Chrysler Suicide Watch 16: Cerberus' Master Plan?

So that's it: deal done. Yesterday, federal regulators cleared DaimlerChrysler's suffix sale to Cerberus Capital Management. In the absence of any immediate change to the status quo, the United Auto Workers (UAW) and the Canadian Auto Workers (CAW) couldn't be happier with their new overlords. Chrysler dealers have also met with the new bosses and sworn their fealty. So it's one big happy family, all pulling together for their mutual health and happiness. And if you believe that, I've got some Ford stock I'd like to sell.

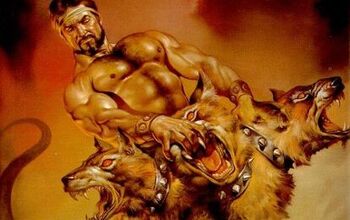

If Chrysler were a healthy company with an economically viable work force, a solid product line and strong financials, Mercedes would have kept it. If Cerberus didn't make billions by transforming ailing companies into cash cows– or sending them to the slaughterhouse– they wouldn't have bought it. So what we have here is a moment of silence: a dignified pause before Cerberus grabs its finest filet knife and guts Chrysler like a fish.

To understand the fishmongery to come, it's important to see Chrysler through Cerberus' eyes. As far as CEO Stephen Feinberg and his Armani-clad mob are concerned, Chrysler doesn't make cars. It makes loans. Its cars, trucks, vans, minivans, SUVs and pickups are simply a means to an end: profitable paper. Chrysler Financial Services is the only part of Chrysler Group that makes any money. Cerberus already owns 51 percent of GM's financial services unit, GMAC. Join the dots. Do the math.

Despite Chrysler's CFO's pre-sale pooh-poohing of the possibilities, Feinberg dropped hints about "synergies" between Chrysler Financial and GMAC at the recent dealer pow-wow. Believe it. It's only a matter of time before Cerberus combines its two lenders to grab the lion's share of the auto loan market from Ford. Aside from the power that comes from being number one, former GMAC Prez Bill Lovejoy reckons the deal will generate tremendous efficiencies in finance and remarketing off-lease vehicles.

Of course, an auto finance company needs autos to finance. That's where the rest of Chrysler comes in– but not Chrysler as we know it.

Start with this: Cerberus is a deal maker, not a car maker; and they sure ain't no miracle maker. They know they can't get Chrysler's unions to agree to the kind of wage and benefit roll backs needed to create American-built cars that compete with non-union transplants– at least not without exercising the nuclear option. While long overdue, a showdown strike would kill the short term value of Cerberus' investment (which is their primary frame of reference).

So here's Cerberus' cunning plan: they're not even going to try. Oh, they'll ask for the same concession as Ford and GM (should there be any on offer). But Cerberus isn't counting on union malleability. They'll simply turn their back on their American unions, build or buy cars elsewhere and transform Chrysler dealers into the automotive equivalent of Wal-Mart. In other words, Cerberus will decouple the traditional link between automotive manufacture and retail.

It's a bold strategy: gut Chrysler to save Chrysler. The fact that GM CEO Rick Wagoner has already expressed interest in a combined Chrysler Financial and GMAC shows that the major players "get it." They understand that cash is King and outsourcing is the way forward,

How much branding is needed for it to work? Could Chrysler dealers sell GM or Ford products? Would Cerberus pick-up Jag and Land Rover, turn them over to someone else to manage and sell the resulting products through their dealers? Sure. Why not?

Of course, none of this relieves Chrysler of its burden to build/import vehicles American consumers want to purchase. Something other than what they're trying to sell at the moment. And so the urgent reevaluation process has begun.

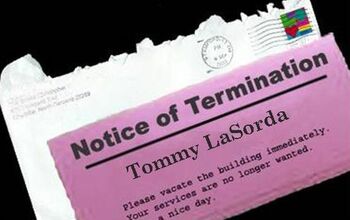

The Detroit News reports that CEO Tom LaSorda and Chief Operating Officer Eric Ridenour consumed Consumer Reports' scathing reviews of the Nitro and Sebring/ Avenger, checked the sales stats and freaked. Apparently the suits were "quite upset" that they "missed where the market was to end up versus our projections." They've begun a "series of deep dives into its processes and standards," looking at both current and future products.

But can they keep Chrysler afloat until Cerberus can change the game? Jeep is the only Chrysler division that's making money, but it isn't enough to carry the group. While Cerberus has deep pockets, will they be willing to continue pouring money into Dodge and Chrysler while they try to reverse nine years of epic mismanagement?

Although Cerberus repeatedly insists they're in it for "the long run," they've never actually defined the term. Since all things are relative, Chrysler has to move quickly if they're to survive the latest chapter in their less-than-illustrious recent history. Cerberus' mission is to make money, pure and simple. Whether sliced to bits or served whole, any company that doesn't meet that goal is history.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

- Formula m Same as Ford, withholding billions in development because they want to rearrange the furniture.

- EV-Guy I would care more about the Detroit downtown core. Who else would possibly be able to occupy this space? GM bought this complex - correct? If they can't fill it, how do they find tenants that can? Is the plan to just tear it down and sell to developers?

- EBFlex Demand is so high for EVs they are having to lay people off. Layoffs are the ultimate sign of an rapidly expanding market.

- Thomas I thought about buying an EV, but the more I learned about them, the less I wanted one. Maybe I'll reconsider in 5 or 10 years if technology improves. I don't think EVs are good enough yet for my use case. Pricing and infrastructure needs to improve too.

Comments

Join the conversation

Management and union are mutually responsible for product quality, both in materials used and assembly. Both must act within the confines of the agreement. This puts a relatively high labor cost in place, which in turn limits the amount that can be spent on materials. To remind the "younger" readers, management "caving" into union demands seems a lot more reasonable when the company is making billions in profits and the workers demand their fair share. Trouble is, as we are discussing, now that the tables are turned and the big 3 are losing their rears, union's response is "not our fault" and "don't give up an inch." I would like to see Cerberus hand the vehicle assembly over to the UAW at a fixed rate per finished unit. I suspect that would help clear up any work rule and job bank BS real quick.