Car Buying Tips: The Games Car Dealers Play

Sometime between the sale of the first Model T and now, the automobile business has come to represent all that is wrong with sales, marketing and advertising. According to the surveys that track respect for professions, automobile salesmen are bottom feeders, swimming just above the mud with politicians and marketing folk. Do new and used-car dealers deserve such scorn? Absolutely. The truth about car dealers lies far closer to the stereotype than what they’d like you to believe.

I used to produce TV commercials for a chain of Texas dealerships. On my first shoot, I noticed a quarter on the asphalt. Naturally, I bent down to pick it up. “What are you doing?” the cameraman whispered. The sales reps had “seeded” the lot with pocket change to stop customers from literally running away from an approaching car salesman.

Virtually every TV ad I made highlighted misleading or downright deceptive “offers.” How about a new Ford F-150 for $10 a day? While $300 a month IS ten bucks a day, dealers use this psychological ploy to lure low-income customers who would balk at a higher (though empirically equal) number. It gets worse from there. How about a special offer?

Fancy a Dodge Caravan SXT minivan for $19 a month? Bob Saks Dodge of Farmington Hills is happy to oblige – as long you put $1999 down and lease a 2007 Dodge Ram 1500 SLT Quad Cab for $179 a month. And work for Chrysler. With A Tier credit. And already lease a Chrysler, Dodge or Jeep vehicle. And pay all taxes, destination and “acquisition fees” and other “routine charges” on both vehicles. And don’t drive either vehicle more than 10,500 miles a year.

Then there are mega-clearance sales. The dealer has trucked in (at great expense!) a lot-load of used cars (starting at only $99!). “No offer will be refused!” “Every application will be accepted!” “Agents are on-site to accept your financing!”

To avoid arrest, the dealer only has to have ONE vehicle for $99 on his lot on the first day of the sale. Obviously, this loss leader will be gone before you get there – if it even existed and you'd even want it.

Customers falling (and falling and falling) into the bad credit category get loan shark rates and/or an extremely limited selection of beaters to buy. True: the dealer doesn’t refuse any offer. They just never promise to accept any offer. And so it goes: amazing deals married to astounding fine print.

And speaking of credit scores, do you know what yours is? If a salesman reappears from the Finance Guy’s lair and tells you your credit score leaves something to be desired, if he’s inadvertently downgraded your credit, your payments will go up, right along with the dealer’s profits. Strange that.

Those zero percent finance offers sound great, but you're often better off with a higher rate. If you factor in the rebates on offers— which are not available to zero percenters— it’s usually true. Bottom line: If you’re paying $199 a month on a $35k car, there's a reason. Eventually, inevitably, somehow, you’re going to have to pay off the principal.

To hide this fact, dealers play Three Card Monte with the three major transactions involved with buying a car: selling your old car to the dealer, buying the new car and financing your purchase.

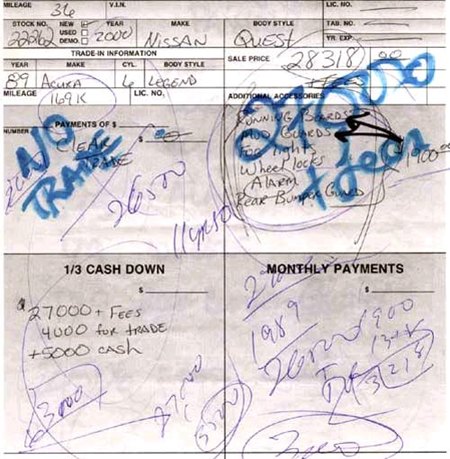

As seen on “The King of Cars” reality series (and dealerships throughout America), the salesman divides a piece of paper into four squares: trade value ($3k for your trade-in guaranteed!), price, down payment and monthly payment. He fills out the boxes with some insulting numbers and then encourages you to focus on the monthly payment – forgetting the fact that he’s stiffed you on your trade-in and listed the highest possible “price.”

If you insist on a higher trade-in value, he’ll bump up the price, down payment or monthly payment. If you say the starting price is too high (i.e. wrong), no problem! The monthly payment goes up. Up, down, move it around. Numbers are “dragged” from one box to the other. The deal doesn’t get much better, but it's made to look more acceptable.

At some point, the Sales Manager strolls in and says he can do the deal for $10 or $20 or $30 more than the monthly payment on the “four square.” Bingo! The dealer just added another $1k – $3k (over five years) profit to the “deal.”

The battle lines are drawn. The dealers have created an adversarial relationship with customers. They’ve armed themselves with every dirty trick in the book and they have experience, time, and greed on their side. You are but a lamb to the slaughter; an “up” that becomes a grease pencil mark on a tote board, and with any luck, another checkmark on their way to “Salesman of the Month.” Caveat emptor, pal.

I'm a marketing guy, who loves cars - but hates most automobile advertising. I'm also a writer, graphic designer, animator, musician, and stand-up philosopher.

More by Brad Kozak

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 2ACL I'm pretty sure you've done at least one tC for UCOTD, Tim. I want to say that you've also done a first-gen xB. . .It's my idea of an urban trucklet, though the 2.4 is a potential oil burner. Would been interested in learning why it was totaled and why someone decided to save it.

- Akear You know I meant stock. Don't type when driving.

- JMII I may just be one person my wife's next vehicle (in 1 or 2 years) will likely be an EV. My brother just got a Tesla Model Y that he describes as a perfectly suitable "appliance". And before lumping us into some category take note I daily drive a 6.2l V8 manual RWD vehicle and my brother's other vehicles are two Porsches, one of which is a dedicated track car. I use the best tool for the job, and for most driving tasks an EV would checks all the boxes. Of course I'm not trying to tow my boat or drive two states away using one because that wouldn't be a good fit for the technology.

- Dwford What has the Stellantis merger done for the US market? Nothing. All we've gotten is the zero effort badge job Dodge Hornet, and the final death of the remaining passenger cars. I had expected we'd get Dodge and Chrysler versions of the Peugeots by now, especially since Peugeot was planning on returning to the US, so they must have been doing some engineering for it

- Analoggrotto Mercury Milan

Comments

Join the conversation

I can remember the very first time I tried to buy a new car. I was dealing on a ’stang, and the deal died just as soon as the Sales Prevention Officer showed up. The SPO put a white piece of paper on the table in front of me with some hand writen numbers. “You see these numbers.” Yeah, I see ‘em. “Well, these numbers is the stock number of this vehicle, and these numbers backwards is our cost on this vehicle.” He realized I was a lost cause when I never bothered to try to decipher these numbers backwards, as I immediately knew I had to get out of there. His mouth was running a mile a minute, but whatever he was saying was going in one ear and out the other. Eventually, there was a lull and I seized the moment and picked myself up and left. I was a very young and inexperienced new car buyer back then, but that did not mean that I was stupid. This presumption of stupidity has had a long lasting effect on me, so much so that I could never go back to a Ford dealer. I have tried, but as soon as my four wheels are on the Ford dealer’s lot I get panic stricken and have to drive off. I have had even worse experiences at other dealers, including the local Toyota dealer. Would you buy a new car from this Lexus-Toyota-Acura-Honda dealer? http://tinyurl.com/27jkez But this Ford thing has left a mark on my psyche for no other reason because it was my first time I went “mano-a-mano” with a dealer's SPO and was totally unprepared for battle. I will have to live with this for the rest of my life. I do not forsee ever driving a new Ford product anyway, (I now prefer Honda products) so there is no loss there.

Confessions of a Maniac The purchase of a new car represents the second largest consumer purchase, behind the household. (which includes improvements ad repairs) The research and preparation that go into these purchases should resemble this magnitude, and determination. The intention of the New Car Dealer (dealer) is to move as much product as possible, while maximizing all incentives and opportunities. These opportunities include, but are not limited to: Daily targets Weekly targets Unit targets Model targets Finance/Lease targets Accessory/Warranty targets Volume targets All profit centers of the dealership, other than Service and Body Shop are in tune with a New Car Sale. They all have a secular motive, and are willing to deal amongst each other to further it. The internal dealings are a benefit to the customer that is focused and prepared. Preparation is key and will e revisited. The reason for coming to the dealership is to purchase the car. There is nothing else that should be acquired at transaction time by the customer. This fact is misconstrued by the public as an adversarial restriction on the conversation, and give and take with the dealer. Just as the dealer wants you to feel comfortable and confused, you want him to feel the same. Comfort for the dealer is that you are a qualified, easy going customer who is open to his advise, and willing to invest in the new vehicle. The source of the investment is you ability to pay, and the provider is the other departments of the dealership. So. The final person at the dealership that says that a deal will occur; the person you always want to meet, is the General Sales Manager. The GM directs all the departments of the dealership. He looks at the sum of the deal. Your objective is to make the sum of the deal as broad and large as possible. Sounds stupid, but keep reading. When a car deal engages multiple profit centers of a dealership, they all will lobby (on your behalf) to have the car price approach cost. This was the objective. Right? The items that appear on the Sales contract are cash. Treat them as such. If the deal says that they will give $1500 dollars on your $11,000 trade that is a great spot to be in. Why? Because, you have used your $1500 down payment, to relieve pricing pressure on the new car. (They will allow the new car price to fall, because they will make money on the trade) The same goes for the accessories, and financing. Agree to that 17% 72 month car loan, initially. The undercoating and Simonize stuff too. The deal is set once you sign. The only thing you sign for is the car. To execute these deals you must go to the dealer prepared to buy and finance. Plan to spend the evening. 2 to 4 hours. Go damn near closing, on a midnight sale if you can, and stay until it is signed. You must have your own financing approved and waiting. Get the name for the rep that you are dealing with, it comes in handy sometimes. So here are a few example deals, they are real, so try them at you own peril: 1991 Ford Mustang GT bran new purchase, Crystal Ford Isuzu, no trade; I walk in at around 3 pm, the car I want is still in plastic on the back lot, I’ve been stalking the dealers inventory for a few weeks…driving thru the lot occasionally. I go in, get a salesman, and stake exactly what I want…Plain GT Black, no sunroof, 5spd. The sticker is near $17k. They don’t have it, they have a sunroof. Not what I asked for, so it has to be free. Cause I really don’t want it. They inquire on my trade; I brought a 1978 XJ12 4dr given to me as a wedding present. Good looking car, but completely unreliable…had to go. They offer $1,500. Car is probably worth $8,000. We talk about financing; I’m just out of school, got no credit, good job….15.5%. fine by me. Undercoating? Sure! Simonize? Yeah! I looked at all the accessories possible, picked a few. Extended warranty? Oh yeah! Time for the financing office. They come with the contract, 4 hours later. The price for the car is I the $15’s now. The rest of the stuff is….a lot. I pull my jag from the trade and replace it with $1500 cash, decline the accessories and gu, but still take the financing. Leave with the car and call the State Farm agent to move the car loan over to a lower rate. Example 2, used car, 2002 Lincoln LS V8, ??? Infiniti, no trade; Simple deal. The car that I was purchasing was on the used car lot, after inspecting it I decided that it had been wrecked hard, but fixed impeccably well. The dealer likely did not know or care. I secured financing for the car from an online place, cheesy, but I just needed the nod. Went into the dealership, and haggled a bit, no good, the car price was super low to begin with. The opportunity was only in the financing or the accessories. So I went into the finance room, and the guy asked if he could earn my business. Of course you can, this cheesy finance place gave me a rate of…insert bazare number here….this is the person who I am dealing with. I had them fax over a letter that said I was approved to buy that particular car earlieir in the deal. The finance guy went to work beating my made up number. Got a good rate, and a quality car to boot. Example 3; 2004 Mustang Cobra, ??? Ford, trade 2002 Lincoln LS V8; I decided that I was not old enough for the Lincoln, and found that I wanted my mustang back. So I took my LS and went to work. The Lincoln has a depreciation rate that is relatively stair-stepped. Big percentages off the floor, then a huge percentage as new models come out annually. Eventually you will get stuck in the car. It was time to decide to keep it for the long run or get out. Then you add in the prior years Lease program car return calendar, and the price can plummet very quickly. So. Trade your cars before the new NADA or whatever books are published, and whatch what the returns are for leases. Why? The cars value what the book says, but they do have realtime auction websites now, so be prepared. The Infiniti dealer couldn’t tell that the Lincoln was wrecked, so why would the Ford dealer be able to. I trade my cars filthy dirty when things are wrong with them. Let them find the flaws. End results of this deal was 500 more for the LS (six months after purchase), and around sticker for the Cobra. Refinanced immediately afterward. The moral of this story is; the dealer does not expect you to want to make money on the car deal. Be patient, observant, flattering, prepared. Don’t be openly focused on the price. Let the deal unfold. Every time they put the numbers in front of you look for the only one that matters, but only talk about the rest. Expand the deal until the one you want comes down to where you believe it can’t go anymore. Remember that the dealer incentives are multi-faceted. Below sticker is possible, but only in combination with the other departments. Also, when it comes time to sign, calmly remove everything but, the car from the deal. The GM and Sales Manager have already agreed and signed. The finance manager can remove the gu on his own. The GM and Sales Manager can’t unsign the deal. Happy hunting.