Editorial: General Motors Death Watch 241: The Good, The Bad and The Ugly

I view the government’s intervention in GM’s business (or lack thereof) as automotive ebola. But we can all agree on one thing: the president’s decision to fire GM CEO Rick Wagoner was a no-brainer. Giving the Harvard MBA and GM lifer millions of dollars to guide GM to viability was like letting Al-Qaeda run a liberal arts university. Now that Wagoner’s gone, his supporters are notable by their absence. That’s because deep-sixing Red Ink Rick was the right thing to do. It was also the easy thing to do. While the MSM is lionizing Steve Rattner, the head of the presidential quango that defenestrated the GM CEO, the Obama administration’s wallow in the GM quagmire is just beginning.

There is no longer any doubt that GM is headed for bankruptcy. The GM C11 gestalt is growing by the day, of which there are only 56 left. The question is no longer “if” GM will file but “how.” Yesterday, GM’s federally elevated Chairman of the Board, Kent Kresa, signed his name to a plan unofficially called “Good GM, Bad GM.” In this scenario, the government would split GM into two companies, “old” (bad) and “new” (good). GM’s best bits would become part of the unencumbered business. The remaining dreck would be sold or liquidated.

It’s a good idea—in theory. Separating the potentially profitable wheat from the same old chaff would be a relatively rapid way to reinvent the American icon. But there’s a good reason why this practice isn’t the norm: someone’s got to decide which part of GM is Michael Knight and which part’s his evil twin Garth.

In a normal bankruptcy, management creates a recovery plan. A federal judge (or judges) rules on the plan, and then oversees its execution. The judge can demand forensic accounts, call witnesses, order asset sales, protect assets, etc. Yes, yes, Delphi; the former GM parts maker that’s been in Judge Robert Drain’s bankruptcy court since the late Pleistocene era. But that doesn’t obviate the main advantage of a judicial bankruptcy process: someone without an axe to grind has the power to make sure that creditors and other “stakeholders” aren’t screwed.

Lest we forget, GM is [still] a vast, sprawling enterprise, with thousands of dealers, suppliers, workers and former workers. Both here and abroad. All dependent on various parts of GM’s business for their survival. A triage-trained bankruptcy judge decides the least bad options for all concerned.

Now imagine the Presidential Task Force on Automobiles (PTFOA) deciding which bits of GM fall into the “good” (life) or “bad” (death) column.

First of all, the separation poses a huge philosophical conundrum. What is the new GM and why? If you subscribe to the theory that Chevrolet and Cadillac are the only GM brands worth saving, what of GMC, which accounts for a large chunk of GM’s truck biz? Kill or consolidate?

Viability means profitability, which requires both situational awareness and dedication to a specific competitive advantage (a.k.a. a unique selling point). The PTFOA’s recent report said the money-making GM of the future would build and sell reliable, practical, safe and fuel efficient vehicles. Must. Choose. One. Oh, and WTH does any of that have to do with Cadillac?

Secondly, on a more practical level, holy shit. GM has assets all over the world, with enough overlap to keep bean counters busy for decades (as it has). So which vehicles will these “good” brands sell, and where will they be made? Will the new GM only build vehicles in the U.S.? Given that some of the best/most profitable GM products are fabricated outside of the United States, an America-first approach would put the “good” GM at a huge competitive disadvantage.

Which, of course, leads us to the most important thumbs-up, thumbs-down consideration of all: politics. In a judge’s case, there is no political consideration. He or she is beholden to no single constituency. In contrast, the PTFOA. Anyone who thinks that this politically appointed body will be ready, willing and able to set aside partisan politics to look after the taxpayer’s best financial interest is woefully naive.

If nothing else, we’ve not heard the last of the United Auto Workers (UAW). So far, the union’s done all that they could do to “help” GM: nothing (i.e. no major concessions). The next step: make sure the PTFOA looks after UAW members’ interests in the pre-pack process. And while that’s happening, political markers are already being called in. How many pols with a GM factory in their jurisdiction have PTFOA boss Timothy Geithner in their sights? I’m thinking . . . all of them.

So here’s my idea: the PTFOA calls in GM’s federal loans. GM files for Chapter 11 protection. A bankruptcy judge does his or her thing. The feds (that’s you and me) provide debtor-in-possession financing (I’d prefer C7 but no one asked me). Fair enough?

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff Self driving cars are not ready for prime time.

- Lichtronamo Watch as the non-us based automakers shift more production to Mexico in the future.

- 28-Cars-Later " Electrek recently dug around in Tesla’s online parts catalog and found that the windshield costs a whopping $1,900 to replace.To be fair, that’s around what a Mercedes S-Class or Rivian windshield costs, but the Tesla’s glass is unique because of its shape. It’s also worth noting that most insurance plans have glass replacement options that can make the repair a low- or zero-cost issue. "Now I understand why my insurance is so high despite no claims for years and about 7,500 annual miles between three cars.

- AMcA My theory is that that when the Big 3 gave away the store to the UAW in the last contract, there was a side deal in which the UAW promised to go after the non-organized transplant plants. Even the UAW understands that if the wage differential gets too high it's gonna kill the golden goose.

- MKizzy Why else does range matter? Because in the EV advocate's dream scenario of a post-ICE future, the average multi-car household will find itself with more EVs in their garages and driveways than places to plug them in or the capacity to charge then all at once without significant electrical upgrades. Unless each vehicle has enough range to allow for multiple days without plugging in, fighting over charging access in multi-EV households will be right up there with finances for causes of domestic strife.

Comments

Join the conversation

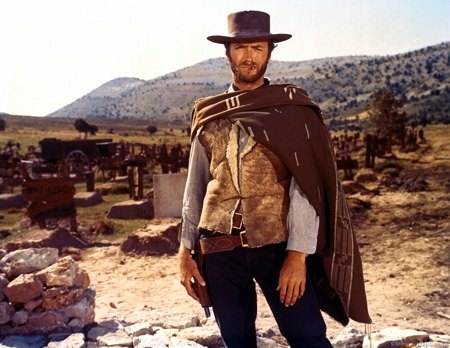

/Threadjack: All throughout the movie the guns keep switching. It all depends on whether they will be fired or not. Percap for the visual, carts for actual usage. It's just like Blondie's rifle: it's a cut down Winchester made to look like a period Henry. These aren't mistakes but attempt to be accurate within the confines of safety and practicality. /threadjack I certainly don't want to be the judge having to make those decisions. Everyone will lose out in the end. Someone's ox is going to get gored and at this stage it looks like everybodies will. A q of the B+B: who should be appointed a receiver in your opinion? Ideally it should be someone with immense familiarity with the auto sector, perhaps of GM itself but without biases. What paragon would this be?