"Non-TARP" (For Now) Chrysler Bondholders Revealed

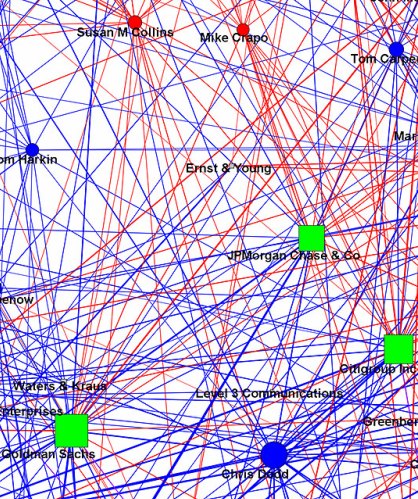

TTAC commenter Bluecon points us to Bloomberg, who reveal the identities of some of the 100-odd Chrysler bondholders recently described by President Obama as “hedge fund holdouts.” Yale University, Oaktree Capital Management and assets managed for the University of Kentucky, Halliburton, Kraft Foods Master Retirement and the Bill and Melinda Gates Foundation top the name-recognition list. According to that report, the government plans to ask Judge Gonzalez to let it pay the creditors in that group $2 billion, or 29 cents on the dollar, to end their claims. That’s an interesting strategy, considering the “not-yet-TARPed” bondholders already turned down an offer at 33 cents on the dollar. Let’s see how forcefully the government “asks” Judge Gonzalez to allow the cramdown. Or whether rumblings of a better deal materialize. (Image from Computational Legal Studies‘ amazing interactive map of TARP recipient campaign donations and the US Senate)

More by Edward Niedermeyer

Comments

Join the conversation

The Banks wrote CDS swaps on all of this and don't want to pay, so their friends at the Fed are changing the rules to accommodate them and screwing the senior debtholders in the process. When the investment banks speculate with no intention of paying and then "holdout" it seems that contract law is suddenly unimportant yet when they want their bonuses contract law must not be violated.