China To Import Gas by 2010. Maybe.

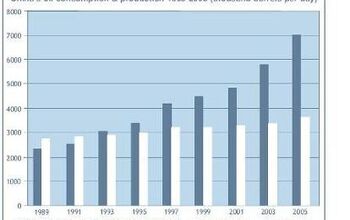

Pity the poor analysts over at Resource Investor. How do you measure current and projected oil importation and consumption in a country as enormous, secretive and chaotic as China? Still, this is one of the best reports on the subject I've seen. It includes a look at the country's rush to build new oil refineries and an explanation of the effect of "teapot" operations on supply. The bottom line's at the bottom: "Vehicle ownership in China is expected to double to about 55 million vehicles over the next five years, as falling prices encourage consumers to purchase cars… The ever increasing number of vehicles in China will help sustain the growth in both oil demand and transportation, driven by the country's rapid economic growth. Moreover, this will offset any efforts by the Chinese government to curb oil demand and imports." So rising international oil prices then? Depends on the supply, obviously. If the peak oil prognosticators are right… uh-oh.

More by Robert Farago

Comments

Join the conversation

It would be nice if the Chinese government stopped subsidizing the cost of gasoline through the state owned oil companies. Actual market fuel prices would go a long way towards reducing car usage.

I'm confused, is that title sarcasm or does China really not currently import oil?

China has been a nett oil importer, from memory, since the mid 1990s. The title is ambiguous. Importing gas as in, gasoline, or the usual meaning of "gas" as in natural gas? Both are used to power vehicles. Toyota (hybrids) and the European manufacturers (Diesel) are best placed to deal with the increasing price of oil. SUVs will once again become the sole domain of those who actually need them or can afford the running costs (farmers and rap stars).

Cambridge Energy Research Associates, which has been the most reliable prognosticator of oil reserves over the last 30 years or so, estimates that 3X as much oil as has been pumped to date, remains in the ground and recoverable. China and India will step up the pace of consumption, but we don't have a terminal crisis yet. Other estimates are higher still. http://www.cera.com/aspx/cda/public1/news/pressReleases/pressReleaseDetails.aspx?CID=8444 Put aside human-related CO2 induced climate change, as this will prove unrelated to the overwhelming natural and cyclic drivers. The primary environmental threat here will be surging particulate pollution and chemical aerosols that will be dispersed globally, undermining local air quality districts' ability to meet regional goals. China will have to go straight to the cleanest-burning technologies to avert such a spike. Already, Chinese particulate pollution is complicating the air quality picture in the Los Angeles region. There will be price surges as Chinese and Indian demand sometimes outpaces the ebb and flow of new exploration and extraction. Similarly, any progress made in the west to get off the oil drip will moderate China's price impacts. The more difficult shortages will be in refined products due to insufficient refinery capacity. The US faces this too, and NIMBYism is likely to result in refinery builders flocking to less regulated countries where a willingness to trade environment for wealth still prevails. If we really cared about global environmental health, we'd expand refinery construction here in the US, under our more stringent environmental regulations. We'll continue to see price surges in a futures-driven market that is made nervous by day-to-day fluctuations in politics, weather, terrorism, and general misfortune, coupled with price declines when demand softens in response to surging prices and buyers win back some influence. Fuel will continue to be more expensive in Europe and Japan than in the US while producers as well as state economies valuing domestic political compliance will subsidize or artificially price their energy. What else is new? Phil