GM Sales Beat Toyota As Well, Down 34 Percent

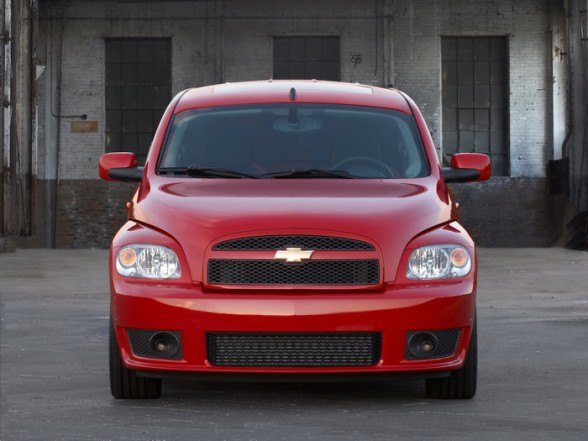

GM was able to move 173,007 units last month (press release here, sales chart in PDF format), up 11 percent from March but down 34 percent from last April. Cars fared worst in GM Land, falling 40 percent across all brands, while truck totals were down only 27 percent. Buick outsold Cadillac 8,928 to 8,337, but the defunctified Pontiac outsold both at 10,838. Watch for those numbers to tank next month, though, since the death was announced late enough in April to not affect prices overly. GM’s worst-performing cars were Buick LaCrosse (-62 percent), Caddy STS (-62.6 percent on 711 units sold), Aveo (-63 percent), G5 (-78 percent, 400 units), Cobalt (down by over 8,000 units), Solstice/Sky (barely cracking 500 sales between the two nameplates) and Aura (-66.6 percent). GM’s car high points were the Buick Lucerne (-20.8), Malibu (-14 percent, 14,665 units), Pontiac G8 (-5 percent, 2,013 units) and Astra, down only 9.6 percent (compared to consistently weak sales last year). Chevy’s HHR was up 7.5 percent (don’t ask why it’s categorized as a truck), Tahoe held even at just over 8,000 units and Suburban was down only 6.3 percent.

More by Edward Niedermeyer

Comments

Join the conversation

Sales are a little off on the LaCrosse?Shocking really,unless one would take into account,that W Buick ceased production 6 months ago.