Bailout Watch 54: Big Banks Beg for Bailout Bucks

TTAC commentator, Buick dealer and GM stockholder activist Jim Dollinger (a.k.a. Buickman) has long argued that Wall Street’s money men have been running GM into the ground accidentally on purpose. While we understand his POV– who could possibly be this stupid?– The Detroit News reveals that Goldman Sachs and JPMorgan Chase are working “back channel negotiations” to protect their asses from a Motown C11 (i.e. get your elected representatives to give American automakers $25b+ in low-interest federal loans that the banks can’t or won’t give). That’s because both of these “august” financial institutions own big chunks of Ford and GM {the exact “vig” in the comment below). Only time is running out, as bailout fatigue grows. Oops, sorry, this isn’t a bailout. Not that you’d know it from JP Morgan’s pleas. “Beyond the need to provide a safety net for workers, we believe the automotive industry is critical to national security. Not only does the automotive sector support the steel infrastructure that is critical to manufacturing defense weaponry, but the automotive sector also provides about 1 out of every 12 jobs in the U.S., is a key factor in getting the U.S. independent from foreign oil and is essential toward cleaning up the environment,” wrote JP credit analyst Eric Selle. All done? No, I didn’t think so.

More by Robert Farago

Comments

Join the conversation

There was an article in NYT (I can't find it any more) a few days ago by an economist basically saying that the Chrysler bailout, regarded as glorious success by most people, may have actually been a failure in the long-term because it made Detroit believe that they can keep on doing things the way they have always done. If the bailout was refused chances are the Ford and GM would have woken up and fixed themselves. Now I think it's too late but I don't see how a bailout can be denied by Washington after this week.

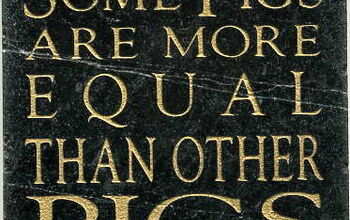

Red Ink Rick Wagoner never had an accounting degree yet was made CFO, no surprise our financials are in disarray. the man was a failure in purchasing and a disaster as head of NAO. still the banksters put him in as CEO and continue to support him in spite of the biggest losses in corporate history. ask yourself why???? I have theories and they are not pretty... much of America suffers from the effects of this man's personal incompetence, or shall I say...bidding of the banksters looking to relocate an industry, subjugate a former middle class, and lead to their conceptual world order of rice eating subservient mindless believers in a collective governance devoid of personal liberties. WAKE UP AMERICA!!!! http://www.youtube.com/watch?v=Nq9udFmsNO0

Building autos means steel which is used in making cannons and weaponry, building suv's makes us independent of foreign oil, thus cleaning up the environment. What a suck up. Or maybe for Eric Selle LSD didnt go out with the 70's. By the way buickman, I know where you are going and you are right. The masses wont figure it out until it has already happened. Oh well, some like the security of slavery...

If the bailout invalidates union contracts, and the feds also enforce a national right to work law, then I will support the bailout. Ain't gonna happen. The reason those jobs won't come back at wage parity is that the total compensation of the work force is unsustainable. We should not bailout banks that have books full of investments that can't be valued, and we should not transfer wealth to people who force terms on their ridiculously incapable management in order to save their "jobs". Jobs have no value. Only the products and services have value. If the products and services don't bring enough profit to pay the salaries, the jobs aren't worth saving.