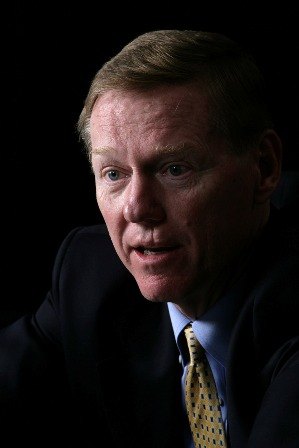

Bailout Watch 42: Ford's Mulally Says "It Wazzunt Us"

Ford CEO Alan Mulally may be a Detroit “outsider,” but the former Boeing executive sure knows how to tow the Motown party line– especially when it comes to securing $25 – $50b of low-interest federal loans. “Speaking on the CNBC cable television network Friday,” Forbes reports. “Mulally said Ford built and sold the trucks because marketplace demanded them. ‘In the United States, Ford’s strategy was to focus on what the customers really wanted, and those were the larger SUVs and trucks,’ he said. ‘Fuel prices were low, the interest rates were low. It’s what the customers chose.'” Oh for Christ’s sake. What about all those consumers who didn’t choose pickups and SUVs? What about the executives’ responsibility NOT put all FoMoCo’s eggs (i.e. billions in profits) into stupid-ass basket case misadventures like Aston, Jaguar, Volvo and Land Rover? I’m no Catholic, but Mually’s reframing of Ford’s former sins, his abject unwillingness to accept responsibility for Ford’s culpability in its current cash crisis, is not what I’d call proper penance. “Ford, he said, has a different strategy now that energy prices have risen, developing a portfolio that includes small cars already on sale in other parts of the world.” Great! So leave my tax money alone and get on with it.

More by Robert Farago

Comments

Join the conversation

Focusing only on Trucks and SUVs is not a bad business strategy. Diversification for companies is a great way to distroy shareholder value. CEOs are often too eager to "diversify," hell that's what got Ford into trouble (Jag, Land Rover, internet companies, junk yards, etc.) In fact what Ford is doing now is not diversifying. Instead they realize they have a huge automotive asset in Europe. They're simply taping into what they already have. If Ford did not have this asset and were suddenly anouncing huge investments into cars, I'd say that would be a losing strategy.

I think that if the Big 2.8 want to get their loans then they should be required to go before Congress and allocute, the same way a perp has to allocute when accepting a plea bargain. None of this perfect storm nonsense. They should have to detail the long history of bad business decisions that led them to asking for a handout. If the companies cannot come up with a clear explanation of how they destroyed their businesss then they obviously won't be able to fix them, no matter how much money they get.