NADA Economist Sees '09 Car Sales Upturn. Huh?

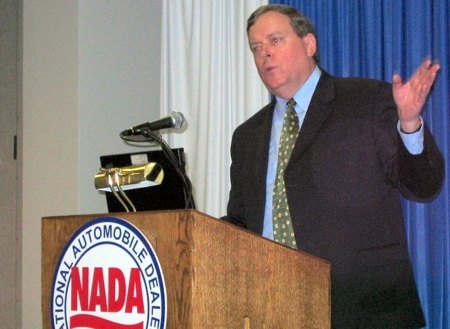

At the risk of slipping in a “I told you so,” TTAC flagged the current automotive meltdown back in summer ’06, when new housing starts cratered. A bit late, but there you go. At the time, TTAC pointed out that the housing slowdown would kill pickup truck sales– at the precise moment GM CEO Rick Wagoner and his media groupies were saying the then-new Silverado was GM’s salvation ( Edmunds: “If these hit, GM might have a full turnaround on its hands.”) Obviously, we didn’t see the collapse of the entire housing market and then, by extension, the new car market. But we sure as Hell made the connection between too-easy credit (for both homes and cars) and an eventual, inescapable reckoning. I mention all this because it’s obvious enough that new car sales won’t recover until the U.S. housing market recovers. And not just to us. Speaking at the dealer wake in N’orlins, the National Automobile Dealers Association’s chief economist Paul Taylor preached econ 101 to the bruised and battered faithful.

“Taylor said auto sales are tied to the fall in real estate values,” The Detroit News dutifully reports, “and in order for vehicle sales to recover in 22 states, housing values must stabilize. The states generally are along both coasts, in the Northeast and around the Great Lakes.

“States with the highest residential real estate value declines are Nevada, California, Florida and Arizona, and all of them have among the highest percentage drops in new-car registrations, Taylor said.”

From this realistic perspective, Taylor jumps off into the deep end, telling his adherents what they want to hear.

“[Taylor predicts] sales in the first half of the year will remain slow, but slight economic improvement starting in the third quarter should push sales to at least 12.7 million vehicles for the year.

“That’s still 3.8 percent shy of last year’s 13.2 million in sales, but better than the 10.3 million annual selling rate in December. Other analysts and automakers have predicted sales as low as 10.5 million for the entire year in 2009.”

Housing recovery leading to car sales recovery in 2009, eh? Consider this, from Bloomberg:

“The [housing] rebound last month was led by a distressed-property related jump in the West, including California, Nevada and Arizona, the NAR [National Association of Realtors] said. Sales of distressed properties accounted for about 45 percent of all sales last month…

“Property values are down by about 23 percent, according to the S&P/Case-Shiller index covering 20 metropolitan areas…

“U.S. foreclosure filings jumped 81 percent last year as more than 2.3 million properties got a default or auction notice, or were seized by lenders, according to RealtyTrac Inc., an Irvine, California-based seller of default data.

“KB Home, the fourth-largest U.S. homebuilder, on Jan. 9 reported a fourth-quarter loss exceeding analysts’ estimates and predicted more pain for the housing market this year.

“’The housing industry continues to confront unprecedented downward pressure,’ Chief Executive Officer Jeffrey Mezger said in a conference call. ‘These conditions persist nationally, with no visible signs of lessening in the near term.'”

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jkross22 When I think about products that I buy that are of the highest quality or are of great value, I have no idea if they are made as a whole or in parts by unionized employees. As a customer, that's really all I care about. When I think about services I receive from unionized and non-unionized employees, it varies from C- to F levels of service. Will unionizing make the cars better or worse?

- Namesakeone I think it's the age old conundrum: Every company (or industry) wants every other one to pay its workers well; well-paid workers make great customers. But nobody wants to pay their own workers well; that would eat into profits. So instead of what Henry Ford (the first) did over a century ago, we will have a lot of companies copying Nike in the 1980s: third-world employees (with a few highly-paid celebrity athlete endorsers) selling overpriced products to upper-middle-class Americans (with a few urban street youths willing to literally kill for that product), until there are no more upper-middle-class Americans left.

- ToolGuy I was challenged by Tim's incisive opinion, but thankfully Jeff's multiple vanilla truisms have set me straight. Or something. 😉

- ChristianWimmer The body kit modifications ruined it for me.

- ToolGuy "I have my stance -- I won't prejudice the commentariat by sharing it."• Like Tim, I have my opinion and it is perfect and above reproach (as long as I keep it to myself). I would hate to share it with the world and risk having someone critique it. LOL.

Comments

Join the conversation

It's legal to give a discount for cash; it's illegal to charge more to use a credit card. That is, you can print a price list and then say "5% cash discount" at the bottom. But you can't print a price list and then say "5% extra for credit card purchases". You can print two price lists, though. Cash discounts are fairly common from mom and pop computer dealers, and two price lists are fairly common at gas stations.

"They don’t make money on us. " Actually, they do. The banking system takes about 2% off every transaction you make with your credit card and keeps it. Whoever you used your credit card to pay is out that money. The right to a 2% tax on such a massive flow of transactions is a big money maker.