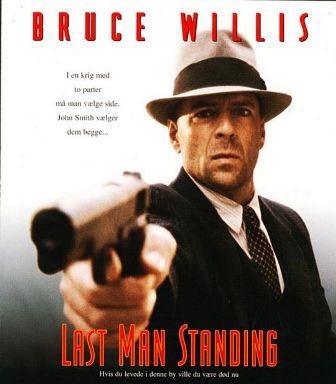

Ford Death Watch 45: Last Man Standing Pt. 2

I recently bought a dishwasher. Investor Kirk Kerkorian (a.k.a. “The Lion of Las Vegas”) bought 20m shares of Ford Motor Company. As a percentage of net worth, we each spent comparative amounts. But I’m pretty sure I got the better deal. I’m positive I’m going to have guacamole-free dinnerware for the next five years. Capt. Kirk can’t make anywhere near as bold a statement about the longer-term value of his Ford shares. Or can he?

In May, billionaire Kirk Kerkorian’s Tracinda Corp. tendered an offer to purchase Ford stock at $8.50 per share, back when the American automaker’s stock price hovering around $6.12. Investors offered 1.02 billion of the outstanding 2.24 billion shares. Tracinda increased its stake in FoMoCo from 4.7 to 5.5 percent. This week, Kirk's mob upped their share of FoMoCo to 148m shares, or 6.49 percent of Ford's public stock.

The deal is glass-like, as in half empty or half full. The fact that the nation’s seventh richest man is willing to overpay for Ford paper by 34 percent is a glowing vote of confidence in the company. Tracinda believes Ford will transcend its troubles.

Conversely, owners holding almost half the company’s value wanted to dump and scatter like the cops just showed up. These people didn’t think Ford stock would reach even $8.60 any time soon. And why would they? Ten years ago, the stock traded in the 60s. Exactly whose view is more valid is a matter of perspective. Do you put more credence in the opinion of a couple thousand people or one 91-year-old guy?

It helps to know more about Kirk. An accomplished pilot, Kerkorian made his early money delivering Canadian planes to England using the fastest, most profitable and life-risking route. After WWII, he turned surplus bombers into an enormously successful charter airline. Its core service was Los Angles to Los Vegas. Sin City is where Kerkorian made his banked billions, buying and selling casinos and hotels.

Kerkorian’s interest in America’s automotive world is a familiar story. In 1995, he ambled over to a house of straw. Chrysler fended off the hostile takeover. In 2006, it was the RenCen’s house of wood. Kirk blew into the boardroom with 9.9 percent of GM’s stock, but accomplished nothing. He unloaded it all and huffed away. Departing from the traditional tale, Kerkorian went back to Chrysler in 2007, as Daimler sought to shed the company. He was outbid by Cerberus Capital Management. A year later and he’s standing outside Ford’s house of glass.

So what, precisely, does Tracinda want out of its Ford position? Seven percent of a company is certainly a good chunk, but it’s far from controlling interest. The Ford family retains 40 percent control, no matter who else owns what. Sure, you get influence, but you are not in charge. Even if, according to regulatory filings, Kirk's willing to offer an an "infusion of additional capital."

Perhaps Ford is a good buy. There are angles from which to view Ford stock whereby it’s doesn’t look so limp. Cash and equivalents divide out to more than $11 per share. Property is worth about $16 per share. Eight dollars and fifty cents ain’t bad if you’re going to carve this pig up. Not that slicing and serving are in Ford’s future. The family has become quite attached. Besides, if GM or Chrysler go down, they’ll be other meat on the table.

If Tracinda were simply taking a position in an undervalued stock, why go whole hog for this one? As of June Standard & Poors put FoMoCo in the bottom 40 of their 500 index. Ford’s off 28.9 percent for the year. Soaring gas prices are shifting U.S. consumers' tastes faster than any company can re-tool. Ford is running far bellow capacity at eight of its 15 North American plants.

On the positive side, Ford is probably better positioned than Chrysler or GM to survive the near future. At the very least, they have some fuel-efficient cars to market, with another on the way. The other two American automakers have sucking chest wounds where their trucks and SUVs used to be. Still, that is an odd way to buy stock: wait to see if two major competitors kick it.

Kerkorian is euphemistically referred to as an “activist stockholder.” During his 18 months as a major GM player, he tried to force a deal with Renault/Nissan. When the board wouldn’t play his game, he sold his ball and left. Again, despite the back room meetings with Big Al and attendant ass-kissing, Kirk can’t realistically expect more power at Ford until the company is so far gone it's probably not worth it.

All Kirk can really do is depreciate CEO Alan Mulally’s authority, either by suggesting what Mulally was going to do anyway, thus sapping credit, or causing dissention. Put short, he can make a small mess just when it appears Mulally has set the Blue Oval for “pots and pans” and hit start. Half full, half empty, whatever. For Ford’s sake, I’d like to see Kerkorian come clean.

More by Michael Martineck

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- FreedMike I would find it hard to believe that Tesla spent time and money on developing a cheaper model, only to toss that aside in favor of a tech that may or may not ever work right. Having said that, though, I think what's happening with Tesla is something I've been predicting for a long time - they have competition now. That's reflected in their market share. Moreover, their designs are more than a bit stale now - the youngest model is the Model Y, which is in its' fifth model year. And it's hard to believe the Model 3 is in its' seventh model year. Aside from an interior restyle on the Model 3, neither of those cars looks substantially different than they did when they came on the market. That's a problem. And you can also toss in Tesla's penchant for unnecessary weirdness as a liability - when the Model 3 and Y were introduced, there was no real competition for either, so people had to put up with the ergonomic stupidity and the weird styling to get an electric compact sedan or crossover. Today, there's no shortage of alternatives to either model, and while Tesla still holds an edge in battery and EV tech, the competition is catching up. So...a stale model lineup, acceptable alternatives...and Elon Musk's demon brain (the gift that keeps on giving), All that has undercut their market share, and they have to cut prices to stay competitive. No wonder they're struggling. Solution? Stop spending money on tech that may never work (cough...FSD) and concentrate on being a car company.

- EBFlex “Tesla’s first-quarter net income dropped a whopping 55 percent”That’s staggering and not an indicator of a market with insatiable demand. These golf cart manufacturers are facing a dark future.

- MrIcky 2014 Challenger- 97k miles, on 4th set of regular tires and 2nd set of winter tires. 7qts of synthetic every 5k miles. Diff and manual transmission fluid every 30k. aFe dry filter cone wastefully changed yearly but it feels good. umm. cabin filters every so often? Still has original battery. At 100k, it's tune up time, coolant, and I'll have them change the belts and radiator hoses. I have no idea what that totals up to. Doesn't feel excessive.2022 Jeep Gladiator - 15k miles. No maintenance costs yet, going in for my 3rd oil change in next week or so. All my other costs have been optional, so not really maintenance

- Jalop1991 I always thought the Vinfast name was strange; it should be a used car search site or something.

- Theflyersfan Here's the link to the VinFast release: https://vingroup.net/en/news/detail/3080/vinfast-officially-signs-agreements-with-12-new-dealers-in-the-usI was looking to see where they are setting up in Kentucky...Bowling Green? Interesting... Surprised it wasn't Louisville or Northern Kentucky. When Tesla opened up the Louisville dealer around 2019 (I believe), sales here exploded and they popped up in a lot of neighborhoods. People had to go to Indy or Cincinnati/Blue Ash to get one. If they manage to salvage their reputation after that quality disaster-filled intro a few months back, they might have a chance. But are people going to be willing to spend over $45,000 for an unknown Vietnamese brand with a puny dealer/service network? And their press photo - oh look, more white generic looking CUVs. Good luck guys. Your launch is going to have to be Lexus in 1989/1990 perfect. Otherwise, let me Google "History of Yugo in the United States" as a reference point.

Comments

Join the conversation

I don't know if I would go so far as to say that it was a "lie" that small cars couldn't be built profitably with union labor here in the U.S. Even UAW Chief Ron Gettelfinger admitted that Ford would not make any money on the Fiesta if it were to be built here; hence the UAW hasn't kicked up too much of a fuss over the decision to build it in Mexico. The key is what Ford does with this cost advantage. If it uses it to add more content to the car to better compete with the Fit, it will have a winner that will change the public's perception of what a small Ford is. If it builds another stripper fleet special, Ford will ultimately end up right back where it started...

Well, whatever Ford, et als, has planned they certainly have NO plans for $250 per barrel oil do they? Gazprom, the Russian giant, is the largest supplier of fuels in the world and stated last week that some time in 2009, mind you, oil would be $250 per barrel. One of Ford's Chief Engineers recently stated that "no economist predicted the economy to be as bad as it is or that the cost of fuel would be this high" in response to concerns about the apparently 'delayed timing' of focusing on small car. Well, he and I surely read different materials... If the heads within Ford could not forsee $4.00 per gallon fuel I'd not bet that they can forsee $7.50 per gallon fuel, either. Time will most assuredly tell though won't it?