remains largely unexamined: from where will manufacturers secure the raw materials needed to mass produce this new technology?

Back in the good old bad old days, cars were literally lumps of iron. The bodies were made from steel. The engines from cast iron. Even as new features were added, the primary raw materials remained ore-based. New-fangled electrical accessories like starters, power windows, power seats and stereos brought copper into that mix. As metallurgical science progressed, aluminum and its alloys entered the mass market mix. No problem there: aluminum is the most abundant metallic element on earth. It’s lightweight and eminently recyclable (today’s beer can is tomorrow’s bumper). Dropping market prices continue to move the metal from exotic cars to daily drivers.

Along with various materials derived from petrochemicals, modern cars are made from iron, steel, aluminum and copper. Manufacturers use other metals (e.g., magnesium) in structural and other applications, but The Big Four reign supreme.

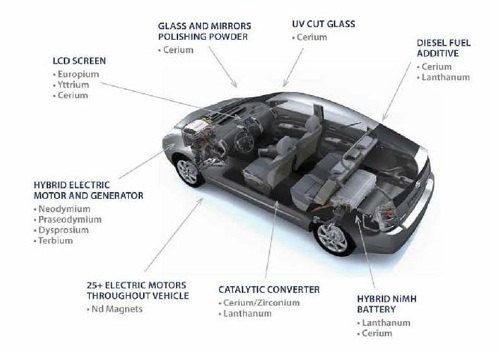

In the 1960s, a research effort between the Air Force and General Motors made a discovery: if you combine the rare earth element neodymium with boron and iron you can make incredibly strong magnets. These magnets are mission critical for the compact-yet-powerful motors used in today’s gas-electric hybrid vehicles. “Doping” the magnets with a bit of dysprosium (another rare earth metal) makes them even more effective, helping them withstand the automotive application’s high operating temperatures.

Industry expert Jack Lifton estimates that manufacturing the battery pack of a second generation Prius required 60 pounds of assorted rare earth metals. And there’s more. Carmakers use rare earths for catalytic converters, computer chips, UV-filtering glass, LCD screens and solar panels. In fact, many of the new technologies that inform advanced vehicles owe their existence—one way or another— to rare earths.

Thankfully, rare earths aren’t that rare. China has huge deposits of rare earth ores and (until very recently) little regard for the environmental impact of mining and refining them. In 2007, China exported 49k tons of rare earth products, down 14.93 percent. BUT the export value surged 51 percent to $1.179 billion. In 1992, Deng Xiaoping stated “There is oil in the Middle East. There are rare earths in China. We must take full advantage of this resource.” And so they have.

The U.S. used to be the world’s biggest producer of rare earths. That ended in the ’90s when the Mountain Pass mining operation in California shut down due to “market pressure” (i.e., cheap Chinese product). Environmental regulations also helped seal the mine’s fate; rare earth mining can produce some pretty nasty byproducts like thorium.

And so the Chinese rare earth industry has grown unchallenged to the point where it essentially owns the market. Molycorp recently reopened the Mountain Pass operation. There are efforts underway to develop mines in Canada, Australia (where Chinese companies just bought big portions of two Aussie mining companies), Vietnam and India. As of now, none of these future mines offers significant competition to China’s efforts to dominate the rare earth market.

Adding to the problem: while there are mines producing rare earth ores and oxides elsewhere, China’s the only one country on earth where the ores are refined into the rare earth metals. For the time being, no matter where the rare earth materials are mined, the production pipeline flows through—and is controlled by—China.

So far, China hasn’t tried playing silly buggers with rare earth prices, as OPEC has been known to do with oil. However, any company that manufactures anything using rare earths is at the mercy of the Chinese government’s production and pricing.

China has raised the export tax on some rare earth metals as high as 25 percent. Foreign companies aren’t allowed to invest in exploration and mining. There are limits on foreign involvement in ore processing. Industries that use rare earth metals are “encouraged” to produce their end product there.

Because China hasn’t curtailed supplies (i.e., raised prices significantly), there’s no interest in recycling rare earths from discarded autos. When that wrecked hybrid is sent to the crusher, the copper, iron and aluminum in it will be recovered. The rare earth metals will not.

As the government pushes the automakers to improve mileage and cut emissions, they’re practically demanding carmakers produce electric or hybrid-electric vehicles. Even though the government and industry know how important these rare earths are critical to their environmental goals, they’ve failed to consider the potential impact of a “rare earth” gap, trusting that the free market will provide the required raw materials at a cost-effective price.

For now, yes. In the future, who knows?

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ChristianWimmer This would be pretty cool - if it kept the cool front end of the standard/AMG G-Class models. The front ends of current Mercedes’ EVs just look lame.

- Master Baiter The new Model 3 Performance is actually tempting, in spite of the crappy ergonomics. 0-60 in under 3 seconds, which is faster than a C8 Corvette, plus it has a back seat and two trunks. And comparable in weight to a BMW M3.

- SCE to AUX The Commies have landed.

- Arthur Dailey The longest we have ever kept a car was 13 years for a Kia Rondo. Only ever had to perform routine 'wear and tear' maintenance. Brake jobs, tire replacements, fluids replacements (per mfg specs), battery replacement, etc. All in all it was an entirely positive ownership experience. The worst ownership experiences from oldest to newest were Ford, Chrysler and Hyundai.Neutral regarding GM, Honda, Nissan (two good, one not so good) and VW (3 good and 1 terrible). Experiences with other manufacturers were all too short to objectively comment on.

- MaintenanceCosts Two-speed transfer case and lockable differentials are essential for getting over the curb in Beverly Hills to park on the sidewalk.

Comments

Join the conversation

@ M1EK ....the VW TDI, for instance, is planted firmly in the dirtiest ‘bin’ that’s still legal. Would you care to clarify that? The just superseded engines exceeded Euro 5, while the current ones meet Euro 6 (not due 'till 2014). I'm fairly certain most states (maybe just CA) don't have a current standard that would be considered comparable to Euro 4/5 and certainly not Euro 6. (Happy to be shot down).

PeteMoran, Tier 2 Bin 5 is the dirtiest emissions category that's still legal in this country going forward. Many gas-only engines have no trouble achieving better classifications. All hybrids I'm aware of do.